Microstructure modeling focuses on the detailed mechanisms of order execution, price formation, and liquidity in financial markets, providing insights into market behavior and trading strategies at a granular level. Transaction cost analysis (TCA) evaluates the explicit and implicit costs associated with trade execution, such as bid-ask spreads, market impact, and timing delays, to optimize trading performance. Explore the nuances of microstructure modeling and transaction cost analysis to enhance your trading outcomes and strategy development.

Why it is important

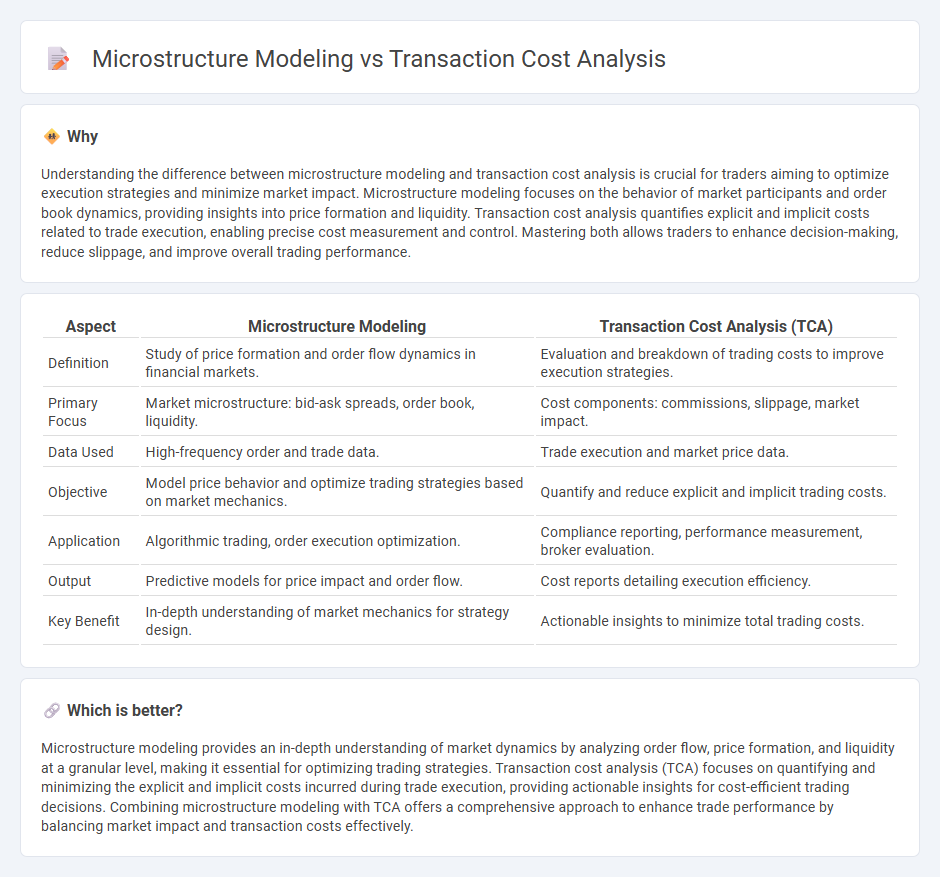

Understanding the difference between microstructure modeling and transaction cost analysis is crucial for traders aiming to optimize execution strategies and minimize market impact. Microstructure modeling focuses on the behavior of market participants and order book dynamics, providing insights into price formation and liquidity. Transaction cost analysis quantifies explicit and implicit costs related to trade execution, enabling precise cost measurement and control. Mastering both allows traders to enhance decision-making, reduce slippage, and improve overall trading performance.

Comparison Table

| Aspect | Microstructure Modeling | Transaction Cost Analysis (TCA) |

|---|---|---|

| Definition | Study of price formation and order flow dynamics in financial markets. | Evaluation and breakdown of trading costs to improve execution strategies. |

| Primary Focus | Market microstructure: bid-ask spreads, order book, liquidity. | Cost components: commissions, slippage, market impact. |

| Data Used | High-frequency order and trade data. | Trade execution and market price data. |

| Objective | Model price behavior and optimize trading strategies based on market mechanics. | Quantify and reduce explicit and implicit trading costs. |

| Application | Algorithmic trading, order execution optimization. | Compliance reporting, performance measurement, broker evaluation. |

| Output | Predictive models for price impact and order flow. | Cost reports detailing execution efficiency. |

| Key Benefit | In-depth understanding of market mechanics for strategy design. | Actionable insights to minimize total trading costs. |

Which is better?

Microstructure modeling provides an in-depth understanding of market dynamics by analyzing order flow, price formation, and liquidity at a granular level, making it essential for optimizing trading strategies. Transaction cost analysis (TCA) focuses on quantifying and minimizing the explicit and implicit costs incurred during trade execution, providing actionable insights for cost-efficient trading decisions. Combining microstructure modeling with TCA offers a comprehensive approach to enhance trade performance by balancing market impact and transaction costs effectively.

Connection

Microstructure modeling examines the detailed processes and behaviors within financial markets, such as order flow, liquidity, and price formation, providing insights critical for effective transaction cost analysis (TCA). Transaction cost analysis quantifies the implicit and explicit costs incurred during trade execution, relying on microstructure data like bid-ask spreads, market impact, and order book dynamics to evaluate trading performance accurately. Integrating microstructure models with TCA enables traders and portfolio managers to optimize execution strategies by minimizing costs and improving trade timing in complex market environments.

Key Terms

Transaction Cost Analysis:

Transaction Cost Analysis (TCA) quantifies the costs associated with trading, including explicit fees, market impact, and timing risks, providing traders with actionable insights to optimize execution strategies. By dissecting components such as bid-ask spreads, latency, and slippage, TCA enables firms to benchmark performance and reduce unnecessary expenses. Explore comprehensive methodologies and tools of TCA to enhance trading efficiency and cost-effectiveness.

Implementation Shortfall

Transaction cost analysis (TCA) quantifies the total costs incurred during trade execution, emphasizing Implementation Shortfall as a key metric to measure the difference between the decision price and actual execution price. Microstructure modeling examines the underlying market mechanisms--such as order book dynamics and liquidity--to predict price impact and optimize execution strategies that minimize Implementation Shortfall. Explore how integrating TCA with microstructure models enhances trading performance and reduces execution costs.

Market Impact

Transaction cost analysis (TCA) quantifies the costs associated with executing trades, emphasizing realized market impact by measuring slippage against benchmarks such as arrival price or VWAP. Microstructure modeling delves deeper into the mechanisms driving market impact, examining order book dynamics, liquidity, and information flow at a granular level. Explore more to understand how integrating both approaches enhances trade execution strategies and cost management.

Source and External Links

Transaction cost analysis - Transaction cost analysis (TCA) studies trade prices to measure, attribute, and evaluate trading costs such as explicit, implicit, delay, and opportunity costs to improve trade execution and decision-making for institutional investors.

Transaction Cost Analysis (TCA) - MillTech - TCA evaluates past trade data to assess execution quality and FX trade costs, providing cost transparency, benchmarking, risk management, and optimization of trading strategies to minimize expenses and improve execution efficiency.

Transaction Cost Analysis - Charles River IMS offers integrated TCA solutions providing real-time decision support and reporting that helps investment managers evaluate trade costs, broker and trader performance, reduce slippage, and improve overall trade execution quality.

dowidth.com

dowidth.com