High-frequency trading (HFT) bots execute thousands of trades within fractions of a second by leveraging advanced algorithms and ultra-low latency connections to capitalize on minimal price discrepancies. Low-frequency trading (LFT) bots, meanwhile, focus on longer-term strategies using in-depth market analysis and trend forecasting to make fewer but potentially higher-value trades. Discover more about how these trading bots reshape market dynamics and optimize investment strategies.

Why it is important

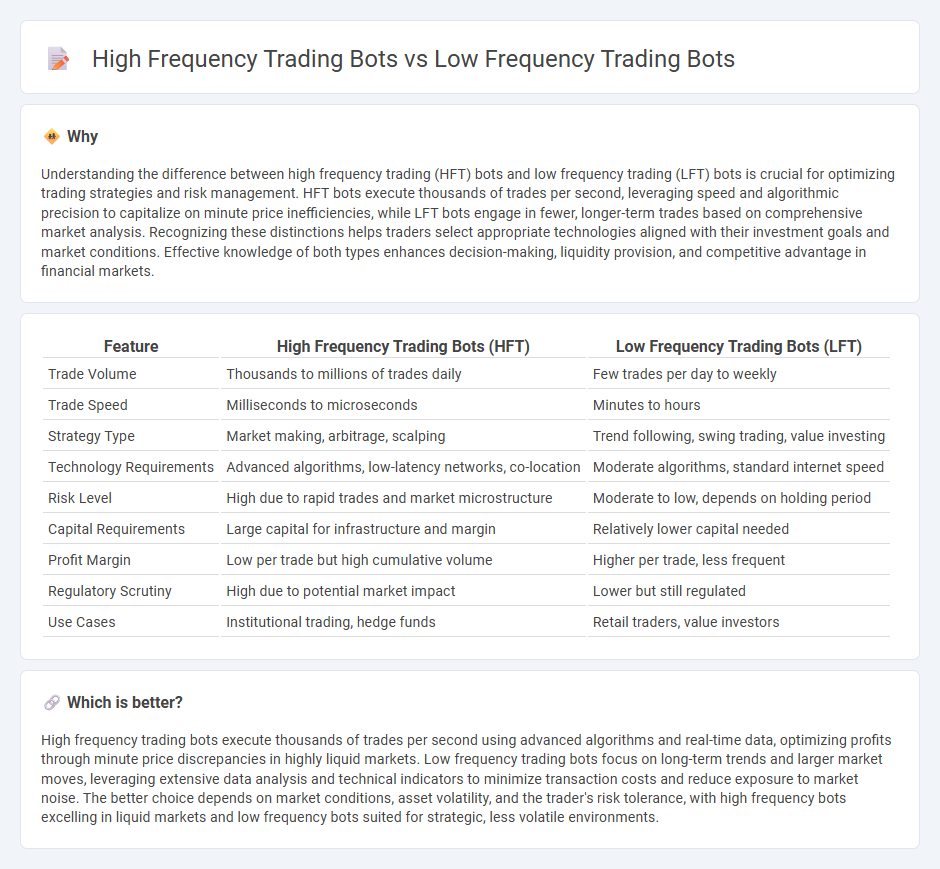

Understanding the difference between high frequency trading (HFT) bots and low frequency trading (LFT) bots is crucial for optimizing trading strategies and risk management. HFT bots execute thousands of trades per second, leveraging speed and algorithmic precision to capitalize on minute price inefficiencies, while LFT bots engage in fewer, longer-term trades based on comprehensive market analysis. Recognizing these distinctions helps traders select appropriate technologies aligned with their investment goals and market conditions. Effective knowledge of both types enhances decision-making, liquidity provision, and competitive advantage in financial markets.

Comparison Table

| Feature | High Frequency Trading Bots (HFT) | Low Frequency Trading Bots (LFT) |

|---|---|---|

| Trade Volume | Thousands to millions of trades daily | Few trades per day to weekly |

| Trade Speed | Milliseconds to microseconds | Minutes to hours |

| Strategy Type | Market making, arbitrage, scalping | Trend following, swing trading, value investing |

| Technology Requirements | Advanced algorithms, low-latency networks, co-location | Moderate algorithms, standard internet speed |

| Risk Level | High due to rapid trades and market microstructure | Moderate to low, depends on holding period |

| Capital Requirements | Large capital for infrastructure and margin | Relatively lower capital needed |

| Profit Margin | Low per trade but high cumulative volume | Higher per trade, less frequent |

| Regulatory Scrutiny | High due to potential market impact | Lower but still regulated |

| Use Cases | Institutional trading, hedge funds | Retail traders, value investors |

Which is better?

High frequency trading bots execute thousands of trades per second using advanced algorithms and real-time data, optimizing profits through minute price discrepancies in highly liquid markets. Low frequency trading bots focus on long-term trends and larger market moves, leveraging extensive data analysis and technical indicators to minimize transaction costs and reduce exposure to market noise. The better choice depends on market conditions, asset volatility, and the trader's risk tolerance, with high frequency bots excelling in liquid markets and low frequency bots suited for strategic, less volatile environments.

Connection

High frequency trading (HFT) bots use algorithms to execute thousands of trades per second, capitalizing on minute price fluctuations for rapid profit. Low frequency trading (LFT) bots, by contrast, operate on longer timeframes, analyzing broader market trends to make fewer but higher value trades. Both HFT and LFT bots rely on advanced data analytics and machine learning models to optimize trade execution strategies within electronic financial markets.

Key Terms

Low Frequency Trading Bots:

Low frequency trading bots execute trades less frequently, focusing on long-term market trends and fundamental analysis to identify undervalued assets and maximize returns with lower transaction costs. Unlike high frequency trading bots that rely on milliseconds speed and complex algorithms, low frequency bots prioritize strategy over speed, making them suitable for investors seeking stable growth with reduced market noise. Discover how low frequency trading bots can enhance your portfolio management and risk mitigation strategies.

Swing Trading

Swing trading benefits from low frequency trading bots that execute trades over hours or days, leveraging market trends and price patterns to maximize profit potential. High frequency trading bots operate on millisecond algorithms focusing on rapid order execution and short-term price discrepancies, making them less suitable for swing trading strategies. Explore the nuanced differences between these bots to optimize your swing trading approach effectively.

Order Execution Time

Low frequency trading bots execute trades with longer decision intervals, often ranging from minutes to hours, prioritizing strategy over speed and reducing sensitivity to market microstructure noise. High frequency trading bots operate on millisecond or microsecond timescales, leveraging ultra-low latency technology and co-location services to execute orders at lightning-fast speeds, thereby capitalizing on minute price discrepancies. Explore the key differences in order execution time and their impact on trading strategies to optimize your market approach.

Source and External Links

Low-frequency trading - InstaForex - Low-frequency trading bots use algorithms to execute fewer trades (e.g., one per day or session) focusing on quality over quantity, allowing individual traders to participate without the high costs associated with high-frequency trading robots.

LFT - Quantra by QuantInsti - Low-frequency trading (LFT) involves trades executed intraday or daily, with holding periods from a day to weeks, reducing transaction costs and focusing on strategies based on technical, fundamental, or quantitative analysis.

LF Trading Bot - Superalgos - The Low Frequency Trading Bot specializes in executing trading strategies on time frames of one minute and longer, making it suitable for algorithmic approaches that do not require millisecond-level speed.

dowidth.com

dowidth.com