Funded account programs provide traders with real capital to trade, offering real profit opportunities and emotional engagement absent in paper trading, which uses simulated funds to practice strategies without financial risk. While paper trading helps beginners build skills and test approaches in a risk-free environment, funded programs demand consistent performance and risk management aligned with professional trading standards. Explore the advantages of funded trading accounts and how they can accelerate your path to becoming a profitable trader.

Why it is important

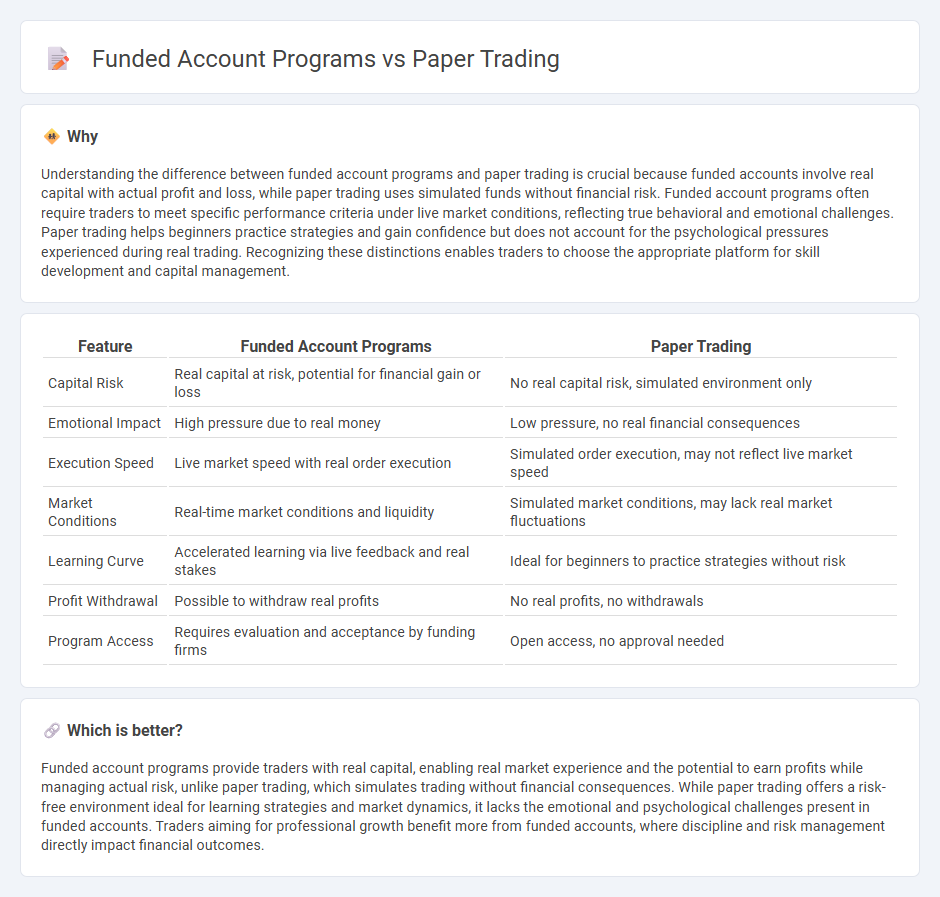

Understanding the difference between funded account programs and paper trading is crucial because funded accounts involve real capital with actual profit and loss, while paper trading uses simulated funds without financial risk. Funded account programs often require traders to meet specific performance criteria under live market conditions, reflecting true behavioral and emotional challenges. Paper trading helps beginners practice strategies and gain confidence but does not account for the psychological pressures experienced during real trading. Recognizing these distinctions enables traders to choose the appropriate platform for skill development and capital management.

Comparison Table

| Feature | Funded Account Programs | Paper Trading |

|---|---|---|

| Capital Risk | Real capital at risk, potential for financial gain or loss | No real capital risk, simulated environment only |

| Emotional Impact | High pressure due to real money | Low pressure, no real financial consequences |

| Execution Speed | Live market speed with real order execution | Simulated order execution, may not reflect live market speed |

| Market Conditions | Real-time market conditions and liquidity | Simulated market conditions, may lack real market fluctuations |

| Learning Curve | Accelerated learning via live feedback and real stakes | Ideal for beginners to practice strategies without risk |

| Profit Withdrawal | Possible to withdraw real profits | No real profits, no withdrawals |

| Program Access | Requires evaluation and acceptance by funding firms | Open access, no approval needed |

Which is better?

Funded account programs provide traders with real capital, enabling real market experience and the potential to earn profits while managing actual risk, unlike paper trading, which simulates trading without financial consequences. While paper trading offers a risk-free environment ideal for learning strategies and market dynamics, it lacks the emotional and psychological challenges present in funded accounts. Traders aiming for professional growth benefit more from funded accounts, where discipline and risk management directly impact financial outcomes.

Connection

Funded account programs enable traders to manage real capital after proving their skills in simulated environments, closely linked to paper trading which offers risk-free practice and strategy testing. Paper trading replicates live market conditions, allowing traders to build confidence and refine techniques before qualifying for funded accounts. This progression ensures disciplined risk management and performance consistency, crucial for success in funded account programs.

Key Terms

Simulation

Simulation in paper trading provides a risk-free environment to practice trading strategies using virtual funds and real-time market data, ensuring traders can refine skills without financial loss. Funded account programs often require demonstrating consistent profitability through simulated or live trading before accessing actual capital, bridging the gap between practice and real-world application. Explore in-depth differences and strategic implications between simulation in these trading modalities.

Real Capital

Real Capital offers both paper trading and funded account programs designed to refine traders' skills and capital allocation strategies. Paper trading allows participants to practice with simulated funds, enhancing decision-making without financial risk, while funded account programs provide real capital to qualified traders, enabling profit-sharing based on performance. Explore Real Capital's platform to understand how these options can accelerate your trading career.

Profit Split

Profit split in paper trading vs funded account programs varies significantly, with funded accounts typically offering between 70% to 90% of profits to traders, while paper trading involves no real profit distribution as it is a simulated environment. Funded account programs require passing evaluation phases to qualify for profit sharing, emphasizing risk management and consistency. Explore detailed comparisons and strategies to maximize your earnings in funded trading programs.

Source and External Links

Paper Trading At TradeZero: 100% Risk Free - Paper trading is a risk-free simulated trading experience that lets you practice buying and selling stocks and other securities using real-time data without real money, available free for 30 days on TradeZero's platform with full features.

Paper Trading -- main functionality - TradingView - TradingView's paper trading simulates trading with $100,000 in virtual funds and adjustable settings like leverage and commissions, allowing users to practice strategies without financial risk in close-to-real market conditions.

5 Best Paper Trading Apps & Platforms for 2025 - StockBrokers.com - Paper trading apps let beginners and experienced traders practice stock and options investing risk-free using virtual money, with popular brokers offering free, large simulated balances to test strategies and platforms.

dowidth.com

dowidth.com