Copy trading allows investors to replicate the strategies of experienced traders automatically, providing a hands-off approach to the financial markets. Manual trading demands active decision-making, market analysis, and timing precision to execute trades independently. Discover the advantages and risks of both methods to optimize your trading performance.

Why it is important

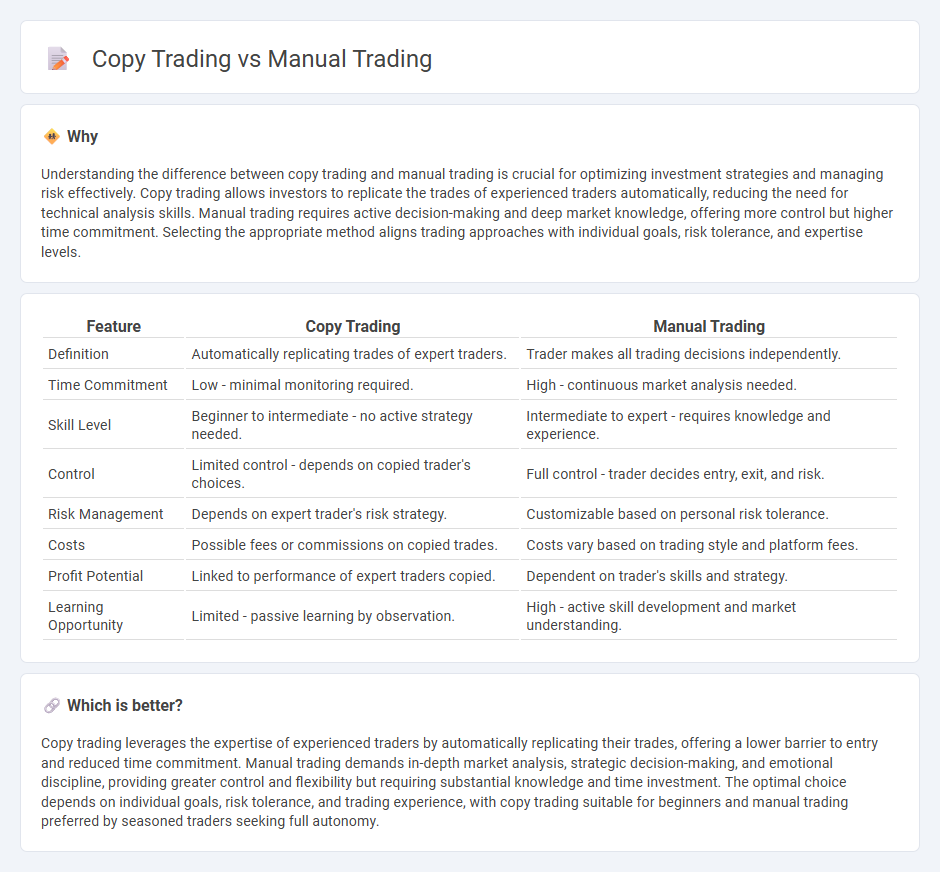

Understanding the difference between copy trading and manual trading is crucial for optimizing investment strategies and managing risk effectively. Copy trading allows investors to replicate the trades of experienced traders automatically, reducing the need for technical analysis skills. Manual trading requires active decision-making and deep market knowledge, offering more control but higher time commitment. Selecting the appropriate method aligns trading approaches with individual goals, risk tolerance, and expertise levels.

Comparison Table

| Feature | Copy Trading | Manual Trading |

|---|---|---|

| Definition | Automatically replicating trades of expert traders. | Trader makes all trading decisions independently. |

| Time Commitment | Low - minimal monitoring required. | High - continuous market analysis needed. |

| Skill Level | Beginner to intermediate - no active strategy needed. | Intermediate to expert - requires knowledge and experience. |

| Control | Limited control - depends on copied trader's choices. | Full control - trader decides entry, exit, and risk. |

| Risk Management | Depends on expert trader's risk strategy. | Customizable based on personal risk tolerance. |

| Costs | Possible fees or commissions on copied trades. | Costs vary based on trading style and platform fees. |

| Profit Potential | Linked to performance of expert traders copied. | Dependent on trader's skills and strategy. |

| Learning Opportunity | Limited - passive learning by observation. | High - active skill development and market understanding. |

Which is better?

Copy trading leverages the expertise of experienced traders by automatically replicating their trades, offering a lower barrier to entry and reduced time commitment. Manual trading demands in-depth market analysis, strategic decision-making, and emotional discipline, providing greater control and flexibility but requiring substantial knowledge and time investment. The optimal choice depends on individual goals, risk tolerance, and trading experience, with copy trading suitable for beginners and manual trading preferred by seasoned traders seeking full autonomy.

Connection

Copy trading and manual trading are connected through their reliance on trader behavior and market analysis to execute profitable trades. Copy trading automates manual trading decisions by replicating the strategies of experienced traders in real time, allowing less experienced investors to benefit from expert insights without active management. Both methods require understanding market trends, risk management, and timing to maximize returns in volatile financial markets.

Key Terms

Decision-making

Manual trading requires traders to analyze market data, evaluate risks, and make independent decisions, leveraging technical and fundamental analysis skills. Copy trading automates decision-making by replicating expert traders' actions, reducing the need for in-depth market knowledge but potentially increasing reliance on others' strategies. Explore more about how decision-making impacts your trading style and outcomes.

Signal provider

Manual trading requires signal providers to analyze market trends, generate precise trading signals, and apply their expertise to execute trades independently. Copy trading depends heavily on the reliability and performance history of signal providers, as traders replicate their strategies automatically, minimizing personal input. Explore how top signal providers influence success rates and risk management in both trading methods.

Trade execution

Manual trading requires active decision-making and precise trade execution by the trader, who analyzes market conditions and places orders individually. Copy trading automates trade execution by replicating the actions of experienced traders, allowing users to mirror their strategies instantly without in-depth market analysis. Explore the differences in trade execution techniques to optimize your trading approach and strategy.

Source and External Links

What is Manual Trading? Characteristics of Manual Traders - Manual trading involves buying and selling financial assets based on a trader's own analysis and judgment, requiring emotional control and hands-on decision-making with strategies like day trading and swing trading.

Auto-Trading vs. Manual Trading: Which Is Best? - Manual trading demands active involvement, market knowledge, and emotional resilience, offering control and flexibility but requiring time and exposing traders to human error and emotional bias.

Manual vs. Automated Trading in Forex: Which Strategy Suits You Best? - Manual trading gives traders complete control and adaptability but is time-intensive and prone to emotional and inconsistency risks, unlike automated trading designed for efficiency and discipline.

dowidth.com

dowidth.com