Risk reversal and strangle are popular options trading strategies used to manage and capitalize on market volatility. Risk reversal involves buying an out-of-the-money call and selling an out-of-the-money put, aiming to profit from directional moves, while strangle involves purchasing both out-of-the-money call and put options to benefit from significant price swings regardless of direction. Explore these strategies to enhance your trading toolkit and better manage market uncertainties.

Why it is important

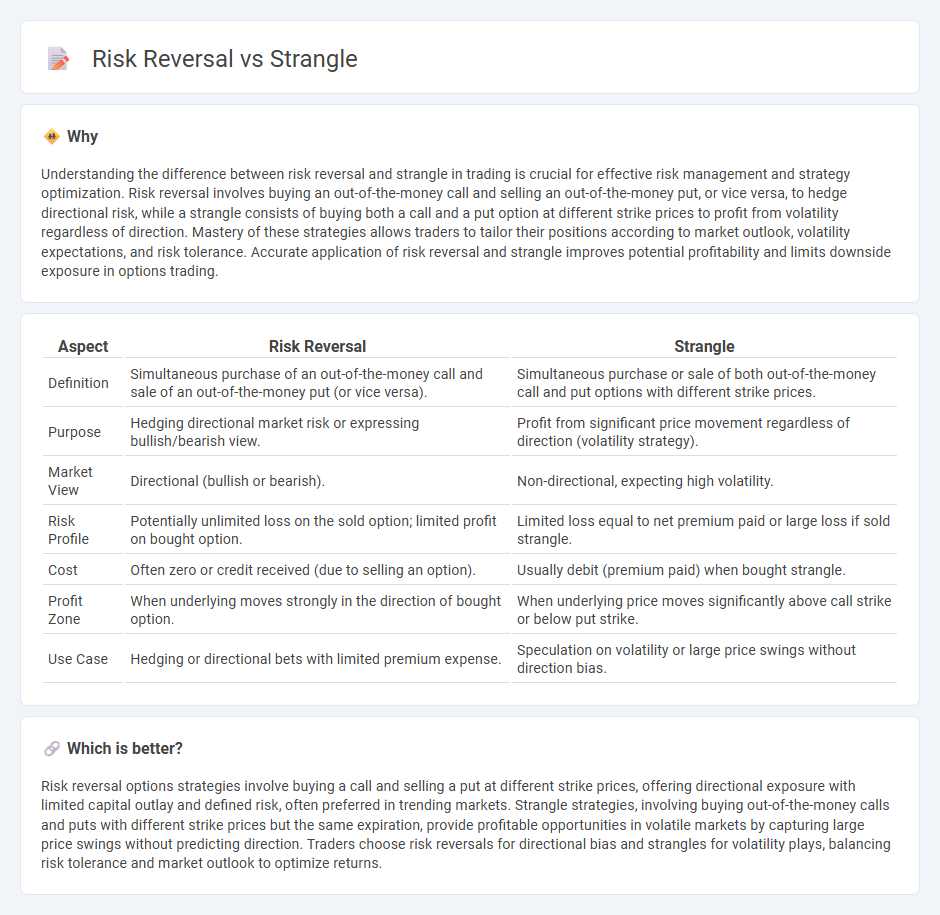

Understanding the difference between risk reversal and strangle in trading is crucial for effective risk management and strategy optimization. Risk reversal involves buying an out-of-the-money call and selling an out-of-the-money put, or vice versa, to hedge directional risk, while a strangle consists of buying both a call and a put option at different strike prices to profit from volatility regardless of direction. Mastery of these strategies allows traders to tailor their positions according to market outlook, volatility expectations, and risk tolerance. Accurate application of risk reversal and strangle improves potential profitability and limits downside exposure in options trading.

Comparison Table

| Aspect | Risk Reversal | Strangle |

|---|---|---|

| Definition | Simultaneous purchase of an out-of-the-money call and sale of an out-of-the-money put (or vice versa). | Simultaneous purchase or sale of both out-of-the-money call and put options with different strike prices. |

| Purpose | Hedging directional market risk or expressing bullish/bearish view. | Profit from significant price movement regardless of direction (volatility strategy). |

| Market View | Directional (bullish or bearish). | Non-directional, expecting high volatility. |

| Risk Profile | Potentially unlimited loss on the sold option; limited profit on bought option. | Limited loss equal to net premium paid or large loss if sold strangle. |

| Cost | Often zero or credit received (due to selling an option). | Usually debit (premium paid) when bought strangle. |

| Profit Zone | When underlying moves strongly in the direction of bought option. | When underlying price moves significantly above call strike or below put strike. |

| Use Case | Hedging or directional bets with limited premium expense. | Speculation on volatility or large price swings without direction bias. |

Which is better?

Risk reversal options strategies involve buying a call and selling a put at different strike prices, offering directional exposure with limited capital outlay and defined risk, often preferred in trending markets. Strangle strategies, involving buying out-of-the-money calls and puts with different strike prices but the same expiration, provide profitable opportunities in volatile markets by capturing large price swings without predicting direction. Traders choose risk reversals for directional bias and strangles for volatility plays, balancing risk tolerance and market outlook to optimize returns.

Connection

Risk reversal and strangle are both option strategies used to manage market exposure and hedge against price movements. Risk reversal involves simultaneously buying a call option and selling a put option, aiming to profit from directional moves, while a strangle consists of buying both out-of-the-money call and put options to capitalize on volatility. Both strategies are connected by their use of options to balance risk and reward in uncertain market conditions.

Key Terms

Strike Price

A strangle involves purchasing out-of-the-money call and put options with different strike prices to profit from significant price movement in either direction, while a risk reversal combines a long call and a short put at different strikes to mimic a synthetic long position. The strike prices in a strangle are typically equidistant from the current spot price, creating a wide range for potential volatility play, whereas in a risk reversal, the call strike is usually set above and the put strike below the spot price, reflecting directional bias. Explore further to understand how strike price selection impacts potential payoff and risk profiles in these option strategies.

Volatility

A strangle is an option strategy involving buying out-of-the-money call and put options, aimed at profiting from significant volatility spikes regardless of direction, while a risk reversal combines a long call and a short put to hedge against directional risk and changes in volatility skew. Strangles benefit from increased implied volatility as both options gain value when market movement intensifies, whereas risk reversals hinge more on volatility skew shifts and directional bias in volatility patterns. Explore detailed volatility analysis and strategy applications to optimize trading outcomes in various market conditions.

Premium

A strangle involves buying or selling out-of-the-money call and put options with different strike prices, generating a higher premium due to the dual option positions. A risk reversal strategy consists of selling an out-of-the-money put option while buying an out-of-the-money call option, often resulting in a net credit or a lower premium outlay compared to a strangle. Explore detailed premium structures and risk profiles to understand which strategy aligns best with your market outlook.

Source and External Links

Strangle (options) - Wikipedia - In finance, a strangle is an options trading strategy involving purchasing or selling one call and one put option with the same expiration but different strike prices, designed to profit from the size of the underlying price moves regardless of direction.

Strangling - Wikipedia - Strangling or strangulation is the compression of the neck that restricts oxygen flow to the brain, potentially causing unconsciousness or death, and can occur by hanging, ligature, or manual force.

Strangle - Definition, Meaning & Synonyms - Vocabulary.com - To strangle means to cut off someone's breathing by squeezing their throat, but it can also mean to hinder or suppress something, like strangling a social life or an action.

dowidth.com

dowidth.com