Option selling strategies like the wheel and calendar spread cater to different risk tolerances and market outlooks. The wheel strategy focuses on selling cash-secured puts and covered calls to generate consistent income, typically benefiting from stable or mildly bullish markets. Explore the nuances of each approach to discover which fits your trading style and investment goals.

Why it is important

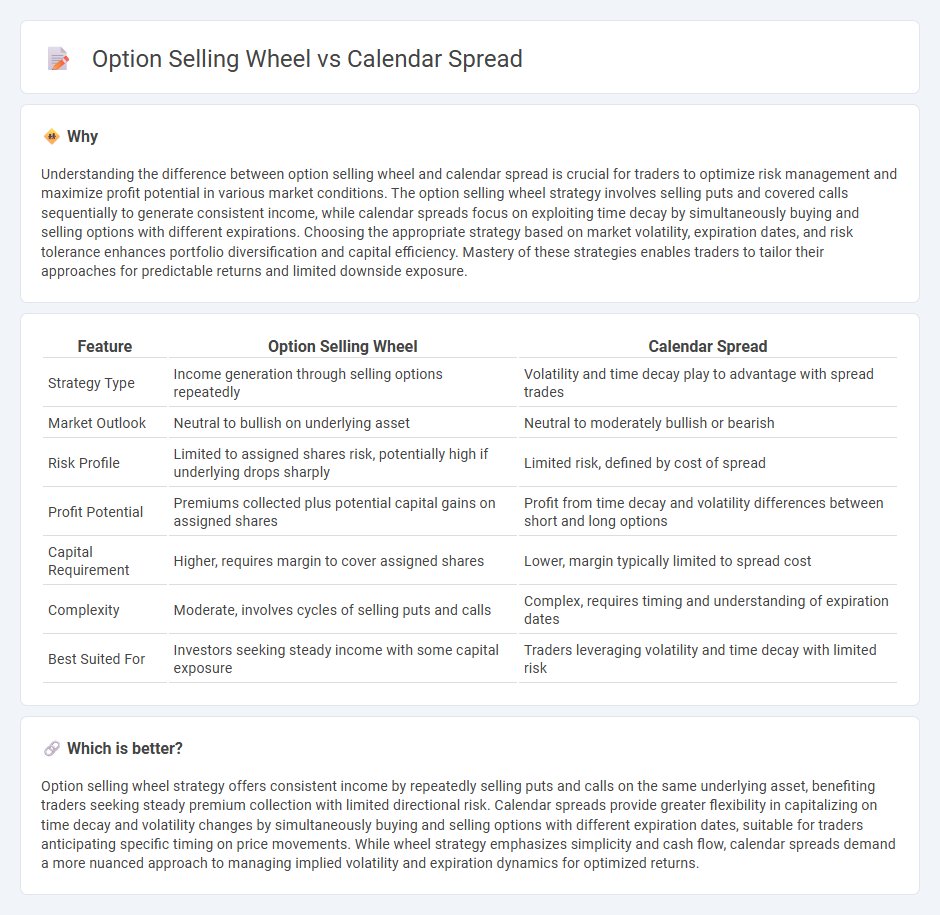

Understanding the difference between option selling wheel and calendar spread is crucial for traders to optimize risk management and maximize profit potential in various market conditions. The option selling wheel strategy involves selling puts and covered calls sequentially to generate consistent income, while calendar spreads focus on exploiting time decay by simultaneously buying and selling options with different expirations. Choosing the appropriate strategy based on market volatility, expiration dates, and risk tolerance enhances portfolio diversification and capital efficiency. Mastery of these strategies enables traders to tailor their approaches for predictable returns and limited downside exposure.

Comparison Table

| Feature | Option Selling Wheel | Calendar Spread |

|---|---|---|

| Strategy Type | Income generation through selling options repeatedly | Volatility and time decay play to advantage with spread trades |

| Market Outlook | Neutral to bullish on underlying asset | Neutral to moderately bullish or bearish |

| Risk Profile | Limited to assigned shares risk, potentially high if underlying drops sharply | Limited risk, defined by cost of spread |

| Profit Potential | Premiums collected plus potential capital gains on assigned shares | Profit from time decay and volatility differences between short and long options |

| Capital Requirement | Higher, requires margin to cover assigned shares | Lower, margin typically limited to spread cost |

| Complexity | Moderate, involves cycles of selling puts and calls | Complex, requires timing and understanding of expiration dates |

| Best Suited For | Investors seeking steady income with some capital exposure | Traders leveraging volatility and time decay with limited risk |

Which is better?

Option selling wheel strategy offers consistent income by repeatedly selling puts and calls on the same underlying asset, benefiting traders seeking steady premium collection with limited directional risk. Calendar spreads provide greater flexibility in capitalizing on time decay and volatility changes by simultaneously buying and selling options with different expiration dates, suitable for traders anticipating specific timing on price movements. While wheel strategy emphasizes simplicity and cash flow, calendar spreads demand a more nuanced approach to managing implied volatility and expiration dynamics for optimized returns.

Connection

The option selling wheel strategy involves selling cash-secured puts and covered calls to generate income, while the calendar spread exploits differences in time decay by selling short-term options and buying longer-term options at the same strike price. Both strategies rely on option premium decay and volatility to maximize returns, with the wheel focusing on income through consistent option selling and the calendar spread emphasizing time decay arbitrage. Traders often combine these approaches to manage risk and optimize returns by leveraging different expiration cycles and option positions.

Key Terms

Expiration Dates

Calendar spreads involve buying and selling options with the same strike price but different expiration dates, typically capitalizing on time decay and volatility differences between front-month and longer-term options. The option selling wheel strategy systematically sells short-term options near expiration to collect premium while managing assignment risk through rolling, focusing on consistent income generation. Explore these strategies further to understand how expiration date selection impacts risk management and profit potential.

Strike Price

A calendar spread involves simultaneously buying and selling options at the same strike price but different expiration dates, optimizing time decay and volatility to maximize profit. The option selling wheel strategy focuses on selecting strike prices near current stock prices to generate consistent premium income while managing assignment risk. Explore detailed strike price selection techniques to enhance your options trading strategy.

Assignment

A calendar spread involves simultaneously buying and selling options with different expiration dates, reducing assignment risk since short options are typically covered by long options expiring later. In contrast, the option selling wheel strategy frequently faces assignment risk as naked short options on the underlying stock are sold and potentially assigned, requiring the seller to buy or sell shares. To better understand the nuances of assignment risk and management in these strategies, explore detailed option trading guides.

Source and External Links

Calendar spread - A calendar spread, also known as a time or horizontal spread, involves simultaneously buying and selling futures or options with the same strike price but different expiration dates, typically aimed at profiting from differences in implied volatility between near-term and longer-term options.

What is a Calendar Spread Option? - A calendar spread is a low-risk, directionally neutral options strategy that profits from time decay and/or an increase in implied volatility, constructed by buying longer-term options and selling shorter-term options of the same underlying and strike price.

Option Calendar Spreads - Buying a calendar spread means selling a near-term option and buying a longer-term option with the same strike price and contract, designed to profit from the passage of time and potential low market volatility before a known event.

dowidth.com

dowidth.com