Statistical arbitrage exploits price inefficiencies by analyzing historical data and executing mean-reverting trades, offering a quantitative approach to market neutral strategies. Momentum trading capitalizes on existing market trends, buying assets showing upward price movement and selling those in decline to capitalize on continued momentum. Explore in-depth insights on statistical arbitrage and momentum trading strategies to enhance your trading performance.

Why it is important

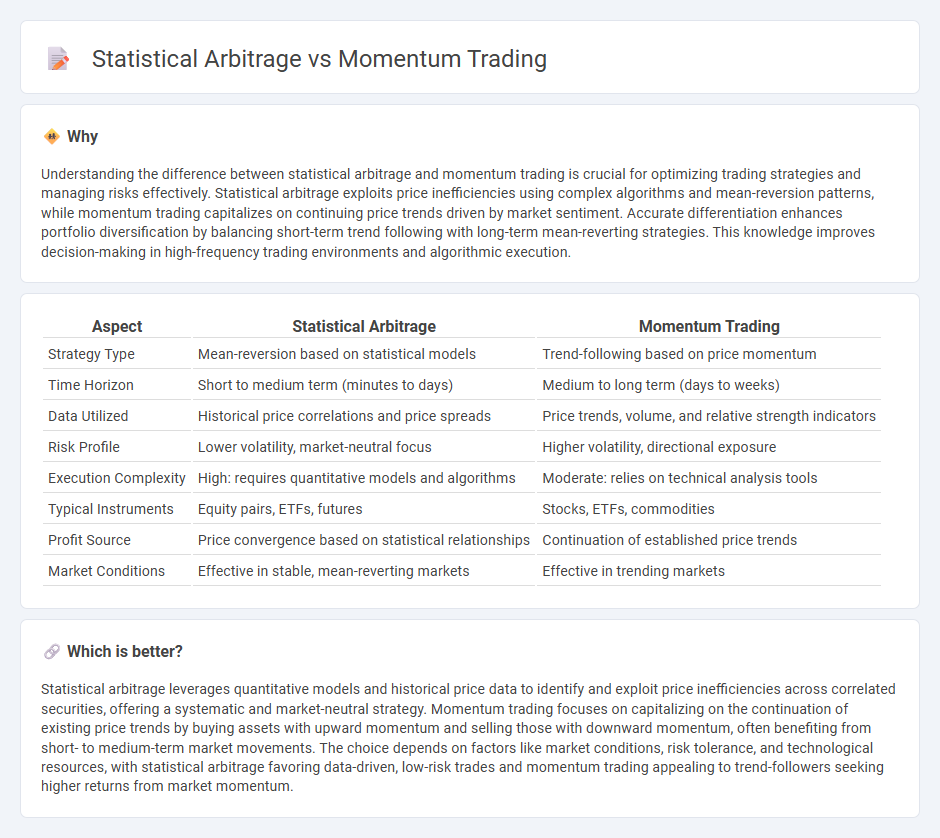

Understanding the difference between statistical arbitrage and momentum trading is crucial for optimizing trading strategies and managing risks effectively. Statistical arbitrage exploits price inefficiencies using complex algorithms and mean-reversion patterns, while momentum trading capitalizes on continuing price trends driven by market sentiment. Accurate differentiation enhances portfolio diversification by balancing short-term trend following with long-term mean-reverting strategies. This knowledge improves decision-making in high-frequency trading environments and algorithmic execution.

Comparison Table

| Aspect | Statistical Arbitrage | Momentum Trading |

|---|---|---|

| Strategy Type | Mean-reversion based on statistical models | Trend-following based on price momentum |

| Time Horizon | Short to medium term (minutes to days) | Medium to long term (days to weeks) |

| Data Utilized | Historical price correlations and price spreads | Price trends, volume, and relative strength indicators |

| Risk Profile | Lower volatility, market-neutral focus | Higher volatility, directional exposure |

| Execution Complexity | High: requires quantitative models and algorithms | Moderate: relies on technical analysis tools |

| Typical Instruments | Equity pairs, ETFs, futures | Stocks, ETFs, commodities |

| Profit Source | Price convergence based on statistical relationships | Continuation of established price trends |

| Market Conditions | Effective in stable, mean-reverting markets | Effective in trending markets |

Which is better?

Statistical arbitrage leverages quantitative models and historical price data to identify and exploit price inefficiencies across correlated securities, offering a systematic and market-neutral strategy. Momentum trading focuses on capitalizing on the continuation of existing price trends by buying assets with upward momentum and selling those with downward momentum, often benefiting from short- to medium-term market movements. The choice depends on factors like market conditions, risk tolerance, and technological resources, with statistical arbitrage favoring data-driven, low-risk trades and momentum trading appealing to trend-followers seeking higher returns from market momentum.

Connection

Statistical arbitrage and momentum trading both exploit price patterns and market inefficiencies to generate profits. Statistical arbitrage relies on mean reversion by identifying mispricings through historical price correlations, while momentum trading capitalizes on the continuation of existing price trends. The connection lies in their use of quantitative analysis and price movement data to inform trading decisions and optimize returns.

Key Terms

**Momentum Trading:**

Momentum trading capitalizes on the continuation of existing market trends by buying assets showing upward price movement and selling those with downward momentum. It relies on technical indicators such as moving averages and relative strength index (RSI) to identify entry and exit points. Discover more about how momentum trading strategies can enhance portfolio performance in dynamic markets.

Trend

Momentum trading capitalizes on existing market trends by buying assets with rising prices and selling those declining, leveraging price continuation patterns for profit. Statistical arbitrage employs quantitative models to identify pricing inefficiencies and mean-reverting behaviors, often across diversified portfolios and short time frames. Discover how trend analysis differentiates these strategies and enhances trading outcomes.

Relative Strength Index (RSI)

Momentum trading leverages the Relative Strength Index (RSI) to identify overbought or oversold assets, capitalizing on the continuation of existing price trends. Statistical arbitrage employs RSI alongside complex algorithms and historical price data to exploit temporary mispricings between correlated securities. Discover how integrating RSI enhances both strategies and optimizes trading decisions.

Source and External Links

Momentum Trading: Types, Strategies and More - Part I - Momentum trading involves buying or selling assets based on recent price trends with two main types: time-series momentum, focusing on an asset's past performance over a period, and cross-sectional momentum, comparing relative performance among assets to select the best performers.

Momentum Trading: Types, Strategies, and More - QuantInsti Blog - Momentum trading strategies include time-series momentum, which buys assets exceeding a certain past return threshold, and cross-sectional momentum, which selects assets outperforming peers within a universe, both aiming to capitalize on price trends.

Momentum Trading for Beginners (What They Don't Teach You) - This video explains momentum trading as a strategy that focuses on riding strong price moves in various markets, emphasizing trading with market strength, using technical indicators like RSI and MACD, and managing risk for successful momentum-based trades.

dowidth.com

dowidth.com