Volatility harvesting leverages market price fluctuations to generate profits through strategic buying and selling, capitalizing on asset price disparities. Liquidity provision involves supplying assets to a market or exchange, earning fees or interest from facilitating trades and improving market efficiency. Explore the nuances of these trading strategies to optimize your investment approach.

Why it is important

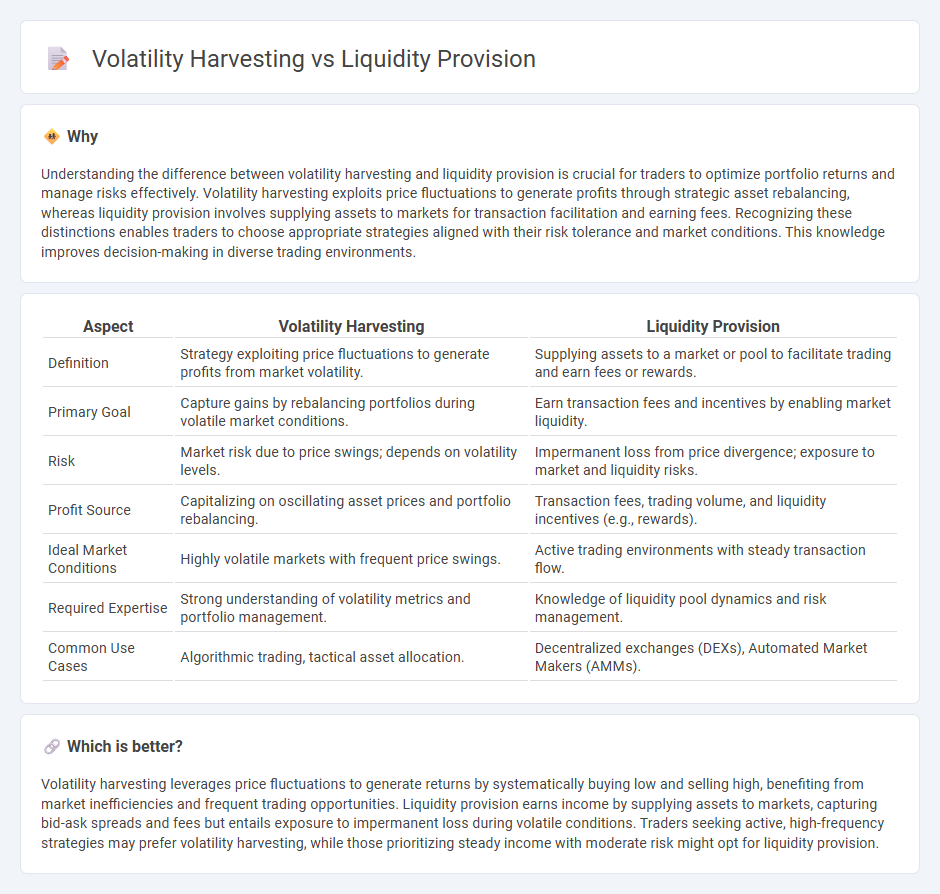

Understanding the difference between volatility harvesting and liquidity provision is crucial for traders to optimize portfolio returns and manage risks effectively. Volatility harvesting exploits price fluctuations to generate profits through strategic asset rebalancing, whereas liquidity provision involves supplying assets to markets for transaction facilitation and earning fees. Recognizing these distinctions enables traders to choose appropriate strategies aligned with their risk tolerance and market conditions. This knowledge improves decision-making in diverse trading environments.

Comparison Table

| Aspect | Volatility Harvesting | Liquidity Provision |

|---|---|---|

| Definition | Strategy exploiting price fluctuations to generate profits from market volatility. | Supplying assets to a market or pool to facilitate trading and earn fees or rewards. |

| Primary Goal | Capture gains by rebalancing portfolios during volatile market conditions. | Earn transaction fees and incentives by enabling market liquidity. |

| Risk | Market risk due to price swings; depends on volatility levels. | Impermanent loss from price divergence; exposure to market and liquidity risks. |

| Profit Source | Capitalizing on oscillating asset prices and portfolio rebalancing. | Transaction fees, trading volume, and liquidity incentives (e.g., rewards). |

| Ideal Market Conditions | Highly volatile markets with frequent price swings. | Active trading environments with steady transaction flow. |

| Required Expertise | Strong understanding of volatility metrics and portfolio management. | Knowledge of liquidity pool dynamics and risk management. |

| Common Use Cases | Algorithmic trading, tactical asset allocation. | Decentralized exchanges (DEXs), Automated Market Makers (AMMs). |

Which is better?

Volatility harvesting leverages price fluctuations to generate returns by systematically buying low and selling high, benefiting from market inefficiencies and frequent trading opportunities. Liquidity provision earns income by supplying assets to markets, capturing bid-ask spreads and fees but entails exposure to impermanent loss during volatile conditions. Traders seeking active, high-frequency strategies may prefer volatility harvesting, while those prioritizing steady income with moderate risk might opt for liquidity provision.

Connection

Volatility harvesting capitalizes on price fluctuations by systematically rebalancing a portfolio to lock in gains, while liquidity provision offers essential market depth that absorbs trades and stabilizes prices. By supplying liquidity, market makers enhance volatility, creating frequent price movements that can be exploited through harvesting strategies. This symbiotic relationship increases market efficiency and potential profitability for traders focused on volatility-driven returns.

Key Terms

Bid-Ask Spread

Liquidity provision involves placing buy and sell orders close to the mid-price to capture the bid-ask spread, profiting from market participants' order flow. Volatility harvesting exploits price fluctuations by rebalancing positions to benefit from high volatility, often incurring wider bid-ask spreads and execution costs. Explore the nuances of bid-ask spread impacts on both strategies to optimize trading performance.

Mean Reversion

Liquidity provision strategies capitalize on collecting transaction fees by facilitating trades in asset pairs, often benefiting from mean reversion as prices revert to equilibrium after temporary imbalances. Volatility harvesting exploits price oscillations by systematically rebalancing portfolios to buy low and sell high, relying heavily on mean reversion to realize consistent gains. Explore the detailed mechanisms and comparative advantages of these strategies in mean-reverting markets to optimize trading performance.

Impermanent Loss

Liquidity provision in decentralized finance often exposes providers to impermanent loss, a risk arising when asset price changes cause divergence in pool holdings compared to holding assets separately. Volatility harvesting strategies aim to capitalize on price fluctuations to minimize impermanent loss and enhance returns by rebalancing portfolios in response to market movements. Explore detailed mechanisms and risk management techniques in liquidity pools to better understand how to optimize yield and reduce impermanent loss.

Source and External Links

Liquidity Provision - CBFS - Liquidity Provision involves financial institutions acting as intermediaries to improve the liquidity of stocks by increasing market depth and trading volumes, which benefits both investors and issuers in securities markets such as Qatar Stock Market.

DeFi Basics: Liquidity Provision - In decentralized finance (DeFi), liquidity provision means users deposit cryptocurrency into smart-contract-based liquidity pools that facilitate token swaps on decentralized exchanges, earning fees as a reward.

Liquidity Provision by the Federal Reserve - Central banks provide liquidity during financial crises to meet short-term payment demands by offering cash or equivalents, using various tools such as open market operations and credit extension, balancing liquidity needs with solvency concerns.

dowidth.com

dowidth.com