Perpetual contracts provide traders with leveraged exposure to cryptocurrencies without expiration dates, enabling continuous market participation and the ability to hedge or speculate efficiently. ETFs (Exchange-Traded Funds) offer diversified asset exposure through a regulated investment vehicle, facilitating long-term investment strategies with lower risk and ease of access on traditional exchanges. Explore more to understand how perpetual contracts and ETFs can align with your trading objectives.

Why it is important

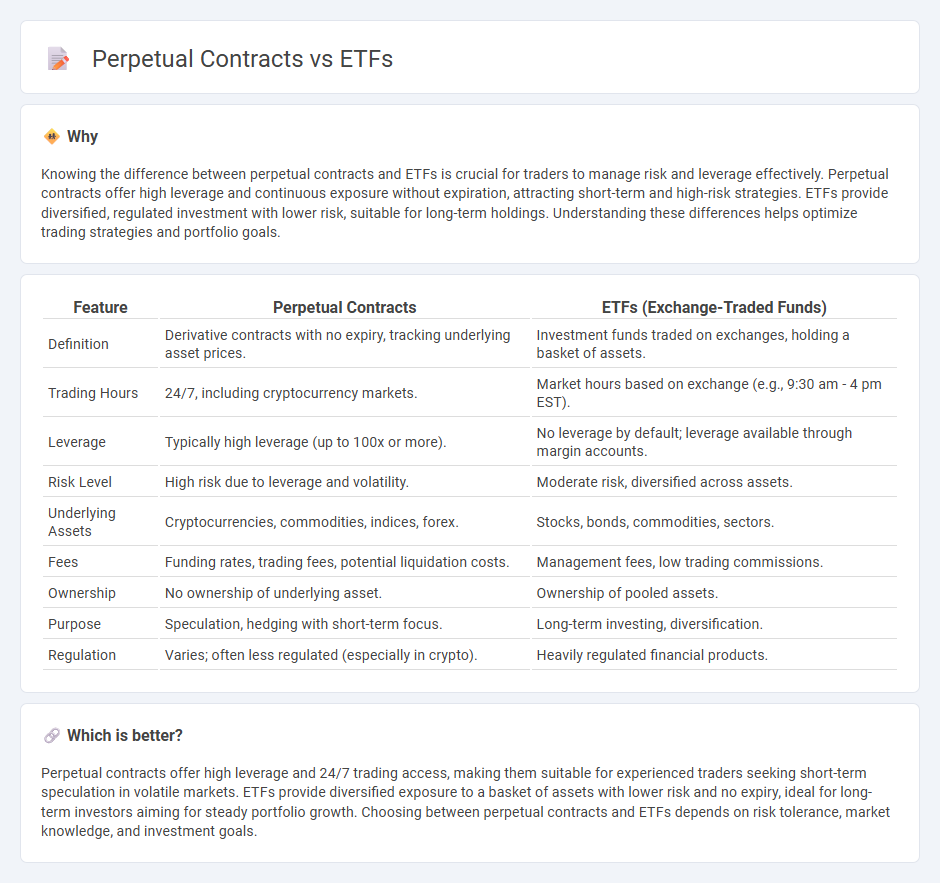

Knowing the difference between perpetual contracts and ETFs is crucial for traders to manage risk and leverage effectively. Perpetual contracts offer high leverage and continuous exposure without expiration, attracting short-term and high-risk strategies. ETFs provide diversified, regulated investment with lower risk, suitable for long-term holdings. Understanding these differences helps optimize trading strategies and portfolio goals.

Comparison Table

| Feature | Perpetual Contracts | ETFs (Exchange-Traded Funds) |

|---|---|---|

| Definition | Derivative contracts with no expiry, tracking underlying asset prices. | Investment funds traded on exchanges, holding a basket of assets. |

| Trading Hours | 24/7, including cryptocurrency markets. | Market hours based on exchange (e.g., 9:30 am - 4 pm EST). |

| Leverage | Typically high leverage (up to 100x or more). | No leverage by default; leverage available through margin accounts. |

| Risk Level | High risk due to leverage and volatility. | Moderate risk, diversified across assets. |

| Underlying Assets | Cryptocurrencies, commodities, indices, forex. | Stocks, bonds, commodities, sectors. |

| Fees | Funding rates, trading fees, potential liquidation costs. | Management fees, low trading commissions. |

| Ownership | No ownership of underlying asset. | Ownership of pooled assets. |

| Purpose | Speculation, hedging with short-term focus. | Long-term investing, diversification. |

| Regulation | Varies; often less regulated (especially in crypto). | Heavily regulated financial products. |

Which is better?

Perpetual contracts offer high leverage and 24/7 trading access, making them suitable for experienced traders seeking short-term speculation in volatile markets. ETFs provide diversified exposure to a basket of assets with lower risk and no expiry, ideal for long-term investors aiming for steady portfolio growth. Choosing between perpetual contracts and ETFs depends on risk tolerance, market knowledge, and investment goals.

Connection

Perpetual contracts and ETFs are connected through their ability to provide traders with exposure to underlying assets without ownership. Perpetual contracts offer leveraged trading on assets like cryptocurrencies or commodities, while ETFs bundle several assets into a single tradable instrument tracking market indices or sectors. Both instruments enhance portfolio diversification, risk management, and liquidity in modern trading strategies.

Key Terms

Leverage

ETFs offer diversified exposure with moderate leverage, typically capped at 2x or 3x to manage risk, while perpetual contracts allow traders to utilize high leverage, often exceeding 50x, amplifying both potential gains and losses. The primary difference lies in risk management; ETFs are regulated financial products with predefined leverage limits, whereas perpetual contracts are derivative instruments on crypto or forex markets, enabling more aggressive speculative strategies. Explore detailed comparisons and risk assessments to determine which leverage option aligns best with your investment goals.

Underlying Asset

ETFs (Exchange-Traded Funds) represent a basket of underlying assets such as stocks, bonds, or commodities, providing diversified exposure and long-term investment potential. Perpetual contracts are derivative instruments relying on underlying assets like cryptocurrencies or indices without expiry, enabling leveraged trading and price speculation. Explore the key differences in underlying assets and risk profiles to make informed investment decisions.

Expiry Date

ETFs (Exchange-Traded Funds) do not have an expiry date, allowing investors to hold positions indefinitely and benefit from long-term market exposure. Perpetual contracts, a type of futures contract, also lack a traditional expiry, but they require regular funding payments to maintain positions, influencing cost and risk. Explore the nuances of expiry and maintenance in ETFs and perpetual contracts for informed trading decisions.

Source and External Links

What is an ETF (Exchange-Traded Fund)? - ETFs are funds traded on exchanges that hold a diversified collection of stocks, bonds, or other securities, offering investors flexibility, diversification, lower costs, and tax efficiency compared to mutual funds.

Exchange-Traded Funds (ETFs) - ETFs are exchange-traded investment products that pool money from many investors to buy diversified portfolios of securities and offer professional management, liquidity, low minimum investments, and tax advantages.

Exchange-traded fund - Most ETFs track a specific market index by holding the same securities as that index, enabling investors to gain market exposure with the benefits of tradability and diversification among various asset classes globally.

dowidth.com

dowidth.com