Market making involves providing liquidity by continuously quoting buy and sell prices to capture spreads, ensuring smoother market operations. News-based trading focuses on capitalizing on market volatility triggered by economic events or breaking news to gain quick profits. Discover key strategies and advantages of each approach to enhance your trading performance.

Why it is important

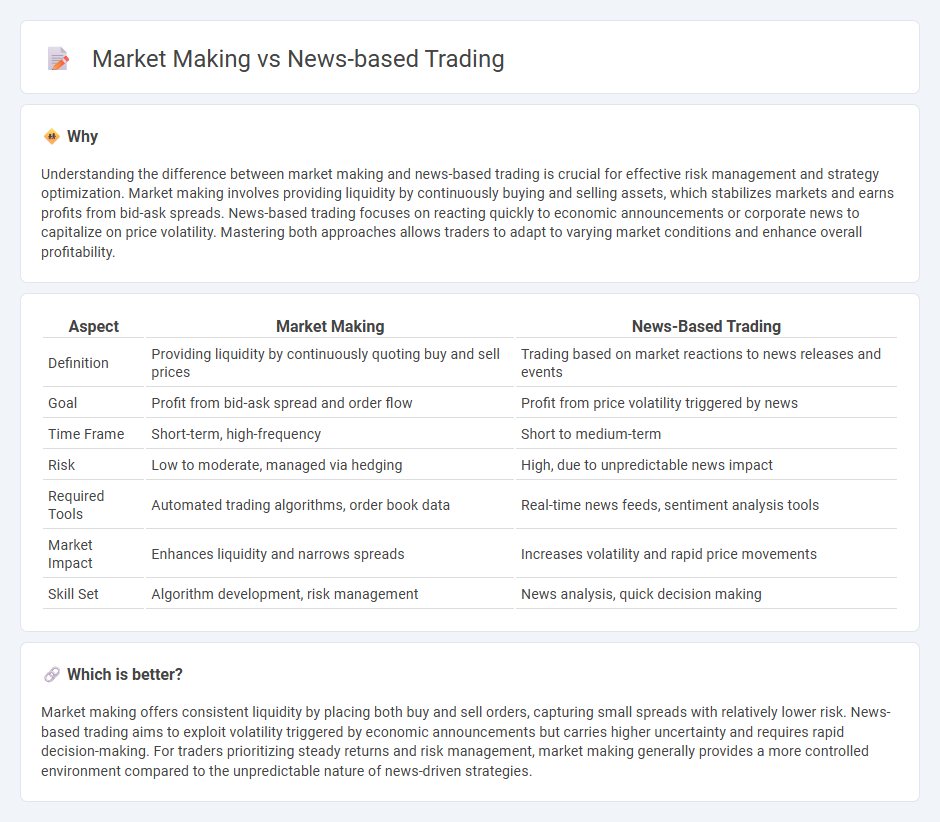

Understanding the difference between market making and news-based trading is crucial for effective risk management and strategy optimization. Market making involves providing liquidity by continuously buying and selling assets, which stabilizes markets and earns profits from bid-ask spreads. News-based trading focuses on reacting quickly to economic announcements or corporate news to capitalize on price volatility. Mastering both approaches allows traders to adapt to varying market conditions and enhance overall profitability.

Comparison Table

| Aspect | Market Making | News-Based Trading |

|---|---|---|

| Definition | Providing liquidity by continuously quoting buy and sell prices | Trading based on market reactions to news releases and events |

| Goal | Profit from bid-ask spread and order flow | Profit from price volatility triggered by news |

| Time Frame | Short-term, high-frequency | Short to medium-term |

| Risk | Low to moderate, managed via hedging | High, due to unpredictable news impact |

| Required Tools | Automated trading algorithms, order book data | Real-time news feeds, sentiment analysis tools |

| Market Impact | Enhances liquidity and narrows spreads | Increases volatility and rapid price movements |

| Skill Set | Algorithm development, risk management | News analysis, quick decision making |

Which is better?

Market making offers consistent liquidity by placing both buy and sell orders, capturing small spreads with relatively lower risk. News-based trading aims to exploit volatility triggered by economic announcements but carries higher uncertainty and requires rapid decision-making. For traders prioritizing steady returns and risk management, market making generally provides a more controlled environment compared to the unpredictable nature of news-driven strategies.

Connection

Market making and news-based trading are connected through their reliance on market liquidity and price volatility. Market makers provide continuous bid and ask quotes, facilitating smoother transactions and tighter spreads, while news-based trading exploits sudden price movements triggered by breaking news and market sentiment shifts. The influx of news influences market makers' adjustments in quotes to manage risk amid increased volatility, linking both strategies in dynamic market environments.

Key Terms

**News-based Trading:**

News-based trading exploits market-moving information from economic reports, corporate announcements, and geopolitical events to capitalize on short-term price volatility. Traders use real-time data feeds, sentiment analysis, and algorithmic models to rapidly interpret and act on breaking news. Explore more to understand how news-driven strategies can influence market timing and risk management.

Event-driven

News-based trading leverages real-time analysis of financial news and economic events to capitalize on short-term market inefficiencies, often requiring rapid execution and advanced natural language processing tools. Market making involves providing liquidity by continuously quoting buy and sell prices, profiting from bid-ask spreads and managing inventory risks, but is less sensitive to immediate event-driven catalysts. Explore our detailed guide to understand how event-driven strategies shape distinct approaches in news-based trading and market making.

Volatility

News-based trading exploits market volatility triggered by breaking news events, capitalizing on rapid price fluctuations to generate short-term profits. Market making stabilizes liquidity by continuously quoting buy and sell prices, managing volatility through balanced order flow and inventory control. Explore the distinct strategies behind volatility management and their impact on market dynamics.

Source and External Links

News Based Trading - Quantra by QuantInsti - News based trading is a strategy where traders use news and sentiment analysis to exploit temporary mispricing of securities caused by events or news that market prices have not yet reflected, often involving algorithmic interpretation of news sentiment to make trading decisions.

News Trading Strategies | How To Trade The News | AvaTrade - News trading focuses on capitalizing on market volatility triggered by economic news or events, relying on fast reactions to headline information and differs from regular technical or fundamental trading by being highly short-term and event-driven.

Trading the news - Wikipedia - Trading the news involves trading financial instruments based on market-moving news releases, either manually by reacting to events or automatically through algorithmic programmed trading that scans live news feeds for relevant triggers.

dowidth.com

dowidth.com