High-frequency scalp bots execute a large number of trades within milliseconds, capitalizing on tiny price fluctuations to generate profits, relying heavily on speed and algorithmic precision. Momentum trading bots identify and follow strong price trends over short to medium timeframes, aiming to ride market momentum for consistent gains. Explore the key differences between these trading bots to optimize your automated trading strategy.

Why it is important

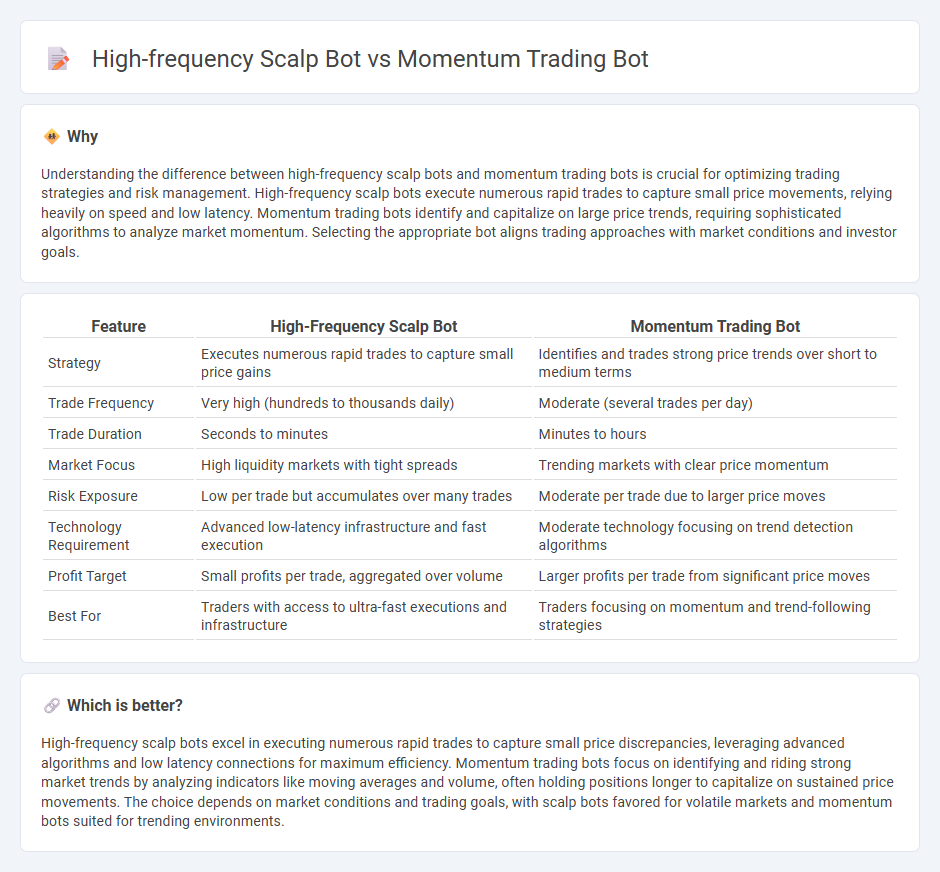

Understanding the difference between high-frequency scalp bots and momentum trading bots is crucial for optimizing trading strategies and risk management. High-frequency scalp bots execute numerous rapid trades to capture small price movements, relying heavily on speed and low latency. Momentum trading bots identify and capitalize on large price trends, requiring sophisticated algorithms to analyze market momentum. Selecting the appropriate bot aligns trading approaches with market conditions and investor goals.

Comparison Table

| Feature | High-Frequency Scalp Bot | Momentum Trading Bot |

|---|---|---|

| Strategy | Executes numerous rapid trades to capture small price gains | Identifies and trades strong price trends over short to medium terms |

| Trade Frequency | Very high (hundreds to thousands daily) | Moderate (several trades per day) |

| Trade Duration | Seconds to minutes | Minutes to hours |

| Market Focus | High liquidity markets with tight spreads | Trending markets with clear price momentum |

| Risk Exposure | Low per trade but accumulates over many trades | Moderate per trade due to larger price moves |

| Technology Requirement | Advanced low-latency infrastructure and fast execution | Moderate technology focusing on trend detection algorithms |

| Profit Target | Small profits per trade, aggregated over volume | Larger profits per trade from significant price moves |

| Best For | Traders with access to ultra-fast executions and infrastructure | Traders focusing on momentum and trend-following strategies |

Which is better?

High-frequency scalp bots excel in executing numerous rapid trades to capture small price discrepancies, leveraging advanced algorithms and low latency connections for maximum efficiency. Momentum trading bots focus on identifying and riding strong market trends by analyzing indicators like moving averages and volume, often holding positions longer to capitalize on sustained price movements. The choice depends on market conditions and trading goals, with scalp bots favored for volatile markets and momentum bots suited for trending environments.

Connection

High-frequency scalp bots and momentum trading bots both leverage real-time market data to execute rapid, algorithm-driven trades aimed at capturing short-term price movements. High-frequency scalp bots focus on exploiting minimal price fluctuations within milliseconds, while momentum trading bots identify and capitalize on emerging trends by analyzing price momentum indicators. The connection lies in their reliance on automated strategies and low-latency execution to maximize profitability in volatile market conditions.

Key Terms

Momentum Trading Bot:

Momentum trading bots capitalize on market trends by identifying stocks or assets exhibiting strong price movement and executing trades aligned with the prevailing momentum to maximize profits. These bots utilize algorithmic strategies, technical indicators such as moving averages and relative strength index (RSI), and real-time data analysis to make informed decisions and minimize risks. Discover how momentum trading bots can enhance your trading strategy and increase your chances of success in dynamic markets.

Trend-following

Momentum trading bots capitalize on sustained price movements by identifying and riding trends over medium to long time frames, enhancing profitability through trend-following algorithms and technical indicators like moving averages and MACD. High-frequency scalp bots execute numerous rapid trades within seconds or milliseconds, aiming for minimal profits per trade by exploiting micro-price fluctuations, with less emphasis on trend direction and more on order book dynamics and latency optimization. Explore more to understand the strategic nuances and technical setups that differentiate trend-following momentum bots from high-frequency scalp bots.

Relative Strength Index (RSI)

Momentum trading bots leverage the Relative Strength Index (RSI) to identify strong trending assets by buying when RSI signals oversold conditions and selling near overbought levels, capitalizing on sustained price movements. High-frequency scalp bots utilize RSI on shorter timeframes, executing rapid trades to exploit minor price fluctuations around neutral RSI ranges for quick profits. Discover how integrating RSI differently can optimize your trading bot strategy by exploring deeper comparisons.

Source and External Links

Momentum Stock Trading Powered by Tickeron AI - Tickeron's AI Momentum Trading Bots feature customizable sensitivity levels for different trading styles, use price spike detection, volatility analysis, and momentum tracking to optimize stock trading with AI precision and adaptability.

Top 10 AI Trading Bots for Momentum & Price Action (2025) - Tickeron - Leading AI momentum trading bots excel in rapid decision-making for volatile markets by leveraging technical analysis to identify momentum shifts and execute trades with various levels of speed and accuracy.

How to Build a Momentum Algorithm Trading Bot in Python w - A practical tutorial demonstrating the creation of a momentum trading algorithm in Python that detects price momentum by comparing recent prices to decide entry points for trades, useful for algorithmic traders interested in custom bot development.

dowidth.com

dowidth.com