Risk reversal and straddle are two popular options trading strategies used to hedge or speculate on market movements. Risk reversal involves simultaneously buying a call option and selling a put option, aiming to capitalize on directional price moves with limited upfront cost, while a straddle involves purchasing both a call and a put option at the same strike price, profiting from significant volatility regardless of direction. Explore the mechanics and optimal market conditions for each strategy to enhance your trading decisions.

Why it is important

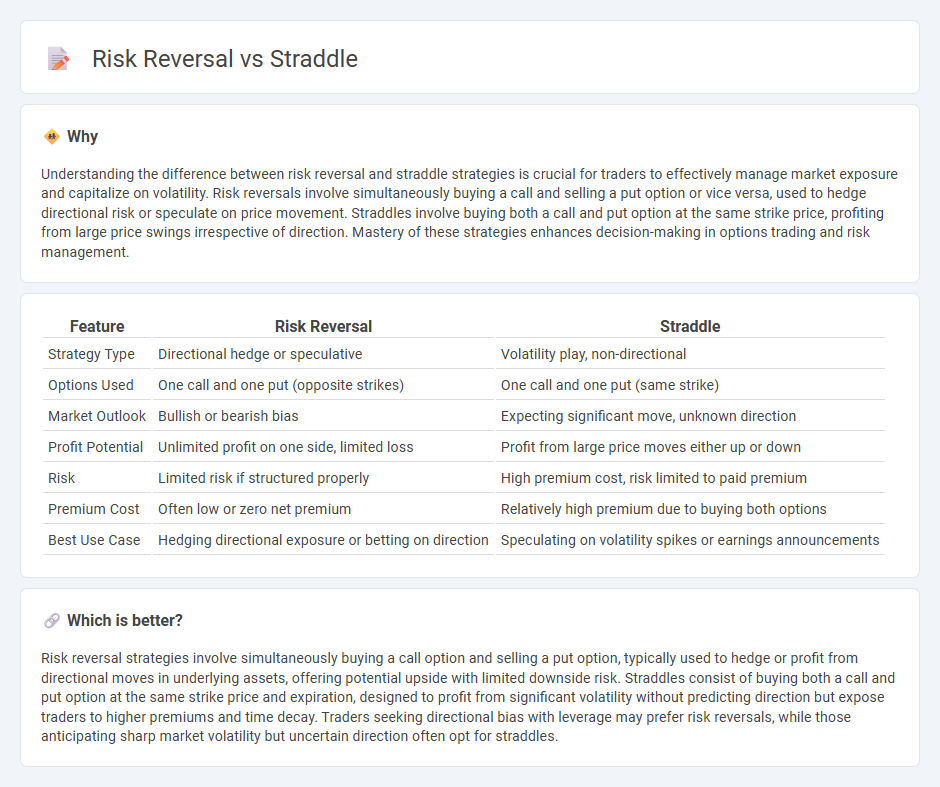

Understanding the difference between risk reversal and straddle strategies is crucial for traders to effectively manage market exposure and capitalize on volatility. Risk reversals involve simultaneously buying a call and selling a put option or vice versa, used to hedge directional risk or speculate on price movement. Straddles involve buying both a call and put option at the same strike price, profiting from large price swings irrespective of direction. Mastery of these strategies enhances decision-making in options trading and risk management.

Comparison Table

| Feature | Risk Reversal | Straddle |

|---|---|---|

| Strategy Type | Directional hedge or speculative | Volatility play, non-directional |

| Options Used | One call and one put (opposite strikes) | One call and one put (same strike) |

| Market Outlook | Bullish or bearish bias | Expecting significant move, unknown direction |

| Profit Potential | Unlimited profit on one side, limited loss | Profit from large price moves either up or down |

| Risk | Limited risk if structured properly | High premium cost, risk limited to paid premium |

| Premium Cost | Often low or zero net premium | Relatively high premium due to buying both options |

| Best Use Case | Hedging directional exposure or betting on direction | Speculating on volatility spikes or earnings announcements |

Which is better?

Risk reversal strategies involve simultaneously buying a call option and selling a put option, typically used to hedge or profit from directional moves in underlying assets, offering potential upside with limited downside risk. Straddles consist of buying both a call and put option at the same strike price and expiration, designed to profit from significant volatility without predicting direction but expose traders to higher premiums and time decay. Traders seeking directional bias with leverage may prefer risk reversals, while those anticipating sharp market volatility but uncertain direction often opt for straddles.

Connection

Risk reversal and straddle are both options strategies used to manage market uncertainty and volatility in trading. Risk reversal involves simultaneously buying a call and selling a put (or vice versa) to hedge directional risk, while a straddle entails purchasing both a call and a put at the same strike price to profit from significant price movements regardless of direction. Both strategies capitalize on implied volatility and are employed to balance risk exposure in options trading.

Key Terms

Strike Price

A straddle involves buying a call and a put option at the same strike price, typically at-the-money, to profit from significant price movements in either direction without predicting the direction. In contrast, a risk reversal strategy combines selling an out-of-the-money put and buying an out-of-the-money call, or vice versa, with different strike prices to hedge risk or speculate on directional moves while financing the position. Explore more to understand how strike price selection influences potential payoffs and risk profiles in these option strategies.

Volatility

Straddle and risk reversal are options strategies that leverage volatility but differ in structure and market outlook; a straddle involves purchasing both a call and put at the same strike price, profiting from significant price movements regardless of direction, making it ideal for high volatility scenarios. Risk reversal combines a long call and a short put or vice versa, used to hedge or speculate on directional volatility skew, often reflecting market sentiment or hedging costs. Explore the detailed mechanics and volatility implications of these strategies to enhance your options trading knowledge.

Option Premium

Straddle and risk reversal strategies both involve specific option premiums that reflect their unique risk profiles and market expectations. A straddle requires paying premiums for both call and put options at the same strike price, leading to a higher upfront cost but potential profit from significant price moves in either direction. Explore how option premiums impact strategy selection and risk management to optimize your trading outcomes.

Source and External Links

Straddle - Definition, How to Create It, Examples - A straddle strategy in finance involves simultaneously buying or selling both a call and a put option on the same underlying asset, with the same strike price and expiration date, to profit from significant price movements regardless of direction.

Straddle - Wikipedia - A straddle is an options strategy where a trader holds both a call and a put with the same strike price and expiration, aiming to benefit from large price changes in the underlying asset without betting on the direction of the move.

Short Straddle - The Options Industry Council - A short straddle involves selling both a call and a put option at the same strike price and expiration, profiting if the underlying stock remains range-bound, but exposing the trader to potentially unlimited losses if the price moves significantly.

dowidth.com

dowidth.com