Risk reversal and butterfly spread are advanced trading strategies used to manage risk and leverage market movements in options trading. Risk reversal involves simultaneously buying a call and selling a put to capitalize on directional trends, while butterfly spread employs multiple options at different strike prices to profit from minimal price volatility. Explore the nuances of risk reversal versus butterfly spread to enhance your trading strategy.

Why it is important

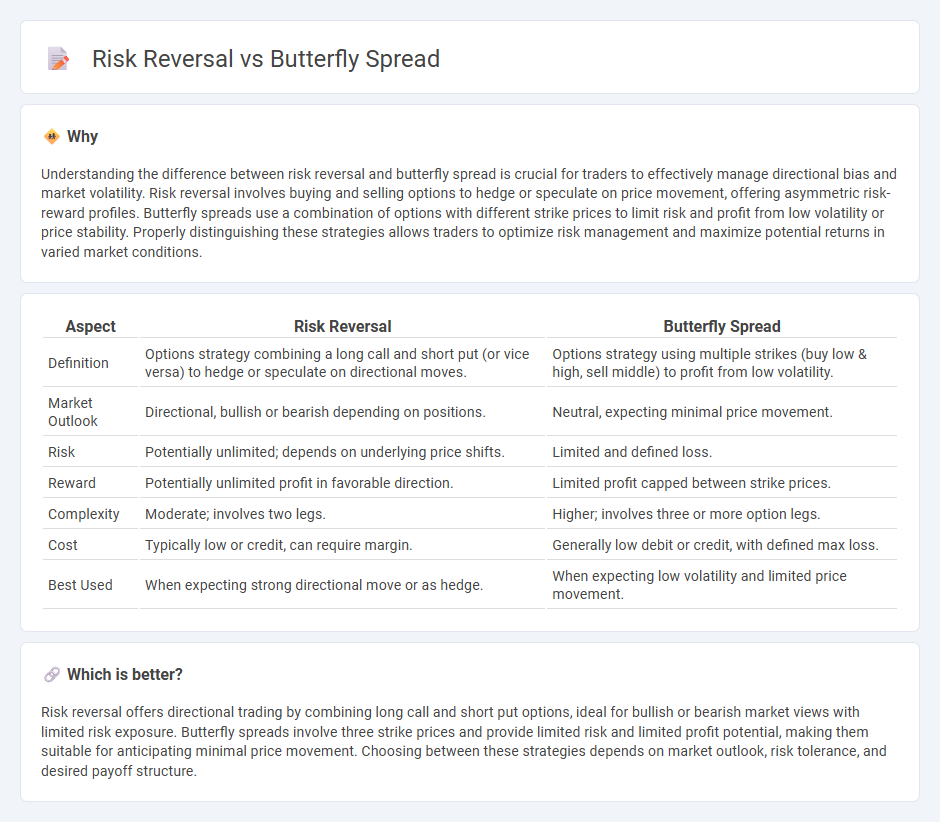

Understanding the difference between risk reversal and butterfly spread is crucial for traders to effectively manage directional bias and market volatility. Risk reversal involves buying and selling options to hedge or speculate on price movement, offering asymmetric risk-reward profiles. Butterfly spreads use a combination of options with different strike prices to limit risk and profit from low volatility or price stability. Properly distinguishing these strategies allows traders to optimize risk management and maximize potential returns in varied market conditions.

Comparison Table

| Aspect | Risk Reversal | Butterfly Spread |

|---|---|---|

| Definition | Options strategy combining a long call and short put (or vice versa) to hedge or speculate on directional moves. | Options strategy using multiple strikes (buy low & high, sell middle) to profit from low volatility. |

| Market Outlook | Directional, bullish or bearish depending on positions. | Neutral, expecting minimal price movement. |

| Risk | Potentially unlimited; depends on underlying price shifts. | Limited and defined loss. |

| Reward | Potentially unlimited profit in favorable direction. | Limited profit capped between strike prices. |

| Complexity | Moderate; involves two legs. | Higher; involves three or more option legs. |

| Cost | Typically low or credit, can require margin. | Generally low debit or credit, with defined max loss. |

| Best Used | When expecting strong directional move or as hedge. | When expecting low volatility and limited price movement. |

Which is better?

Risk reversal offers directional trading by combining long call and short put options, ideal for bullish or bearish market views with limited risk exposure. Butterfly spreads involve three strike prices and provide limited risk and limited profit potential, making them suitable for anticipating minimal price movement. Choosing between these strategies depends on market outlook, risk tolerance, and desired payoff structure.

Connection

Risk reversal and butterfly spread are option trading strategies used to manage directional risk and volatility exposure in the market. Risk reversal involves simultaneous buying and selling of out-of-the-money call and put options to hedge or speculate on price movements, while butterfly spread combines multiple options at different strike prices to limit risk and profit from minimal price fluctuations. Both strategies optimize risk management by leveraging option premiums and strike price differentials to balance potential gains and losses.

Key Terms

Strike Prices

A butterfly spread involves using three strike prices: a lower strike, a middle strike (at-the-money), and a higher strike, creating a neutral strategy that profits from low volatility near the middle strike price. In contrast, a risk reversal uses two strike prices--typically an out-of-the-money call and an out-of-the-money put--aiming to capitalize on directional market moves by simultaneously buying one option and selling the other. Explore detailed strike price selection techniques and strategic applications to optimize your option trading outcomes.

Options Combination

Butterfly spreads and risk reversals are popular options combinations used to manage risk and leverage market outlooks; butterfly spreads involve buying and selling multiple strikes to create a limited risk-reward profile, typically benefiting from low volatility scenarios. Risk reversals combine a long call and short put (or vice versa) to hedge or speculate directional moves in the underlying asset, often reflecting market sentiment on price direction and volatility. Explore detailed strategies and payoff profiles to master when to implement butterfly spreads versus risk reversals in your options trading portfolio.

Risk Profile

A butterfly spread involves buying and selling options at three strike prices, creating a limited risk and reward profile primarily suited for traders expecting low volatility. Risk reversals combine a long call and a short put, producing a directional risk profile that benefits from upward price movement but carries unbounded risk on the downside. Explore detailed comparisons to understand how each strategy aligns with your risk tolerance and market outlook.

Source and External Links

Mastering Butterfly Spread - A butterfly spread is an options trading strategy involving buying and selling three options with the same expiration but different strike prices, designed to profit when the underlying asset's price stays within a specific range while limiting risk.

Long Butterfly Spread - This advanced strategy involves buying the wings and selling the body of calls or puts and produces maximum profit if the underlying asset price settles at the middle strike price at expiration.

Long Butterfly Spread with Puts - Constructed by buying one put at a high strike, selling two puts at a middle strike, and buying one put at a lower strike, this strategy has limited risk equal to its cost and maximum profit when the underlying equals the middle strike at expiration.

dowidth.com

dowidth.com