Synthetic positions replicate the payoff of options strategies by combining underlying assets and options, offering tailored risk and reward profiles without direct option trades. Straddles involve purchasing both a call and put option at the same strike price, enabling traders to profit from significant price movements in either direction. Explore the nuances of synthetic positions and straddles to enhance your trading strategy and risk management.

Why it is important

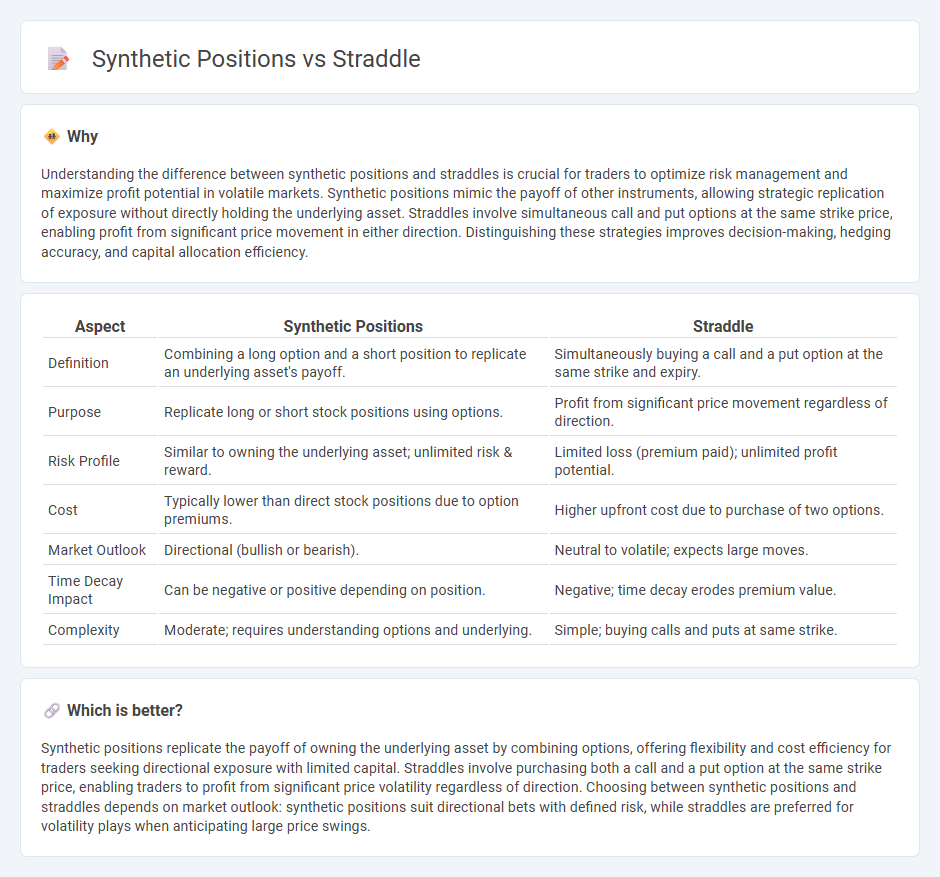

Understanding the difference between synthetic positions and straddles is crucial for traders to optimize risk management and maximize profit potential in volatile markets. Synthetic positions mimic the payoff of other instruments, allowing strategic replication of exposure without directly holding the underlying asset. Straddles involve simultaneous call and put options at the same strike price, enabling profit from significant price movement in either direction. Distinguishing these strategies improves decision-making, hedging accuracy, and capital allocation efficiency.

Comparison Table

| Aspect | Synthetic Positions | Straddle |

|---|---|---|

| Definition | Combining a long option and a short position to replicate an underlying asset's payoff. | Simultaneously buying a call and a put option at the same strike and expiry. |

| Purpose | Replicate long or short stock positions using options. | Profit from significant price movement regardless of direction. |

| Risk Profile | Similar to owning the underlying asset; unlimited risk & reward. | Limited loss (premium paid); unlimited profit potential. |

| Cost | Typically lower than direct stock positions due to option premiums. | Higher upfront cost due to purchase of two options. |

| Market Outlook | Directional (bullish or bearish). | Neutral to volatile; expects large moves. |

| Time Decay Impact | Can be negative or positive depending on position. | Negative; time decay erodes premium value. |

| Complexity | Moderate; requires understanding options and underlying. | Simple; buying calls and puts at same strike. |

Which is better?

Synthetic positions replicate the payoff of owning the underlying asset by combining options, offering flexibility and cost efficiency for traders seeking directional exposure with limited capital. Straddles involve purchasing both a call and a put option at the same strike price, enabling traders to profit from significant price volatility regardless of direction. Choosing between synthetic positions and straddles depends on market outlook: synthetic positions suit directional bets with defined risk, while straddles are preferred for volatility plays when anticipating large price swings.

Connection

Synthetic positions replicate the payoff of traditional options strategies using a combination of underlying assets and options, closely aligning with the risk and reward profiles of straddles. A straddle involves purchasing both a call and put option at the same strike price and expiration date, effectively capturing volatility regardless of market direction. Traders use synthetic positions to mimic straddles, enabling flexible hedging or speculative strategies without directly buying options.

Key Terms

Options (Calls & Puts)

Straddle positions involve buying a call and put option with the same strike price and expiry, aiming to profit from significant price movement in either direction. Synthetic positions replicate the payoff of one option using a combination of other options and underlying assets, such as creating a synthetic long call by buying a call and selling a put at the same strike. Explore detailed strategies and risk profiles to optimize your options trading outcomes.

Underlying Asset

Straddle and synthetic positions both revolve around the underlying asset's price movements but differ in structure and risk exposure. A straddle involves buying a call and put option at the same strike price, benefiting from significant volatility in the underlying asset without directional bias. Explore further to understand how these strategies leverage the underlying asset for distinct market outlooks.

Payoff Structure

A straddle position involves buying both a call and a put option at the same strike price and expiration date, aiming to profit from significant price movement in either direction, with unlimited upside and limited downside risk. In contrast, synthetic positions replicate similar payoff structures using combinations of options and underlying assets, often constructed to mimic long or short stock positions with different risk profiles and capital requirements. Explore the differences in payoff dynamics and strategic applications to optimize your options trading approach.

Source and External Links

Straddle - Definition, How to Create It, Examples - A straddle strategy involves simultaneously buying a call option and a put option with the same strike price and expiration date on the same underlying asset, used when a trader expects high price volatility but is uncertain about the direction of the price movement.

Straddle - Wikipedia - A straddle is an options strategy where an investor holds a call and a put option with the same strike price and expiration, profiting from significant price moves in either direction, and can be either a long straddle (buying both options) or a short straddle (selling both options).

Long Straddle Options Strategy - Fidelity - A long straddle consists of buying one call and one put option with the same strike and expiration to profit from a large price change in either direction, with unlimited profit potential upside and substantial downside profit, while limiting loss to the cost of the options.

dowidth.com

dowidth.com