Dark pool activity allows institutional investors to execute large trades anonymously, minimizing market impact and preserving strategic advantages. Quote stuffing involves rapidly placing and canceling orders to manipulate market perceptions and create false liquidity signals. Explore these advanced trading tactics to understand their implications on market transparency and fairness.

Why it is important

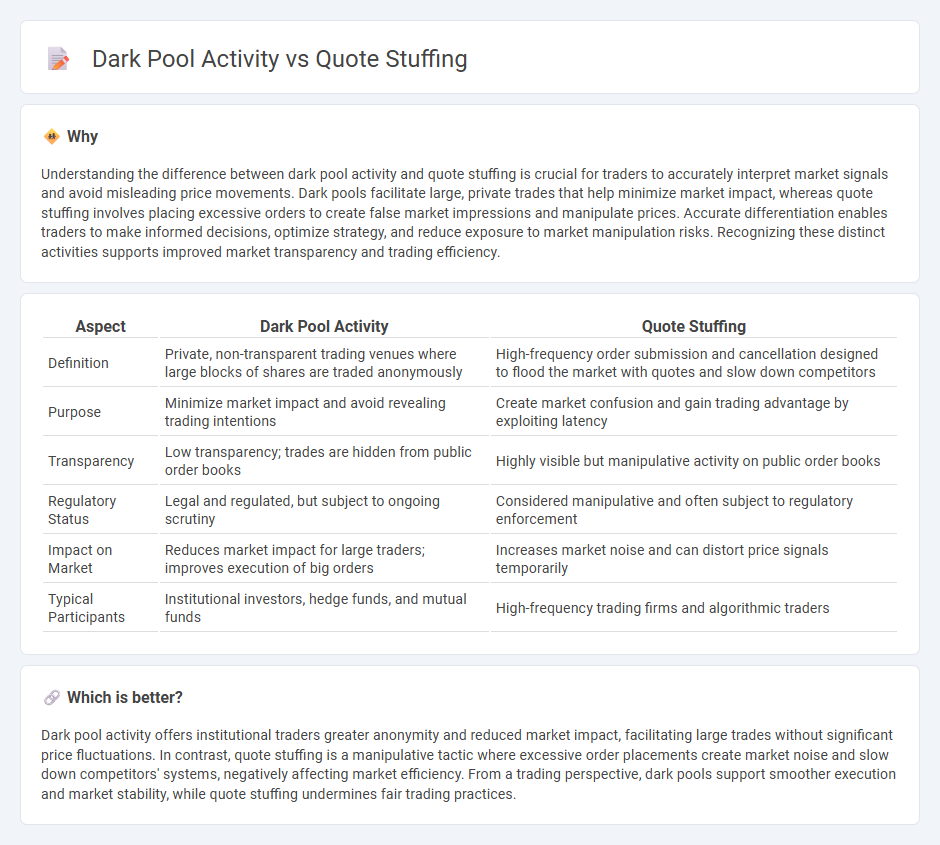

Understanding the difference between dark pool activity and quote stuffing is crucial for traders to accurately interpret market signals and avoid misleading price movements. Dark pools facilitate large, private trades that help minimize market impact, whereas quote stuffing involves placing excessive orders to create false market impressions and manipulate prices. Accurate differentiation enables traders to make informed decisions, optimize strategy, and reduce exposure to market manipulation risks. Recognizing these distinct activities supports improved market transparency and trading efficiency.

Comparison Table

| Aspect | Dark Pool Activity | Quote Stuffing |

|---|---|---|

| Definition | Private, non-transparent trading venues where large blocks of shares are traded anonymously | High-frequency order submission and cancellation designed to flood the market with quotes and slow down competitors |

| Purpose | Minimize market impact and avoid revealing trading intentions | Create market confusion and gain trading advantage by exploiting latency |

| Transparency | Low transparency; trades are hidden from public order books | Highly visible but manipulative activity on public order books |

| Regulatory Status | Legal and regulated, but subject to ongoing scrutiny | Considered manipulative and often subject to regulatory enforcement |

| Impact on Market | Reduces market impact for large traders; improves execution of big orders | Increases market noise and can distort price signals temporarily |

| Typical Participants | Institutional investors, hedge funds, and mutual funds | High-frequency trading firms and algorithmic traders |

Which is better?

Dark pool activity offers institutional traders greater anonymity and reduced market impact, facilitating large trades without significant price fluctuations. In contrast, quote stuffing is a manipulative tactic where excessive order placements create market noise and slow down competitors' systems, negatively affecting market efficiency. From a trading perspective, dark pools support smoother execution and market stability, while quote stuffing undermines fair trading practices.

Connection

Dark pool activity and quote stuffing are connected through their impact on market transparency and price discovery. Dark pools enable large trades to be executed anonymously, obscuring true market demand, while quote stuffing floods the market with rapid, fake orders, creating misleading signals for traders. Together, these practices can distort price information and challenge the efficiency of financial markets.

Key Terms

High-Frequency Trading (HFT)

Quote stuffing, a manipulative tactic in High-Frequency Trading (HFT), involves rapidly placing and canceling large volumes of orders to create market confusion and slow down competitors. Dark pool activity, characterized by private, non-transparent trading venues, enables HFT firms to execute large trades without immediate market impact, affecting price discovery and liquidity. Explore deeper insights into how these HFT strategies influence market structure and trading efficiency.

Market Liquidity

Quote stuffing floods the market with excessive orders, creating artificial liquidity and masking true supply-demand dynamics. Dark pool activity involves private trading venues where large blocks of shares are exchanged away from public view, impacting visible market depth and liquidity. Explore how these phenomena influence market liquidity and trading strategies for deeper insights.

Order Book

Quote stuffing involves rapidly entering and canceling large volumes of orders to overwhelm the order book, creating misleading market depth and volatility. Dark pool activity, conversely, hides order size and intentions from the public order book, enabling large institutional trades with minimal market impact. Explore how these contrasting order book strategies shape modern trading ecosystems.

Source and External Links

Quote Stuffing - Overview, How It Works, Example - Quote stuffing is a practice where a trader rapidly enters and then cancels a massive number of buy or sell orders to manipulate the stock price and profit from the artificially influenced market condition.

How Larger Players Use Quote Stuffing to Gain an Edge in Trading - Quote stuffing is a strategy used by market participants to flood markets with excessive orders, often using algorithms, to create confusion and disrupt trading, ultimately misleading others to gain an advantage.

Quote Stuffing - What Is It, Vs Spoofing Vs Layering - Quote stuffing is a form of market manipulation where multiple orders are placed and quickly canceled to create a false sense of market demand or supply, typically executed by high-frequency traders.

dowidth.com

dowidth.com