Paper trading competitions simulate market conditions to test traders' skills using virtual funds, providing a risk-free environment for strategy development and learning. Quantitative strategy tournaments focus on algorithmic and data-driven trading models, emphasizing mathematical and statistical approaches to maximize returns and minimize risks. Explore the distinctions between these competitive formats to enhance your trading expertise and strategy selection.

Why it is important

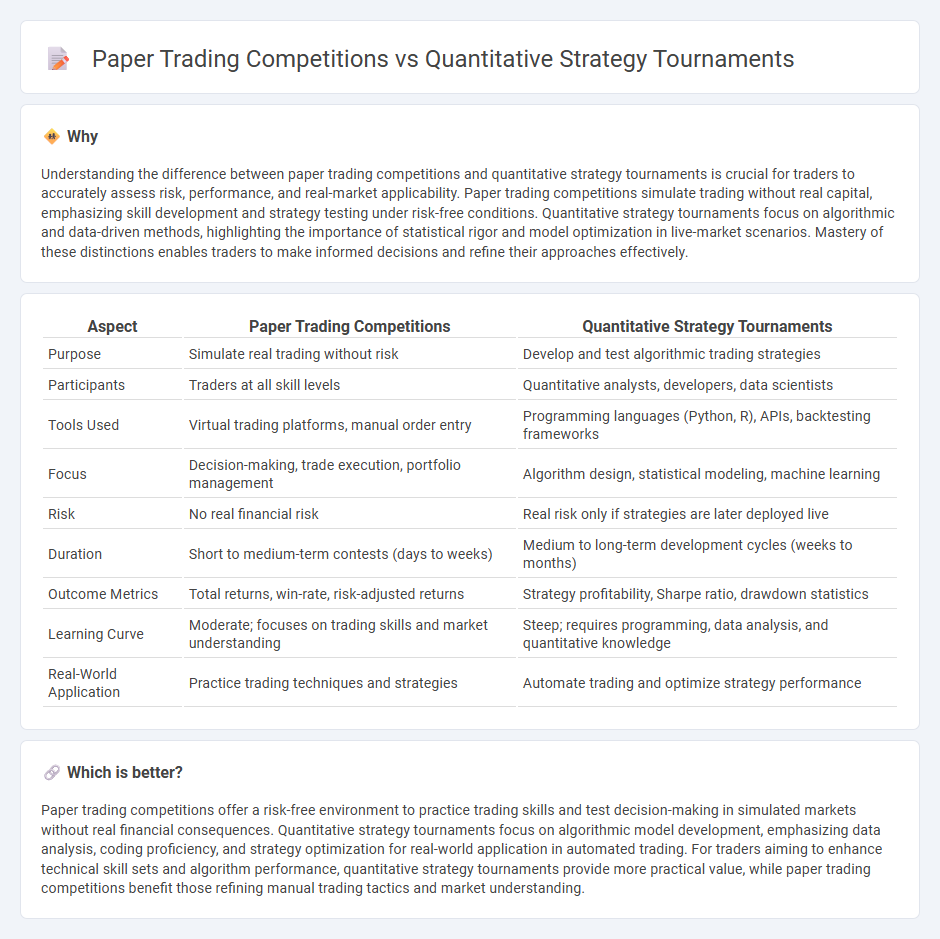

Understanding the difference between paper trading competitions and quantitative strategy tournaments is crucial for traders to accurately assess risk, performance, and real-market applicability. Paper trading competitions simulate trading without real capital, emphasizing skill development and strategy testing under risk-free conditions. Quantitative strategy tournaments focus on algorithmic and data-driven methods, highlighting the importance of statistical rigor and model optimization in live-market scenarios. Mastery of these distinctions enables traders to make informed decisions and refine their approaches effectively.

Comparison Table

| Aspect | Paper Trading Competitions | Quantitative Strategy Tournaments |

|---|---|---|

| Purpose | Simulate real trading without risk | Develop and test algorithmic trading strategies |

| Participants | Traders at all skill levels | Quantitative analysts, developers, data scientists |

| Tools Used | Virtual trading platforms, manual order entry | Programming languages (Python, R), APIs, backtesting frameworks |

| Focus | Decision-making, trade execution, portfolio management | Algorithm design, statistical modeling, machine learning |

| Risk | No real financial risk | Real risk only if strategies are later deployed live |

| Duration | Short to medium-term contests (days to weeks) | Medium to long-term development cycles (weeks to months) |

| Outcome Metrics | Total returns, win-rate, risk-adjusted returns | Strategy profitability, Sharpe ratio, drawdown statistics |

| Learning Curve | Moderate; focuses on trading skills and market understanding | Steep; requires programming, data analysis, and quantitative knowledge |

| Real-World Application | Practice trading techniques and strategies | Automate trading and optimize strategy performance |

Which is better?

Paper trading competitions offer a risk-free environment to practice trading skills and test decision-making in simulated markets without real financial consequences. Quantitative strategy tournaments focus on algorithmic model development, emphasizing data analysis, coding proficiency, and strategy optimization for real-world application in automated trading. For traders aiming to enhance technical skill sets and algorithm performance, quantitative strategy tournaments provide more practical value, while paper trading competitions benefit those refining manual trading tactics and market understanding.

Connection

Paper trading competitions and quantitative strategy tournaments both serve as platforms for testing algorithmic trading models without financial risk, enabling traders to validate strategies under simulated market conditions. These contests promote the development of data-driven approaches by leveraging historical price data, technical indicators, and machine learning techniques to optimize trading performance. Successful participants often gain insights into risk management, predictive analytics, and portfolio optimization, bridging theoretical knowledge with practical algorithmic trading execution.

Key Terms

Quantitative Strategy Tournaments:

Quantitative Strategy Tournaments offer real-time market simulations where participants test algorithmic trading models under dynamic conditions, emphasizing risk management and execution precision. These tournaments provide a competitive environment with live data, enabling participants to adapt strategies based on evolving market trends, unlike paper trading competitions that rely on static historical data. Discover how engaging in Quantitative Strategy Tournaments can enhance your algorithm development and trading performance.

Alpha generation

Quantitative strategy tournaments emphasize real-time alpha generation by testing algorithmic models against live market conditions, providing a practical environment for skill refinement and risk management. Paper trading competitions, while valuable for strategy development and backtesting, lack the dynamic market impact and psychological pressures that real trading introduces, often resulting in discrepancies between theoretical and actual performance. Explore detailed analyses and case studies to understand which platform better accelerates effective alpha generation.

Backtesting

Quantitative strategy tournaments emphasize real-time data analysis and adaptive decision-making, while paper trading competitions prioritize rigorous backtesting to validate models against historical data. Backtesting in paper trading allows traders to refine algorithms by simulating trades under various market conditions without financial risk. Explore in-depth comparisons to understand how backtesting impacts strategic performance in both formats.

Source and External Links

Quant Strats 2024: Generate Alpha. Manage Risk. Optimize Portfolios - An exclusive New York event uniting over 300 quant investment leaders from hedge funds, asset managers, and banks to discuss quantitative investment strategies, including AI and ML applications for alpha generation and risk management.

Quant Strats 2026 - Alpha Events - A premier quant finance conference attracting 380+ quantitative investment professionals from hedge funds, asset managers, and banks to share cutting-edge ideas, network, and explore AI-driven trading and alternative data strategies.

Quantitative Finance Events in 2024 - OpenQuant - Lists key quant competitions and tournaments such as the Citadel Datathon, Cornell Trading Competition, and Cubist Hackathon, which offer challenges on financial data and trading models with prizes and employment opportunities.

dowidth.com

dowidth.com