Alternative data signals encompass unconventional information sources such as satellite imagery, social media trends, and web traffic statistics that provide real-time insights into market movements. Fundamental analysis signals focus on evaluating a company's financial statements, earnings reports, and economic indicators to assess intrinsic value and long-term performance. Explore deeper to understand how combining these approaches can enhance trading strategies and decision-making.

Why it is important

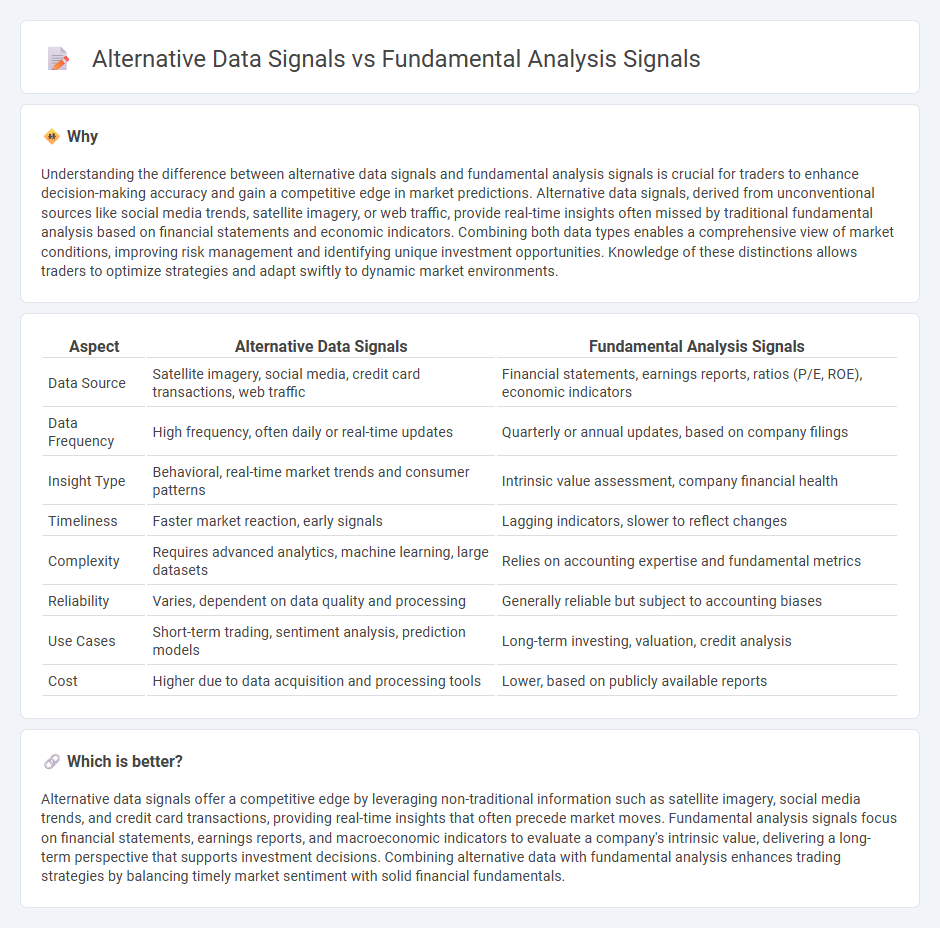

Understanding the difference between alternative data signals and fundamental analysis signals is crucial for traders to enhance decision-making accuracy and gain a competitive edge in market predictions. Alternative data signals, derived from unconventional sources like social media trends, satellite imagery, or web traffic, provide real-time insights often missed by traditional fundamental analysis based on financial statements and economic indicators. Combining both data types enables a comprehensive view of market conditions, improving risk management and identifying unique investment opportunities. Knowledge of these distinctions allows traders to optimize strategies and adapt swiftly to dynamic market environments.

Comparison Table

| Aspect | Alternative Data Signals | Fundamental Analysis Signals |

|---|---|---|

| Data Source | Satellite imagery, social media, credit card transactions, web traffic | Financial statements, earnings reports, ratios (P/E, ROE), economic indicators |

| Data Frequency | High frequency, often daily or real-time updates | Quarterly or annual updates, based on company filings |

| Insight Type | Behavioral, real-time market trends and consumer patterns | Intrinsic value assessment, company financial health |

| Timeliness | Faster market reaction, early signals | Lagging indicators, slower to reflect changes |

| Complexity | Requires advanced analytics, machine learning, large datasets | Relies on accounting expertise and fundamental metrics |

| Reliability | Varies, dependent on data quality and processing | Generally reliable but subject to accounting biases |

| Use Cases | Short-term trading, sentiment analysis, prediction models | Long-term investing, valuation, credit analysis |

| Cost | Higher due to data acquisition and processing tools | Lower, based on publicly available reports |

Which is better?

Alternative data signals offer a competitive edge by leveraging non-traditional information such as satellite imagery, social media trends, and credit card transactions, providing real-time insights that often precede market moves. Fundamental analysis signals focus on financial statements, earnings reports, and macroeconomic indicators to evaluate a company's intrinsic value, delivering a long-term perspective that supports investment decisions. Combining alternative data with fundamental analysis enhances trading strategies by balancing timely market sentiment with solid financial fundamentals.

Connection

Alternative data signals complement fundamental analysis signals by providing real-time insights into market trends and company performance beyond traditional financial statements. These data sources, such as satellite imagery, social media sentiment, and web traffic metrics, enhance the accuracy of fundamental analysis by uncovering hidden patterns and early indicators of earnings or operational shifts. Integrating alternative data with fundamental signals enables traders to make more informed decisions, identify alpha-generating opportunities, and manage risk more effectively.

Key Terms

Source and External Links

Fundamental Signals Strategy - Stanford University - Fundamental analysis uses multiple quantitative company metrics (fundamentals) that are combined into a single predictive signal to forecast stock price changes, with the approach tested to outperform benchmarks in prediction accuracy and returns.

How to Identify the Best Trading Signals & Why Fundamental Analysis is Important - Fundamental analysis evaluates economic indicators, market conditions, and company performance to reveal the intrinsic value of assets, providing signals that explain the reasons behind market moves rather than just price patterns.

Beginners Guide to Fundamental Analysis | Learn to Trade - Oanda - Fundamental analysis focuses on economic and financial factors like interest rates, inflation, and macroeconomic data to forecast market strength and price direction, helping traders anticipate major moves beyond chart patterns.

dowidth.com

dowidth.com