A liquidity sweep aggressively targets multiple price levels to quickly execute large orders, minimizing market impact by clearing available liquidity across the order book. In contrast, iceberg orders conceal the true size by displaying only a small portion, allowing traders to enter or exit positions discreetly without signaling intent. Explore these strategies further to optimize your trading execution and market impact.

Why it is important

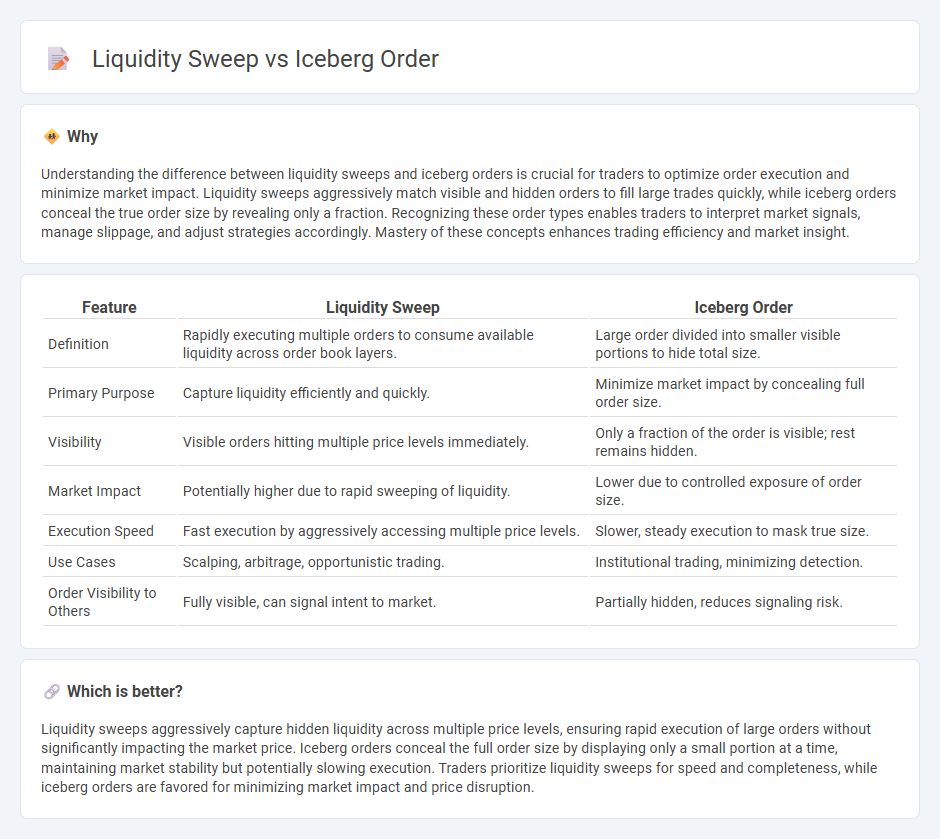

Understanding the difference between liquidity sweeps and iceberg orders is crucial for traders to optimize order execution and minimize market impact. Liquidity sweeps aggressively match visible and hidden orders to fill large trades quickly, while iceberg orders conceal the true order size by revealing only a fraction. Recognizing these order types enables traders to interpret market signals, manage slippage, and adjust strategies accordingly. Mastery of these concepts enhances trading efficiency and market insight.

Comparison Table

| Feature | Liquidity Sweep | Iceberg Order |

|---|---|---|

| Definition | Rapidly executing multiple orders to consume available liquidity across order book layers. | Large order divided into smaller visible portions to hide total size. |

| Primary Purpose | Capture liquidity efficiently and quickly. | Minimize market impact by concealing full order size. |

| Visibility | Visible orders hitting multiple price levels immediately. | Only a fraction of the order is visible; rest remains hidden. |

| Market Impact | Potentially higher due to rapid sweeping of liquidity. | Lower due to controlled exposure of order size. |

| Execution Speed | Fast execution by aggressively accessing multiple price levels. | Slower, steady execution to mask true size. |

| Use Cases | Scalping, arbitrage, opportunistic trading. | Institutional trading, minimizing detection. |

| Order Visibility to Others | Fully visible, can signal intent to market. | Partially hidden, reduces signaling risk. |

Which is better?

Liquidity sweeps aggressively capture hidden liquidity across multiple price levels, ensuring rapid execution of large orders without significantly impacting the market price. Iceberg orders conceal the full order size by displaying only a small portion at a time, maintaining market stability but potentially slowing execution. Traders prioritize liquidity sweeps for speed and completeness, while iceberg orders are favored for minimizing market impact and price disruption.

Connection

Liquidity sweep and iceberg orders are connected through their strategic use in minimizing market impact during large trades. An iceberg order hides the true size of the trade by displaying only a small portion of the total volume, while liquidity sweep aggressively targets hidden liquidity by quickly executing against resting orders, including iceberg orders. This interaction allows traders to access deeper market liquidity without revealing their full trading intentions, optimizing execution efficiency and price stability.

Key Terms

Hidden Orders

Iceberg orders and liquidity sweeps are key hidden order strategies used to minimize market impact while executing large trades. Iceberg orders reveal only a small portion of the total order size to the market, maintaining discretion and preventing price distortion. Explore how these hidden order techniques optimize trading efficiency and reduce slippage in dynamic markets.

Market Depth

Iceberg orders conceal the total trade volume by displaying only a small portion at a time, preserving market depth and minimizing price impact, while liquidity sweeps aggressively target all available liquidity across price levels, often consuming multiple layers of the order book. The contrast between these strategies highlights their influence on market depth and price stability, where iceberg orders maintain a more stable market structure compared to the immediate depletion caused by liquidity sweeps. Explore deeper insights into order execution strategies and market depth dynamics to optimize your trading approach.

Order Execution

Iceberg orders strategically conceal large trade sizes by breaking them into smaller, visible portions, optimizing order execution without significantly impacting market prices. Liquidity sweeps aggressively target multiple price levels to capture available liquidity quickly, prioritizing speed over stealth. Explore these execution strategies in-depth to enhance your trading effectiveness.

Source and External Links

Iceberg Order - Overview, How It Works, and Example - An iceberg order is a large order split into smaller chunks to conceal total size, revealing only a fraction at a time to minimize market impact during large trades.

Iceberg Order (2025): Mechanics, Strategies, Pros, Cons - Iceberg orders manage large trades by showing only a small visible portion on the order book while the rest remains hidden, automatically revealing more as each visible part executes to prevent market disruption.

What are Iceberg Orders? - Bookmap - Iceberg orders help large investors execute big orders incrementally, hiding full size to avoid sharp price movements and rumors that could result from revealing a large order all at once.

dowidth.com

dowidth.com