Tape reading involves analyzing the time and sales data to interpret market sentiment and predict short-term price movements using order flow information. High-frequency trading utilizes powerful algorithms and ultra-low latency systems to execute thousands of trades per second, capitalizing on minimal price discrepancies. Explore the nuances between these two dynamic trading strategies to enhance your market approach.

Why it is important

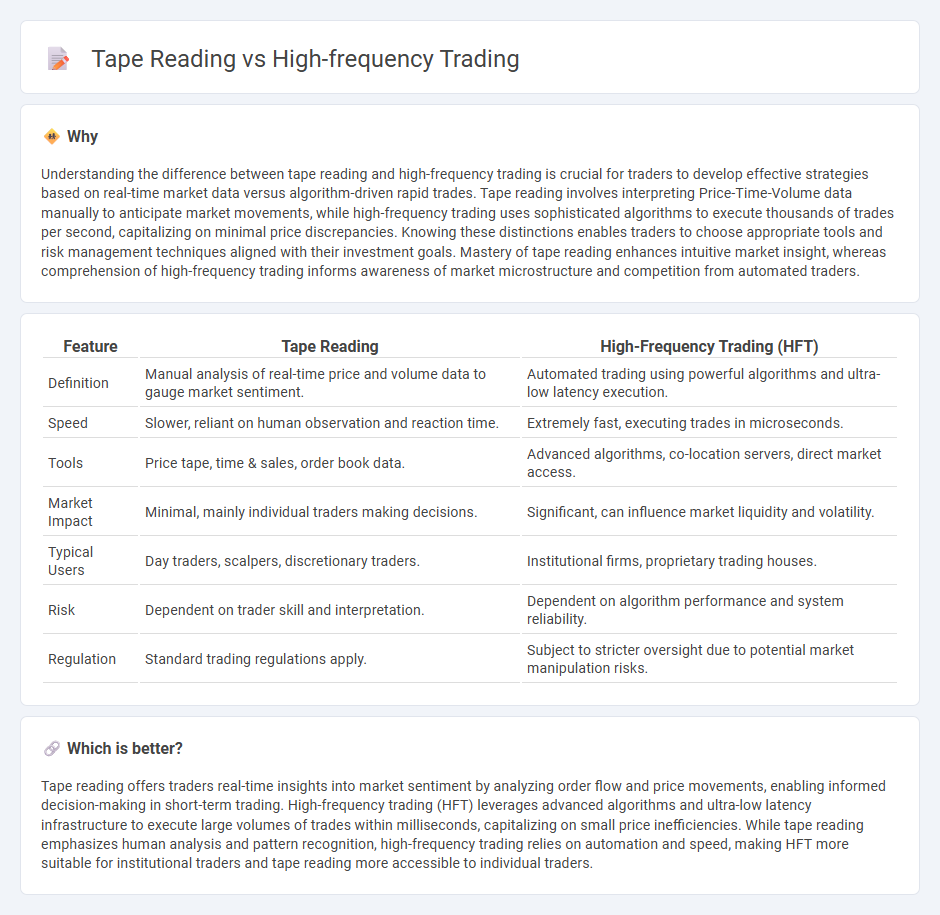

Understanding the difference between tape reading and high-frequency trading is crucial for traders to develop effective strategies based on real-time market data versus algorithm-driven rapid trades. Tape reading involves interpreting Price-Time-Volume data manually to anticipate market movements, while high-frequency trading uses sophisticated algorithms to execute thousands of trades per second, capitalizing on minimal price discrepancies. Knowing these distinctions enables traders to choose appropriate tools and risk management techniques aligned with their investment goals. Mastery of tape reading enhances intuitive market insight, whereas comprehension of high-frequency trading informs awareness of market microstructure and competition from automated traders.

Comparison Table

| Feature | Tape Reading | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Manual analysis of real-time price and volume data to gauge market sentiment. | Automated trading using powerful algorithms and ultra-low latency execution. |

| Speed | Slower, reliant on human observation and reaction time. | Extremely fast, executing trades in microseconds. |

| Tools | Price tape, time & sales, order book data. | Advanced algorithms, co-location servers, direct market access. |

| Market Impact | Minimal, mainly individual traders making decisions. | Significant, can influence market liquidity and volatility. |

| Typical Users | Day traders, scalpers, discretionary traders. | Institutional firms, proprietary trading houses. |

| Risk | Dependent on trader skill and interpretation. | Dependent on algorithm performance and system reliability. |

| Regulation | Standard trading regulations apply. | Subject to stricter oversight due to potential market manipulation risks. |

Which is better?

Tape reading offers traders real-time insights into market sentiment by analyzing order flow and price movements, enabling informed decision-making in short-term trading. High-frequency trading (HFT) leverages advanced algorithms and ultra-low latency infrastructure to execute large volumes of trades within milliseconds, capitalizing on small price inefficiencies. While tape reading emphasizes human analysis and pattern recognition, high-frequency trading relies on automation and speed, making HFT more suitable for institutional traders and tape reading more accessible to individual traders.

Connection

Tape reading involves analyzing real-time price and volume data from stock exchanges, providing insights into market sentiment and liquidity. High-frequency trading relies heavily on this type of detailed, rapid data interpretation to execute ultra-fast trades based on micro-movements in the market. The integration of tape reading data enables high-frequency traders to identify precise entry and exit points, optimizing algorithmic trading strategies for enhanced profitability.

Key Terms

High-Frequency Trading:

High-frequency trading (HFT) leverages advanced algorithms and ultra-low latency connectivity to execute thousands of trades per second, capturing minute price discrepancies across markets. This strategy relies on co-location services and real-time data feeds to gain speed advantages over competitors, often involving complex quantitative models and high-powered computing infrastructure. Explore deeper insights into how HFT transforms market liquidity and trading efficiency.

Algorithmic Execution

High-frequency trading (HFT) utilizes sophisticated algorithms and ultra-fast data processing to execute large volumes of trades within milliseconds, capitalizing on minute price discrepancies across markets. Tape reading, traditionally reliant on manual analysis of price and volume data from the time and sales ticker, contrasts with HFT by focusing on order flow and market sentiment through human interpretation. Explore how algorithmic execution transforms market strategies and trading efficiency in greater detail.

Latency

High-frequency trading (HFT) leverages ultra-low latency technologies to execute thousands of trades within milliseconds, capitalizing on minor price discrepancies. Tape reading, traditionally reliant on real-time interpretation of order flow and price action, faces challenges in latency-sensitive environments due to slower data processing. Discover more about how latency differences shape trading strategies and market efficiency.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading (HFT) is an automated trading method using powerful computers and advanced algorithms to execute many trades in microseconds, capitalizing on very small price differences across markets for profit.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is algorithmic trading characterized by extremely fast execution, a high number of transactions, and short-term horizons, often used by institutional investors to profit from small price fluctuations and arbitrage opportunities.

High-frequency trading - Wikipedia - High-frequency trading involves quantitative, algorithm-driven strategies that execute orders rapidly, often focusing on market-making, arbitrage, and exploiting minute market inefficiencies through speed rather than novel algorithms.

dowidth.com

dowidth.com