Trade journaling software captures detailed records of every transaction, helping traders analyze their strategies and improve decision-making based on historical data. Risk management tools focus on protecting capital by setting stop-loss limits, monitoring exposure, and managing position sizes to minimize potential losses. Explore how combining these tools can enhance your trading performance and safeguard your investments.

Why it is important

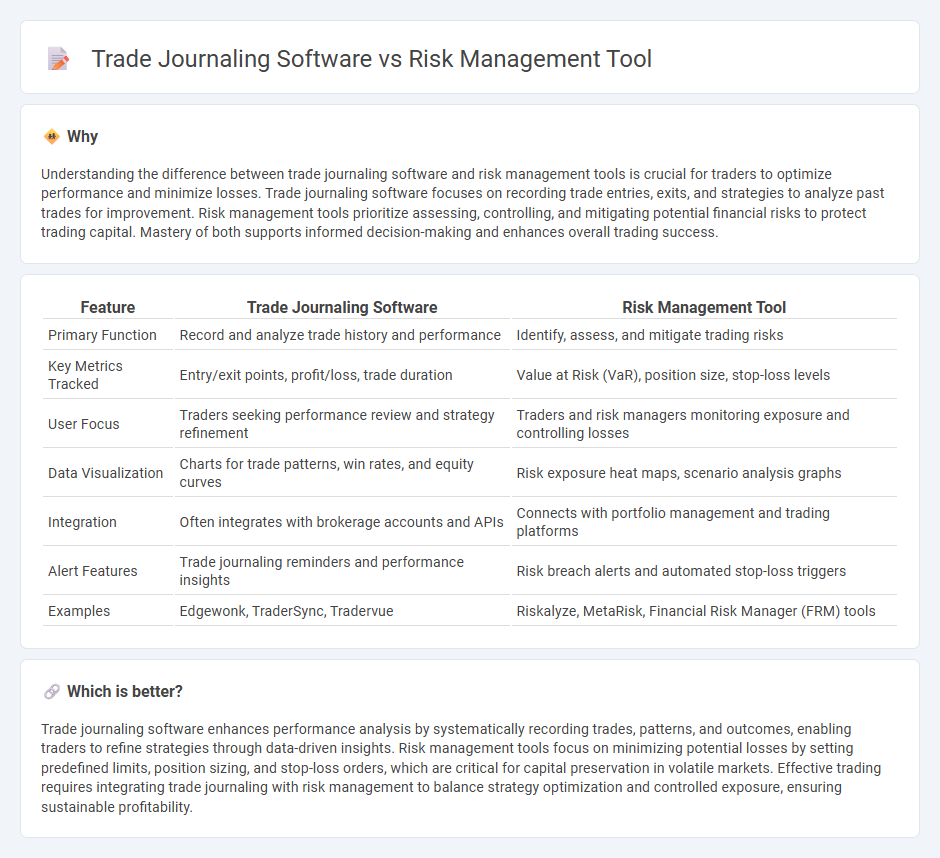

Understanding the difference between trade journaling software and risk management tools is crucial for traders to optimize performance and minimize losses. Trade journaling software focuses on recording trade entries, exits, and strategies to analyze past trades for improvement. Risk management tools prioritize assessing, controlling, and mitigating potential financial risks to protect trading capital. Mastery of both supports informed decision-making and enhances overall trading success.

Comparison Table

| Feature | Trade Journaling Software | Risk Management Tool |

|---|---|---|

| Primary Function | Record and analyze trade history and performance | Identify, assess, and mitigate trading risks |

| Key Metrics Tracked | Entry/exit points, profit/loss, trade duration | Value at Risk (VaR), position size, stop-loss levels |

| User Focus | Traders seeking performance review and strategy refinement | Traders and risk managers monitoring exposure and controlling losses |

| Data Visualization | Charts for trade patterns, win rates, and equity curves | Risk exposure heat maps, scenario analysis graphs |

| Integration | Often integrates with brokerage accounts and APIs | Connects with portfolio management and trading platforms |

| Alert Features | Trade journaling reminders and performance insights | Risk breach alerts and automated stop-loss triggers |

| Examples | Edgewonk, TraderSync, Tradervue | Riskalyze, MetaRisk, Financial Risk Manager (FRM) tools |

Which is better?

Trade journaling software enhances performance analysis by systematically recording trades, patterns, and outcomes, enabling traders to refine strategies through data-driven insights. Risk management tools focus on minimizing potential losses by setting predefined limits, position sizing, and stop-loss orders, which are critical for capital preservation in volatile markets. Effective trading requires integrating trade journaling with risk management to balance strategy optimization and controlled exposure, ensuring sustainable profitability.

Connection

Trade journaling software and risk management tools are interconnected by enabling traders to systematically record and analyze their trades, which helps identify patterns and assess risk exposure. By integrating detailed trade data with risk parameters, these tools facilitate informed decision-making and enhance portfolio protection strategies. This connection supports traders in optimizing performance while minimizing potential losses.

Key Terms

**Risk Management Tool:**

Risk management tools provide traders with advanced analytics and real-time monitoring to quantify and mitigate potential losses through stop-loss limits, position sizing, and diversification strategies. These platforms often integrate with trading accounts to deliver automated alerts and risk exposure reports that enhance decision-making under volatile market conditions. Explore the latest risk management solutions to safeguard your investments and optimize portfolio resilience.

Stop-Loss

Risk management tools primarily emphasize stop-loss orders to limit potential losses by automatically closing positions at predetermined price levels, protecting traders from significant drawdowns. Trade journaling software, while capable of tracking stop-loss effectiveness, focuses more on recording and analyzing trades to improve overall strategy and decision-making processes. Discover how integrating both tools can enhance your trading discipline and optimize stop-loss usage.

Position Sizing

Risk management tools emphasize position sizing techniques to control potential losses by calculating the optimal trade size based on account equity and predefined risk tolerance. Trade journaling software tracks position sizes alongside entry and exit points, providing detailed analytics to refine future position sizing strategies. Explore comprehensive features of both tools to enhance your trading discipline and risk control.

Source and External Links

Active Risk Manager - Riskonnect's Active Risk Manager software helps manage risks across projects and enterprises with features like dashboards, heat maps, risk registers, and Monte Carlo analyses to visualize, assess, and mitigate risks effectively.

The Best Risk Management Tools & Techniques for PM Pros - This resource outlines risk tools such as risk registers, RAID logs, and specialized software like StandardFusion and Resolver, which support scalable risk management and enterprise risk tracking with data analytics and customizable workflows.

Risk management tools vs. spreadsheets: Top 5 winners ... - Describes categories of risk management tools including ERM platforms that integrate diverse risks organization-wide and GRC solutions that link risk management with compliance and auditing for comprehensive risk oversight.

dowidth.com

dowidth.com