Quantitative sentiment analysis leverages numerical data and natural language processing to measure market emotions and predict trading movements, focusing on extracting actionable insights from news, social media, and financial reports. Pattern recognition employs algorithms to identify recurring trends and chart formations in historical price data, enabling traders to anticipate future market behavior and optimize entry and exit points. Explore the nuances and applications of these advanced trading strategies to enhance your market analysis skills.

Why it is important

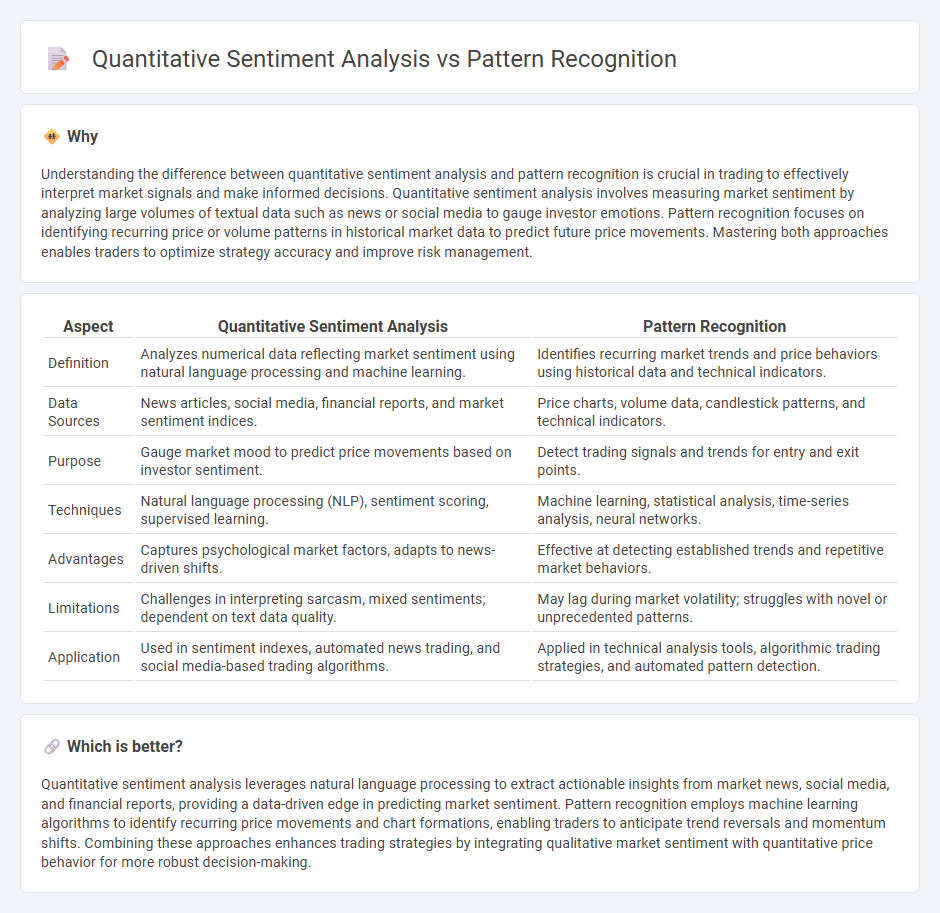

Understanding the difference between quantitative sentiment analysis and pattern recognition is crucial in trading to effectively interpret market signals and make informed decisions. Quantitative sentiment analysis involves measuring market sentiment by analyzing large volumes of textual data such as news or social media to gauge investor emotions. Pattern recognition focuses on identifying recurring price or volume patterns in historical market data to predict future price movements. Mastering both approaches enables traders to optimize strategy accuracy and improve risk management.

Comparison Table

| Aspect | Quantitative Sentiment Analysis | Pattern Recognition |

|---|---|---|

| Definition | Analyzes numerical data reflecting market sentiment using natural language processing and machine learning. | Identifies recurring market trends and price behaviors using historical data and technical indicators. |

| Data Sources | News articles, social media, financial reports, and market sentiment indices. | Price charts, volume data, candlestick patterns, and technical indicators. |

| Purpose | Gauge market mood to predict price movements based on investor sentiment. | Detect trading signals and trends for entry and exit points. |

| Techniques | Natural language processing (NLP), sentiment scoring, supervised learning. | Machine learning, statistical analysis, time-series analysis, neural networks. |

| Advantages | Captures psychological market factors, adapts to news-driven shifts. | Effective at detecting established trends and repetitive market behaviors. |

| Limitations | Challenges in interpreting sarcasm, mixed sentiments; dependent on text data quality. | May lag during market volatility; struggles with novel or unprecedented patterns. |

| Application | Used in sentiment indexes, automated news trading, and social media-based trading algorithms. | Applied in technical analysis tools, algorithmic trading strategies, and automated pattern detection. |

Which is better?

Quantitative sentiment analysis leverages natural language processing to extract actionable insights from market news, social media, and financial reports, providing a data-driven edge in predicting market sentiment. Pattern recognition employs machine learning algorithms to identify recurring price movements and chart formations, enabling traders to anticipate trend reversals and momentum shifts. Combining these approaches enhances trading strategies by integrating qualitative market sentiment with quantitative price behavior for more robust decision-making.

Connection

Quantitative sentiment analysis uses algorithms to measure market sentiment from news, social media, and financial reports, providing numerical indicators that reflect investor emotions. Pattern recognition applies statistical models to detect recurring trends and signals in price movements and trading volumes, enhancing trade decision accuracy. Combining both techniques enables traders to leverage emotional market insights and technical patterns, optimizing predictive capabilities and risk management in algorithmic trading strategies.

Key Terms

**Pattern Recognition:**

Pattern recognition employs machine learning algorithms and neural networks to identify recurring structures and trends within unstructured data such as images, audio, and text, enabling efficient classification and decision-making processes. It emphasizes feature extraction and pattern matching to detect anomalies and insights that traditional statistical methods might overlook. Discover the advantages of pattern recognition and how it enhances data interpretation across diverse applications.

Chart Patterns

Chart patterns serve as a fundamental tool in pattern recognition, enabling traders to identify potential market trends and reversals based on historical price movements. Quantitative sentiment analysis, by contrast, employs statistical algorithms to measure market mood through data such as social media, news, and trading volumes, providing a numerical gauge of investor sentiment. Explore the distinct approaches and benefits of chart pattern analysis versus sentiment quantification to enhance your trading strategy.

Technical Indicators

Pattern recognition leverages historical price charts to identify recurring formations like head-and-shoulders or double tops, aiding traders in predicting market movements without reliance on raw numerical data. Quantitative sentiment analysis employs algorithms to gauge market sentiment from textual sources, integrating metrics such as volume, volatility, and momentum indicators to enhance decision-making. Explore advanced strategies combining both approaches to optimize trading performance using technical indicators.

Source and External Links

What is pattern recognition? A gentle introduction - viso.ai - Pattern recognition is the ability of machines to identify and use patterns in data for decision making, featuring methods like syntactic pattern recognition, which uses hierarchical rule sets, and template matching, which finds similarities between data samples and reference templates.

What is pattern recognition - Arm(r) - Pattern recognition uses machine learning algorithms to automatically identify regularities in diverse data types, enabling applications such as image, speech, and fingerprint recognition, as well as medical imaging and predictive analytics.

Pattern recognition - Wikipedia - Pattern recognition involves assigning classes or labels to data inputs based on extracted features, encompassing classification, regression, and sequence labeling, and aims to make statistically likely matches rather than exact pattern matching.

dowidth.com

dowidth.com