Paper trading platforms simulate real market conditions to allow traders to practice strategies without risking actual money, offering advanced features like real-time data and order execution. Demo accounts typically provide a simplified, risk-free environment for beginners to familiarize themselves with trading interfaces and basic functionalities. Explore the key differences and benefits to choose the platform that best suits your trading goals.

Why it is important

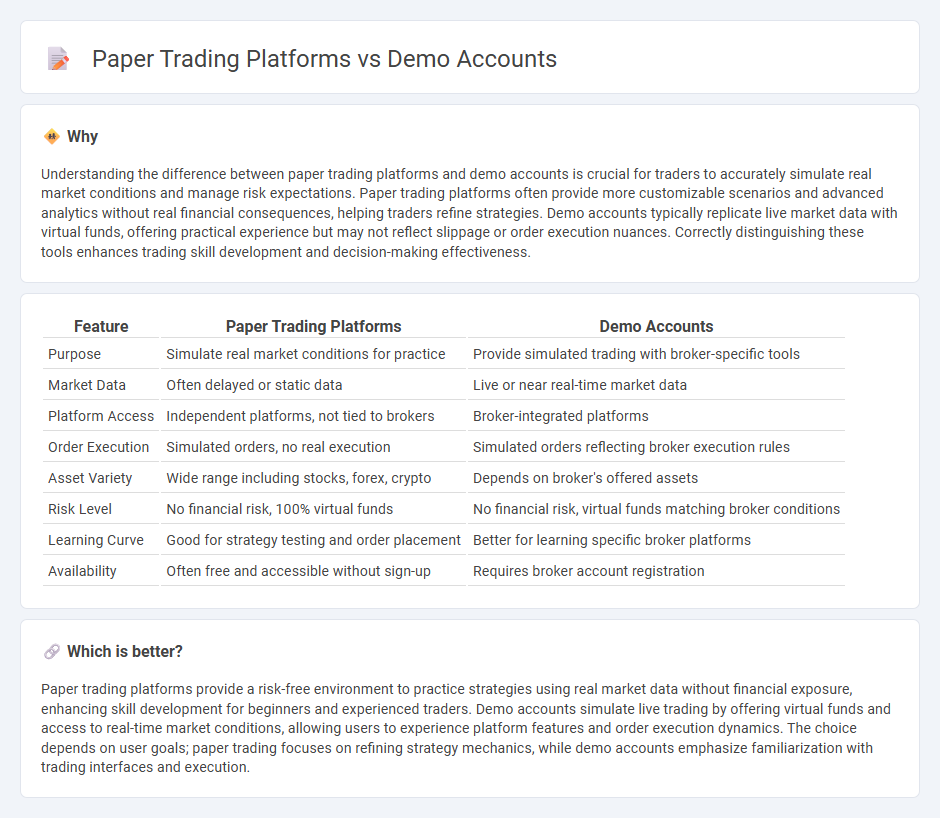

Understanding the difference between paper trading platforms and demo accounts is crucial for traders to accurately simulate real market conditions and manage risk expectations. Paper trading platforms often provide more customizable scenarios and advanced analytics without real financial consequences, helping traders refine strategies. Demo accounts typically replicate live market data with virtual funds, offering practical experience but may not reflect slippage or order execution nuances. Correctly distinguishing these tools enhances trading skill development and decision-making effectiveness.

Comparison Table

| Feature | Paper Trading Platforms | Demo Accounts |

|---|---|---|

| Purpose | Simulate real market conditions for practice | Provide simulated trading with broker-specific tools |

| Market Data | Often delayed or static data | Live or near real-time market data |

| Platform Access | Independent platforms, not tied to brokers | Broker-integrated platforms |

| Order Execution | Simulated orders, no real execution | Simulated orders reflecting broker execution rules |

| Asset Variety | Wide range including stocks, forex, crypto | Depends on broker's offered assets |

| Risk Level | No financial risk, 100% virtual funds | No financial risk, virtual funds matching broker conditions |

| Learning Curve | Good for strategy testing and order placement | Better for learning specific broker platforms |

| Availability | Often free and accessible without sign-up | Requires broker account registration |

Which is better?

Paper trading platforms provide a risk-free environment to practice strategies using real market data without financial exposure, enhancing skill development for beginners and experienced traders. Demo accounts simulate live trading by offering virtual funds and access to real-time market conditions, allowing users to experience platform features and order execution dynamics. The choice depends on user goals; paper trading focuses on refining strategy mechanics, while demo accounts emphasize familiarization with trading interfaces and execution.

Connection

Paper trading platforms and demo accounts are essential tools for traders to simulate real market conditions without risking actual capital. Both offer virtual environments that replicate live trading interfaces, allowing users to practice strategies and test order executions in real time. These platforms enhance trading skills by providing accurate market data and realistic scenarios, which build confidence before engaging with live markets.

Key Terms

Simulated Environment

Demo accounts provide a simulated environment mimicking real market conditions using virtual funds, enabling traders to practice strategies without financial risk. Paper trading platforms also offer risk-free practice but often lack the real-time data precision and market depth found in demo accounts. Discover the nuances between these tools to enhance your trading experience effectively.

Virtual Funds

Demo accounts provide users with virtual funds that closely mimic real market conditions, allowing traders to practice strategies without financial risk. Paper trading platforms also utilize virtual funds but often offer more customizable simulation features, catering to advanced testing and strategy refinement. Explore our detailed comparison to understand which virtual funds setup best suits your trading goals.

Real-time Market Data

Demo accounts and paper trading platforms both provide simulated environments for practicing trades without financial risk, yet demo accounts typically offer real-time market data mirroring actual market conditions more closely than many paper trading platforms, which may use delayed or static data. Real-time market data enhances accuracy in trade execution, helping traders better understand market dynamics and develop strategies under authentic conditions. Explore more to understand how real-time data impacts trading performance and platform selection.

Source and External Links

Demo Trading Account | Binary Options Demo | No Minimum Deposit - Offers a free demo account with $10,000 in virtual funds to practice trading binary options, knock-outs, and call spreads on desktop or mobile, allowing users to test strategies, manage positions, and learn market analysis without risking real money.

Trading Demo Account - FOREX.com US - Provides a risk-free forex demo account with $50,000 virtual funds, real-time pricing on 80+ FX pairs, customizable charts, and educational resources to practice and improve trading skills with no real capital at risk.

Demo Trading Account: Try IG's Paper Trading Simulator - A comprehensive demo account giving access to over 17,000 markets including stocks, forex, bonds, and CFDs, enabling users to simulate real trading environments, understand platform functions, and practice leveraged CFD trading without financial risk.

dowidth.com

dowidth.com