Microstructure modeling focuses on the detailed mechanisms of order execution, liquidity, and price formation within financial markets, capturing the fine-grained interactions at the transaction level. Agent-based market simulation replicates the behavior of heterogeneous market participants, allowing for the analysis of emergent phenomena and market dynamics driven by diverse trading strategies. Explore the nuances between these approaches to enhance your understanding of market behavior and trading strategies.

Why it is important

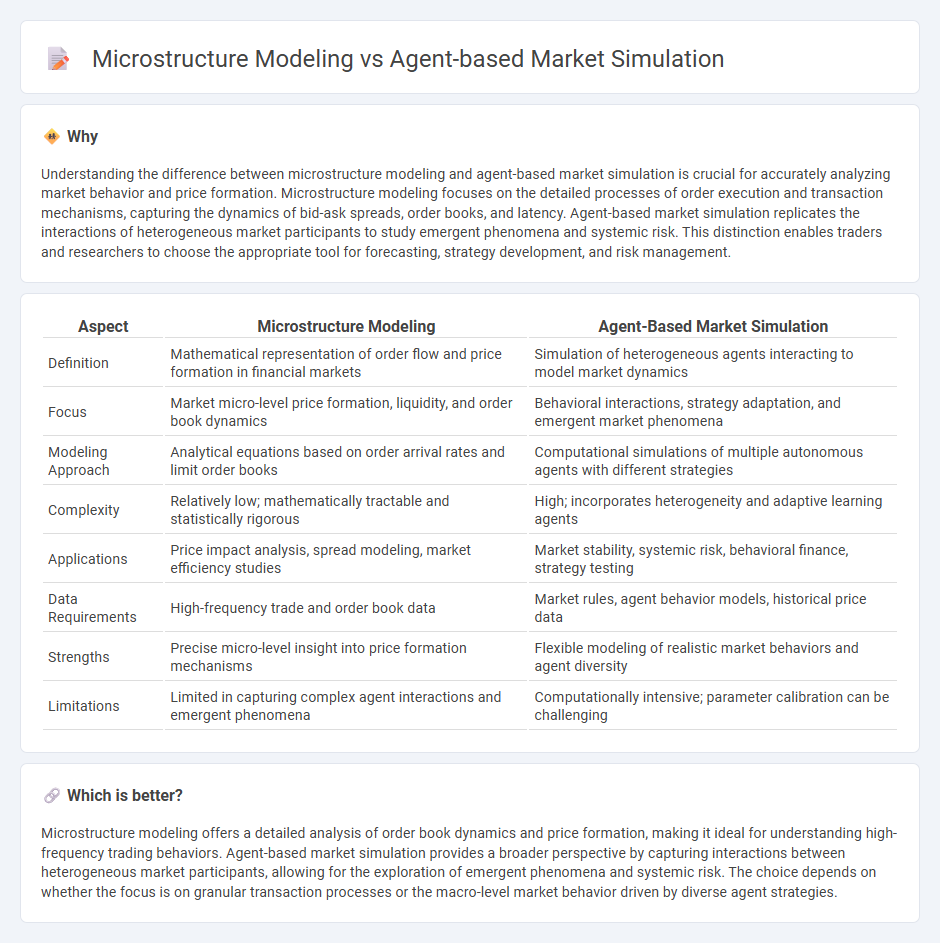

Understanding the difference between microstructure modeling and agent-based market simulation is crucial for accurately analyzing market behavior and price formation. Microstructure modeling focuses on the detailed processes of order execution and transaction mechanisms, capturing the dynamics of bid-ask spreads, order books, and latency. Agent-based market simulation replicates the interactions of heterogeneous market participants to study emergent phenomena and systemic risk. This distinction enables traders and researchers to choose the appropriate tool for forecasting, strategy development, and risk management.

Comparison Table

| Aspect | Microstructure Modeling | Agent-Based Market Simulation |

|---|---|---|

| Definition | Mathematical representation of order flow and price formation in financial markets | Simulation of heterogeneous agents interacting to model market dynamics |

| Focus | Market micro-level price formation, liquidity, and order book dynamics | Behavioral interactions, strategy adaptation, and emergent market phenomena |

| Modeling Approach | Analytical equations based on order arrival rates and limit order books | Computational simulations of multiple autonomous agents with different strategies |

| Complexity | Relatively low; mathematically tractable and statistically rigorous | High; incorporates heterogeneity and adaptive learning agents |

| Applications | Price impact analysis, spread modeling, market efficiency studies | Market stability, systemic risk, behavioral finance, strategy testing |

| Data Requirements | High-frequency trade and order book data | Market rules, agent behavior models, historical price data |

| Strengths | Precise micro-level insight into price formation mechanisms | Flexible modeling of realistic market behaviors and agent diversity |

| Limitations | Limited in capturing complex agent interactions and emergent phenomena | Computationally intensive; parameter calibration can be challenging |

Which is better?

Microstructure modeling offers a detailed analysis of order book dynamics and price formation, making it ideal for understanding high-frequency trading behaviors. Agent-based market simulation provides a broader perspective by capturing interactions between heterogeneous market participants, allowing for the exploration of emergent phenomena and systemic risk. The choice depends on whether the focus is on granular transaction processes or the macro-level market behavior driven by diverse agent strategies.

Connection

Microstructure modeling captures the detailed processes of order flow, price formation, and liquidity at the transaction level, providing a foundation for realistic agent behaviors in market simulations. Agent-based market simulation builds on microstructure insights by modeling interactions of heterogeneous agents, enabling the study of emergent phenomena such as volatility clustering and price impact. This connection allows researchers to analyze how individual trading strategies and market rules influence overall market dynamics and efficiency.

Key Terms

Agent-based market simulation:

Agent-based market simulation models financial markets by representing individual traders as autonomous agents with distinct strategies and behaviors, enabling the study of emergent phenomena like price formation and liquidity. These simulations capture the heterogeneity and interactions of market participants more realistically than traditional microstructure models, which often rely on aggregate or equilibrium assumptions. Explore deeper insights into agent-based market simulation to understand its advantages in analyzing complex market dynamics.

Heterogeneous agents

Agent-based market simulation utilizes heterogeneous agents with diverse strategies and behaviors to replicate complex market dynamics, capturing individual decision-making processes and interactions. Microstructure modeling often assumes more homogeneous agent types or stylized trading protocols, focusing on order flow, price formation, and liquidity in financial markets. Explore the detailed differences and practical applications of both approaches to better understand market behavior with heterogeneous agents.

Emergent behavior

Agent-based market simulations model individual agents with distinct behaviors, enabling the observation of emergent phenomena such as price fluctuations and market crashes arising from local interactions. Microstructure modeling focuses on the detailed mechanisms of order execution and price formation at the transaction level, capturing the influence of market rules and liquidity providers. Explore further to understand how these approaches complement each other in analyzing complex market dynamics.

Source and External Links

Agent-based Modeling in Finance: Revolutionizing Market ... - Agent-based market simulation models each participant as an autonomous agent with independent decision-making, capturing complex interactions and systemic risks often missed by traditional models, making it valuable for risk management and policy testing.

High-Frequency Financial Market Simulation and Flash ... - Agent-based financial market simulations use heterogeneous agents following predetermined rules without equilibrium assumptions, enabling realistic modeling of complex financial phenomena such as flash crashes and high-frequency trading dynamics.

Harnessing the power of agent-based modeling for equity ... - Simudyne's agent-based models create realistic market simulations by combining diverse trading agents, a continuous double auction market environment, and stochastic methods to replicate real-world market behaviors and test execution strategies accurately.

dowidth.com

dowidth.com