High frequency trading bots execute numerous rapid trades to capitalize on small price discrepancies, leveraging advanced algorithms and low-latency data feeds. Market making bots continuously provide buy and sell quotes to maintain liquidity and profit from bid-ask spreads while managing inventory risk. Discover how these trading bots transform financial markets and shape investment strategies.

Why it is important

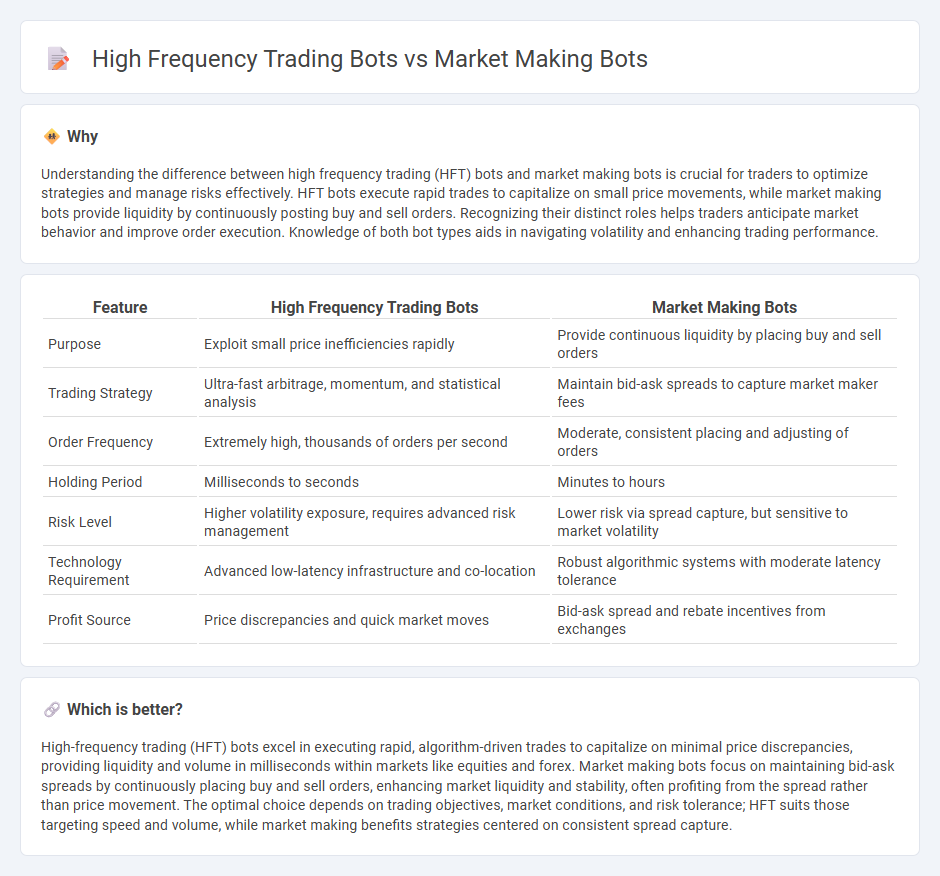

Understanding the difference between high frequency trading (HFT) bots and market making bots is crucial for traders to optimize strategies and manage risks effectively. HFT bots execute rapid trades to capitalize on small price movements, while market making bots provide liquidity by continuously posting buy and sell orders. Recognizing their distinct roles helps traders anticipate market behavior and improve order execution. Knowledge of both bot types aids in navigating volatility and enhancing trading performance.

Comparison Table

| Feature | High Frequency Trading Bots | Market Making Bots |

|---|---|---|

| Purpose | Exploit small price inefficiencies rapidly | Provide continuous liquidity by placing buy and sell orders |

| Trading Strategy | Ultra-fast arbitrage, momentum, and statistical analysis | Maintain bid-ask spreads to capture market maker fees |

| Order Frequency | Extremely high, thousands of orders per second | Moderate, consistent placing and adjusting of orders |

| Holding Period | Milliseconds to seconds | Minutes to hours |

| Risk Level | Higher volatility exposure, requires advanced risk management | Lower risk via spread capture, but sensitive to market volatility |

| Technology Requirement | Advanced low-latency infrastructure and co-location | Robust algorithmic systems with moderate latency tolerance |

| Profit Source | Price discrepancies and quick market moves | Bid-ask spread and rebate incentives from exchanges |

Which is better?

High-frequency trading (HFT) bots excel in executing rapid, algorithm-driven trades to capitalize on minimal price discrepancies, providing liquidity and volume in milliseconds within markets like equities and forex. Market making bots focus on maintaining bid-ask spreads by continuously placing buy and sell orders, enhancing market liquidity and stability, often profiting from the spread rather than price movement. The optimal choice depends on trading objectives, market conditions, and risk tolerance; HFT suits those targeting speed and volume, while market making benefits strategies centered on consistent spread capture.

Connection

High frequency trading bots and market making bots are interconnected through their shared goal of executing rapid trades to capture small price discrepancies, enhancing liquidity and reducing spreads. Market making bots place continuous bid and ask orders, while high frequency trading bots capitalize on these orders by swiftly executing trades based on real-time market data. Together, their algorithms optimize market efficiency by balancing supply and demand at high speeds.

Key Terms

Liquidity provision

Market making bots continuously place buy and sell orders to provide liquidity, reducing bid-ask spreads and enhancing market efficiency. High frequency trading bots execute rapid trades exploiting short-term price inefficiencies, often with less emphasis on sustained liquidity provision. Explore the distinct roles these bots play in modern financial markets to deepen your understanding of liquidity dynamics.

Latency

Market making bots prioritize consistently providing liquidity by placing buy and sell orders, requiring moderate latency to update prices in real-time and manage inventory risk effectively. High frequency trading (HFT) bots demand ultra-low latency to exploit transient market inefficiencies and execute thousands of trades within milliseconds for profit. Discover how latency optimization differentiates these strategies and impacts trading performance.

Bid-ask spread

Market making bots continuously provide liquidity by placing buy and sell orders to profit from the bid-ask spread, maintaining tighter spreads for smoother market operations. High frequency trading (HFT) bots exploit minute price discrepancies through rapid order execution but do not consistently maintain both sides of the order book like market makers. Discover more about how bid-ask spreads impact trading strategies and market dynamics.

Source and External Links

Market Maker Bot: Elevating Trading Strategies - Market making bots optimize trading by continuously placing buy and sell orders to provide liquidity, reduce price disparities, and stabilize markets, helping traders profit from small spreads and ensuring a balanced market environment.

How to set up your Market Maker bot - Market maker bots trade the spread between bid and ask prices by placing strategic buy and sell orders on exchanges, with configurable settings for market selection, trend adaptation, and targeting profitable spreads.

How does a crypto market making bot work? - A crypto market making bot is an automated system designed to maximize profit by executing buy and sell orders without human intervention, trading the spread efficiently and emotionlessly to optimize returns over short periods.

dowidth.com

dowidth.com