Risk reversal and vertical spread are popular options trading strategies used to hedge positions or speculate on price movements while managing risk. Risk reversals involve buying a call and selling a put, or vice versa, to capitalize on directional moves with limited upfront costs. Explore more about how these strategies differ and when to apply each to enhance your trading outcomes.

Why it is important

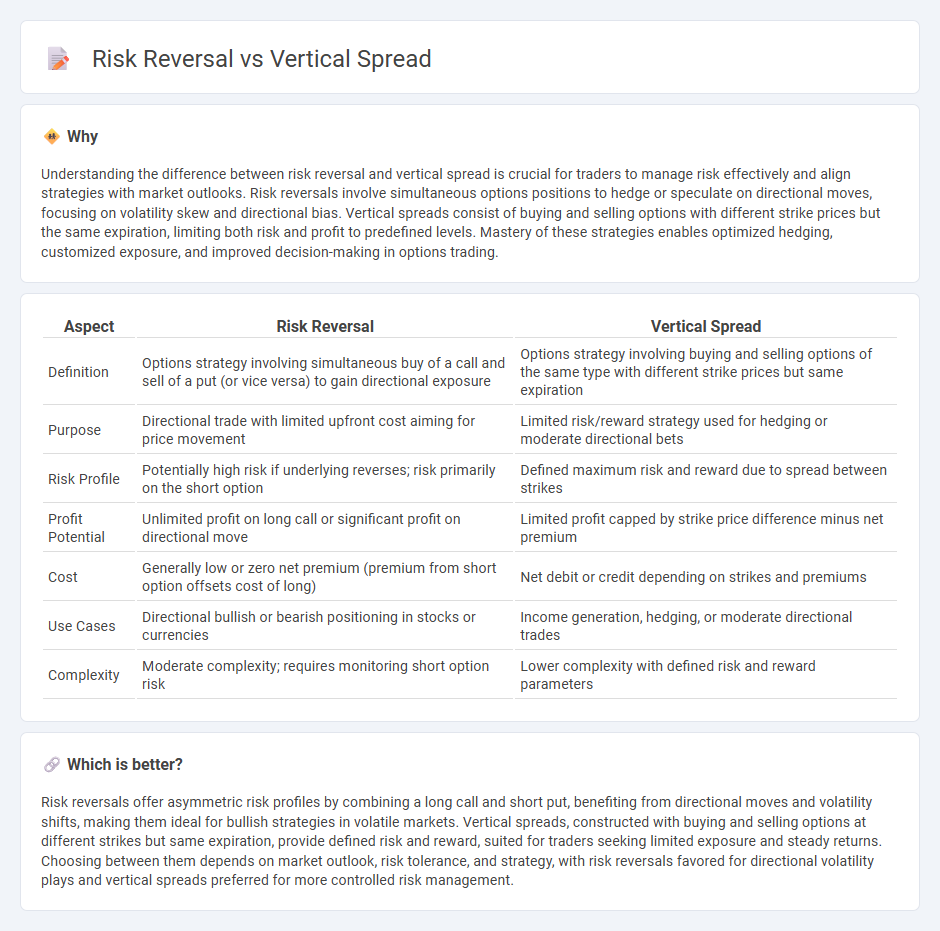

Understanding the difference between risk reversal and vertical spread is crucial for traders to manage risk effectively and align strategies with market outlooks. Risk reversals involve simultaneous options positions to hedge or speculate on directional moves, focusing on volatility skew and directional bias. Vertical spreads consist of buying and selling options with different strike prices but the same expiration, limiting both risk and profit to predefined levels. Mastery of these strategies enables optimized hedging, customized exposure, and improved decision-making in options trading.

Comparison Table

| Aspect | Risk Reversal | Vertical Spread |

|---|---|---|

| Definition | Options strategy involving simultaneous buy of a call and sell of a put (or vice versa) to gain directional exposure | Options strategy involving buying and selling options of the same type with different strike prices but same expiration |

| Purpose | Directional trade with limited upfront cost aiming for price movement | Limited risk/reward strategy used for hedging or moderate directional bets |

| Risk Profile | Potentially high risk if underlying reverses; risk primarily on the short option | Defined maximum risk and reward due to spread between strikes |

| Profit Potential | Unlimited profit on long call or significant profit on directional move | Limited profit capped by strike price difference minus net premium |

| Cost | Generally low or zero net premium (premium from short option offsets cost of long) | Net debit or credit depending on strikes and premiums |

| Use Cases | Directional bullish or bearish positioning in stocks or currencies | Income generation, hedging, or moderate directional trades |

| Complexity | Moderate complexity; requires monitoring short option risk | Lower complexity with defined risk and reward parameters |

Which is better?

Risk reversals offer asymmetric risk profiles by combining a long call and short put, benefiting from directional moves and volatility shifts, making them ideal for bullish strategies in volatile markets. Vertical spreads, constructed with buying and selling options at different strikes but same expiration, provide defined risk and reward, suited for traders seeking limited exposure and steady returns. Choosing between them depends on market outlook, risk tolerance, and strategy, with risk reversals favored for directional volatility plays and vertical spreads preferred for more controlled risk management.

Connection

Risk reversal and vertical spread are both options trading strategies used to manage risk and capitalize on market movements. Risk reversal involves buying a call option and selling a put option to create a directional bullish or bearish position, while a vertical spread entails buying and selling options of the same type with different strike prices to limit risk and potential profit. Both strategies optimize potential returns by balancing risk exposure, enhancing the trader's ability to hedge or speculate effectively within defined price ranges.

Key Terms

Strike Prices

Vertical spreads involve purchasing and selling options at different strike prices within the same expiration date, typically using symmetrical strikes for limited risk and reward. Risk reversals combine a long call and a short put with asymmetric strike prices, designed to capitalize on directional market moves and hedge against potential downside. Explore the nuances of strike choice and strategy implications to optimize your options trading.

Net Premium

Vertical spreads involve buying and selling options at different strike prices within the same expiration, typically resulting in a net premium debit or credit that defines the maximum potential gain or loss. Risk reversals combine the purchase of an out-of-the-money call with the sale of an out-of-the-money put (or vice versa), often generating a net premium near zero, reflecting a directional bias without upfront cost. Explore how net premium influences strategy selection, risk management, and profit potential in options trading.

Directional Bias

Vertical spreads involve buying and selling options at different strike prices within the same expiration to capitalize on a specific directional bias while limiting risk and reward. Risk reversals combine a long call and short put (or vice versa) to express a strong directional conviction with asymmetric risk exposure. Explore further to understand which strategy aligns best with your market outlook and risk tolerance.

Source and External Links

What is a Long Call Vertical Spread & How to Trade it? - A vertical spread is an options strategy combining two calls or puts of the same expiration but different strikes, often used to limit risk and cost for bullish or bearish bets, exemplified by the long call vertical spread which is bullish and involves buying a call closer to the stock price while selling a call further out-of-the-money to cap profit but reduce cost and risk.

Vertical Spread: Definition, Types, & Examples - A vertical spread involves simultaneously buying and selling call or put options of the same underlying with different strike prices and the same expiration, enabling traders to profit from directional price moves while managing risk and costs in bullish, bearish, or neutral market outlooks.

Vertical spread - Wikipedia - A vertical spread is an options trading strategy consisting of buying and selling equal numbers of calls or puts on the same underlying security and expiration date but differing strike prices, categorized into bull vertical spreads (bull call or bull put spreads) and bear vertical spreads (bear call or bear put spreads) based on market sentiment.

dowidth.com

dowidth.com