High frequency trading (HFT) leverages complex algorithms and ultra-fast data networks to execute thousands of trades within milliseconds, aiming to capitalize on minute price discrepancies. Day trading, by contrast, focuses on buying and selling securities within the same trading day, relying on technical analysis and market trends to generate profits. Explore the key distinctions and strategies behind these trading approaches to enhance your market understanding.

Why it is important

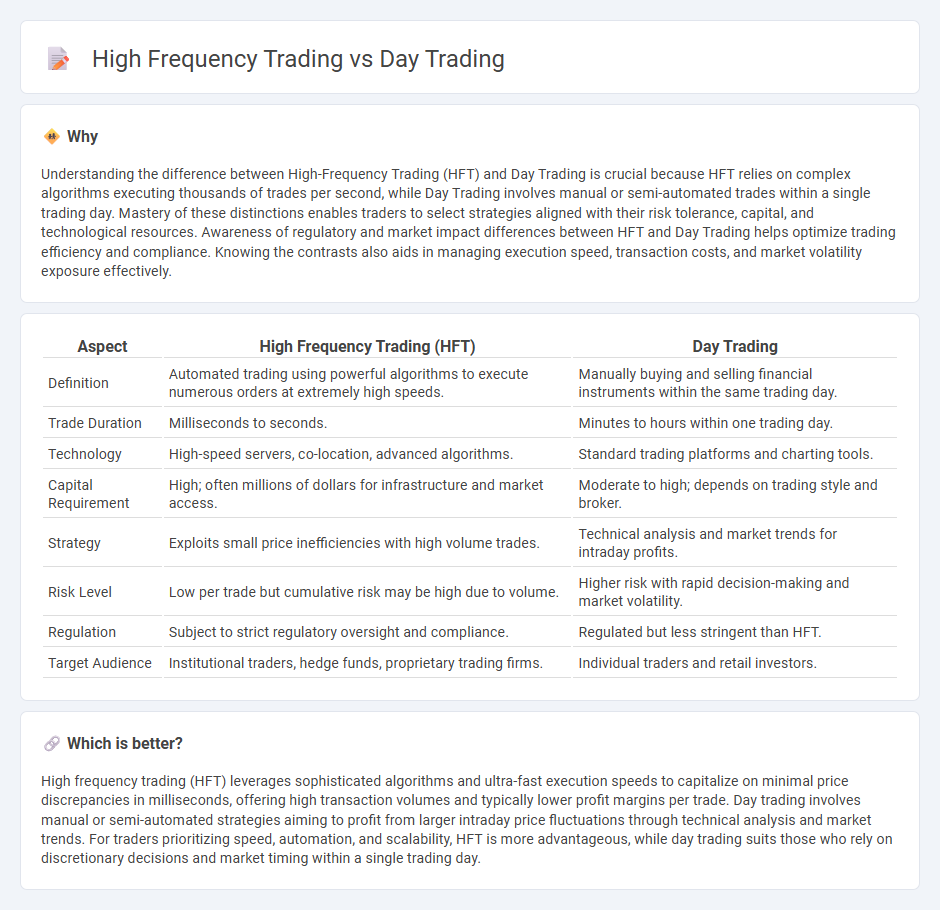

Understanding the difference between High-Frequency Trading (HFT) and Day Trading is crucial because HFT relies on complex algorithms executing thousands of trades per second, while Day Trading involves manual or semi-automated trades within a single trading day. Mastery of these distinctions enables traders to select strategies aligned with their risk tolerance, capital, and technological resources. Awareness of regulatory and market impact differences between HFT and Day Trading helps optimize trading efficiency and compliance. Knowing the contrasts also aids in managing execution speed, transaction costs, and market volatility exposure effectively.

Comparison Table

| Aspect | High Frequency Trading (HFT) | Day Trading |

|---|---|---|

| Definition | Automated trading using powerful algorithms to execute numerous orders at extremely high speeds. | Manually buying and selling financial instruments within the same trading day. |

| Trade Duration | Milliseconds to seconds. | Minutes to hours within one trading day. |

| Technology | High-speed servers, co-location, advanced algorithms. | Standard trading platforms and charting tools. |

| Capital Requirement | High; often millions of dollars for infrastructure and market access. | Moderate to high; depends on trading style and broker. |

| Strategy | Exploits small price inefficiencies with high volume trades. | Technical analysis and market trends for intraday profits. |

| Risk Level | Low per trade but cumulative risk may be high due to volume. | Higher risk with rapid decision-making and market volatility. |

| Regulation | Subject to strict regulatory oversight and compliance. | Regulated but less stringent than HFT. |

| Target Audience | Institutional traders, hedge funds, proprietary trading firms. | Individual traders and retail investors. |

Which is better?

High frequency trading (HFT) leverages sophisticated algorithms and ultra-fast execution speeds to capitalize on minimal price discrepancies in milliseconds, offering high transaction volumes and typically lower profit margins per trade. Day trading involves manual or semi-automated strategies aiming to profit from larger intraday price fluctuations through technical analysis and market trends. For traders prioritizing speed, automation, and scalability, HFT is more advantageous, while day trading suits those who rely on discretionary decisions and market timing within a single trading day.

Connection

High frequency trading (HFT) and day trading both focus on short-term market movements to capitalize on price fluctuations. HFT uses advanced algorithms and ultra-fast execution to trade large volumes within milliseconds, while day trading involves manual or semi-automated trades executed throughout the trading day to exploit intraday volatility. Both strategies rely on liquidity and rapid market data analysis to maximize profits within a single trading session.

Key Terms

Trade Duration

Day trading involves holding positions from minutes to several hours within the same trading day, aiming to capitalize on intraday price movements. High frequency trading (HFT) executes thousands of trades per second, holding assets for mere milliseconds to microseconds to exploit tiny price discrepancies. Explore the distinct trade durations and strategies behind day trading and HFT to optimize your trading approach.

Automation

Day trading relies on manual decision-making and execution within a single trading day, while high frequency trading (HFT) leverages sophisticated algorithms and automated systems to execute thousands of trades per second. HFT requires advanced technology infrastructure, low-latency networks, and co-location services to ensure rapid order placement and market response. Explore the nuances of automation in trading strategies to enhance your market understanding.

Volume

Day trading typically involves executing multiple trades within a single day to capitalize on short-term price movements, with trading volumes varying widely based on the trader's strategy and market conditions. High frequency trading (HFT) relies on sophisticated algorithms to conduct thousands of trades per second, generating enormous volumes often exceeding millions of shares daily across multiple markets. Explore the key distinctions in volume metrics and trading speed to gain deeper insights into these fast-paced trading approaches.

Source and External Links

Day trading - Wikipedia - Day trading is the practice of buying and selling financial instruments within the same trading day to profit from short-term price movements, with all positions closed before markets close to avoid overnight risk.

Day Trading: Definition, Risks and How to Start - NerdWallet - Day trading involves rapidly buying and selling investments--often within minutes or hours--using strategies like range trading, spread trading, fading, or momentum trading to capitalize on market fluctuations.

What are the rules for day trading? - Merrill Edge - Day trades are defined as opening and closing a position in the same security on the same day, and frequent day traders (pattern day traders) must maintain at least $25,000 in their account and follow specific margin rules set by FINRA.

dowidth.com

dowidth.com