Smart Money Concepts focus on analyzing institutional trading behaviors and liquidity zones to anticipate market movements, while Support and Resistance levels identify price points where supply and demand historically affect price reversals or consolidations. Understanding how smart money influences these key price zones enhances the accuracy of trade entries and exits. Discover how integrating these strategies can elevate your trading performance.

Why it is important

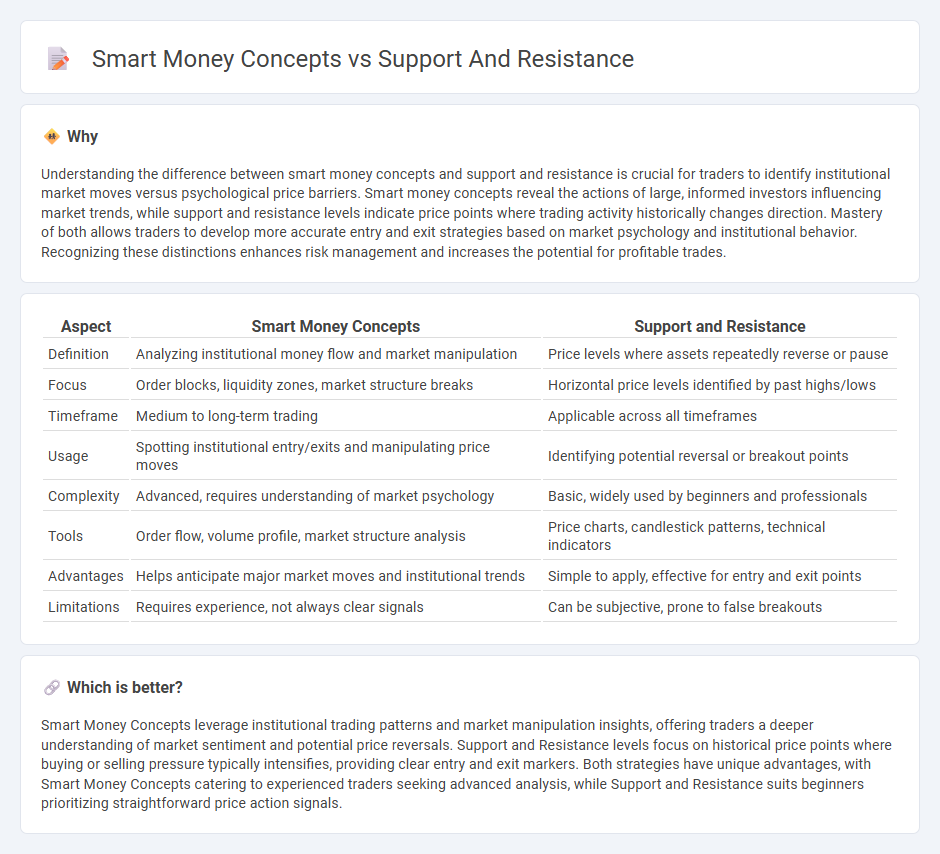

Understanding the difference between smart money concepts and support and resistance is crucial for traders to identify institutional market moves versus psychological price barriers. Smart money concepts reveal the actions of large, informed investors influencing market trends, while support and resistance levels indicate price points where trading activity historically changes direction. Mastery of both allows traders to develop more accurate entry and exit strategies based on market psychology and institutional behavior. Recognizing these distinctions enhances risk management and increases the potential for profitable trades.

Comparison Table

| Aspect | Smart Money Concepts | Support and Resistance |

|---|---|---|

| Definition | Analyzing institutional money flow and market manipulation | Price levels where assets repeatedly reverse or pause |

| Focus | Order blocks, liquidity zones, market structure breaks | Horizontal price levels identified by past highs/lows |

| Timeframe | Medium to long-term trading | Applicable across all timeframes |

| Usage | Spotting institutional entry/exits and manipulating price moves | Identifying potential reversal or breakout points |

| Complexity | Advanced, requires understanding of market psychology | Basic, widely used by beginners and professionals |

| Tools | Order flow, volume profile, market structure analysis | Price charts, candlestick patterns, technical indicators |

| Advantages | Helps anticipate major market moves and institutional trends | Simple to apply, effective for entry and exit points |

| Limitations | Requires experience, not always clear signals | Can be subjective, prone to false breakouts |

Which is better?

Smart Money Concepts leverage institutional trading patterns and market manipulation insights, offering traders a deeper understanding of market sentiment and potential price reversals. Support and Resistance levels focus on historical price points where buying or selling pressure typically intensifies, providing clear entry and exit markers. Both strategies have unique advantages, with Smart Money Concepts catering to experienced traders seeking advanced analysis, while Support and Resistance suits beginners prioritizing straightforward price action signals.

Connection

Smart money concepts revolve around tracking the actions of institutional investors who use support and resistance levels to identify optimal entry and exit points. These key price zones act as psychological barriers where smart money accumulates or distributes positions, influencing market trends. Understanding the interplay between smart money activity and support-resistance dynamics enhances traders' ability to anticipate price reversals and maximize profit potential.

Key Terms

Support and Resistance:

Support and Resistance levels are critical technical analysis tools that identify price points where an asset tends to stop and reverse due to concentrated buying or selling pressure. These levels, derived from historical price data, act as psychological barriers influencing market behavior and trader decision-making. Explore in-depth how mastering Support and Resistance can enhance your trading strategies and improve market predictions.

Price Levels

Support and resistance levels represent predefined price points where traders anticipate potential reversals or pauses in market movement. Smart money concepts emphasize the role of institutional traders and the liquidity pools they target, often using support and resistance zones to execute large orders stealthily. Explore how integrating these approaches can enhance your trading strategy by uncovering hidden market dynamics.

Breakout

Support and resistance levels represent traditional price zones where buying or selling pressure historically reverses market direction, while smart money concepts focus on institutional activity and accumulation or distribution phases that often precede significant breakouts. Breakouts occur when price moves beyond these key levels, signaling strong momentum usually driven by smart money entering or exiting positions, leading to sustained trends. Explore how understanding smart money behavior around breakouts can enhance your trading accuracy and strategy.

Source and External Links

What is Support and Resistance? - Support is a price level where a downtrend may pause due to buying interest acting like a floor to stop prices from falling further, while resistance is a level where selling pressure prevents prices from rising, making them key concepts in technical analysis to identify potential entry and exit points.

What Is Support And Resistance? - Support and resistance levels represent where demand and supply forces meet, with support being where demand stops prices from falling further and resistance where supply stops prices from rising, critical for understanding market psychology.

Support and Resistance - Support and resistance are key price levels where price movement is likely to pause or reverse, with support below price acting to slow a downtrend and resistance above price acting to slow an uptrend, often identified using moving averages, previous highs and lows, or trend lines.

dowidth.com

dowidth.com