Pair trading exploits price divergences between two historically correlated assets, aiming to profit from their relative movements regardless of overall market direction. Trend following strategies focus on capturing gains by identifying and riding sustained market trends using technical indicators and momentum signals. Explore the nuances of these trading approaches to determine which aligns best with your investment goals.

Why it is important

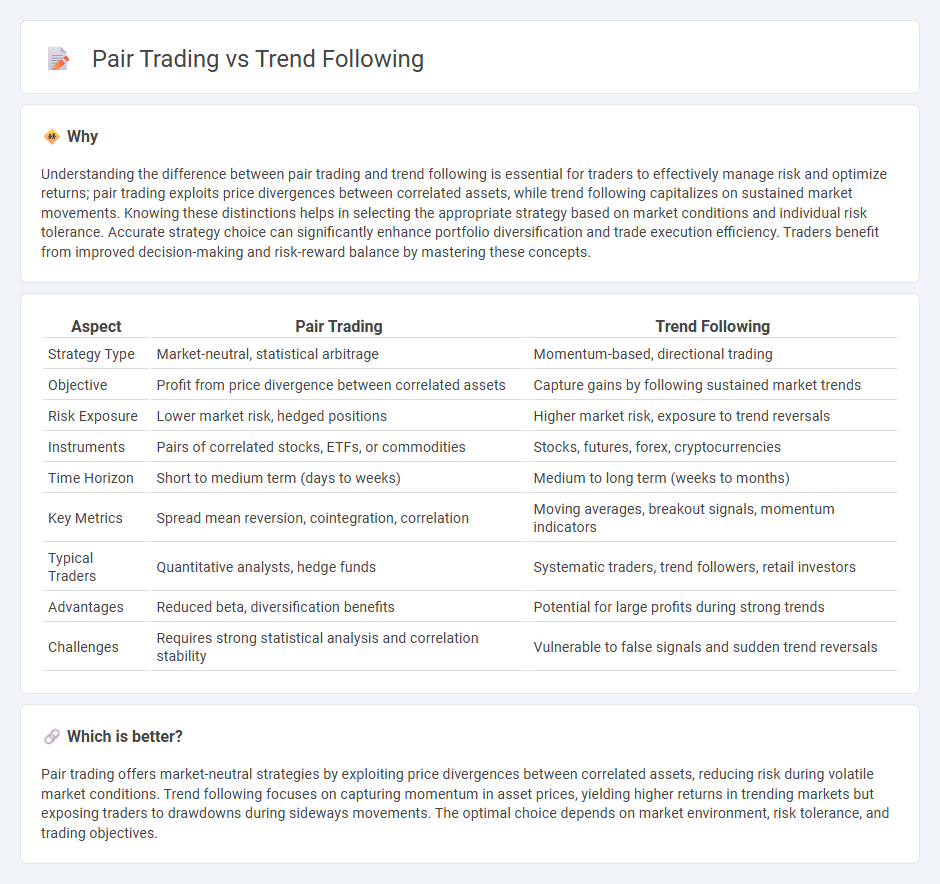

Understanding the difference between pair trading and trend following is essential for traders to effectively manage risk and optimize returns; pair trading exploits price divergences between correlated assets, while trend following capitalizes on sustained market movements. Knowing these distinctions helps in selecting the appropriate strategy based on market conditions and individual risk tolerance. Accurate strategy choice can significantly enhance portfolio diversification and trade execution efficiency. Traders benefit from improved decision-making and risk-reward balance by mastering these concepts.

Comparison Table

| Aspect | Pair Trading | Trend Following |

|---|---|---|

| Strategy Type | Market-neutral, statistical arbitrage | Momentum-based, directional trading |

| Objective | Profit from price divergence between correlated assets | Capture gains by following sustained market trends |

| Risk Exposure | Lower market risk, hedged positions | Higher market risk, exposure to trend reversals |

| Instruments | Pairs of correlated stocks, ETFs, or commodities | Stocks, futures, forex, cryptocurrencies |

| Time Horizon | Short to medium term (days to weeks) | Medium to long term (weeks to months) |

| Key Metrics | Spread mean reversion, cointegration, correlation | Moving averages, breakout signals, momentum indicators |

| Typical Traders | Quantitative analysts, hedge funds | Systematic traders, trend followers, retail investors |

| Advantages | Reduced beta, diversification benefits | Potential for large profits during strong trends |

| Challenges | Requires strong statistical analysis and correlation stability | Vulnerable to false signals and sudden trend reversals |

Which is better?

Pair trading offers market-neutral strategies by exploiting price divergences between correlated assets, reducing risk during volatile market conditions. Trend following focuses on capturing momentum in asset prices, yielding higher returns in trending markets but exposing traders to drawdowns during sideways movements. The optimal choice depends on market environment, risk tolerance, and trading objectives.

Connection

Pair trading and trend following are connected through their reliance on price movements and market trends to generate profits. Pair trading exploits relative price discrepancies between correlated assets while trend following captures momentum by entering positions aligned with prevailing market directions. Both strategies use statistical and technical analysis to identify trading opportunities based on patterns in asset price data.

Key Terms

**Trend Following:**

Trend following strategies capitalize on the momentum of market price movements by identifying and riding sustained trends across various asset classes such as stocks, commodities, and forex. This approach leverages technical indicators like moving averages, breakout signals, and relative strength to enter and exit trades, aiming to capture significant directional shifts while minimizing exposure to market noise. Explore trend following techniques further to understand how they can enhance portfolio performance and risk management.

Moving Average

Trend following uses moving averages, such as the 50-day or 200-day SMA, to identify and ride market momentum by signaling entry and exit points based on price crossing these averages. Pair trading relies on moving averages to monitor the mean-reversion behavior between two correlated assets by tracking their price spread and employing moving average crossovers for trade signals. Discover how leveraging moving averages can enhance strategy effectiveness in both trend following and pair trading methods.

Breakout

Trend following strategies capitalize on sustained market momentum by identifying and trading breakouts that signal the start of new trends in asset prices. Pair trading focuses on exploiting relative price movements between two correlated securities, entering positions when a breakout indicates divergence from their typical historical relationship. Explore more about how breakout signals enhance both trend following and pair trading techniques to improve your market timing and risk management.

Source and External Links

Trend following - A trading strategy of buying assets when their price trend rises and selling when it declines, aiming to capitalize on continued price movements without predicting exact levels, widely used by commodity trading advisors (CTAs).

Trend Following Trading Strategies and Systems (Backtest ...) - Trend following uses technical tools to identify and trade along sustained market movements, employing strategies like ATR and Bollinger channel breakouts, with an emphasis on risk management, simplicity, and systematic rules.

Trend-Following Primer - A major alternative investment strategy managing $300 billion+, trend-following applies algorithmic models to trade long in uptrends and short in downtrends across numerous liquid markets, providing diversification with low correlation to traditional assets.

dowidth.com

dowidth.com