Tokenized assets represent ownership in digital form on a blockchain, offering fractional ownership, enhanced liquidity, and transparent transactions compared to traditional stocks, which are shares in companies traded on centralized exchanges. While stocks remain a popular choice for long-term investment and dividend generation, tokenized assets enable faster settlement times and access to a broader range of asset classes. Explore how tokenization is reshaping the investment landscape and what it means for your trading strategy.

Why it is important

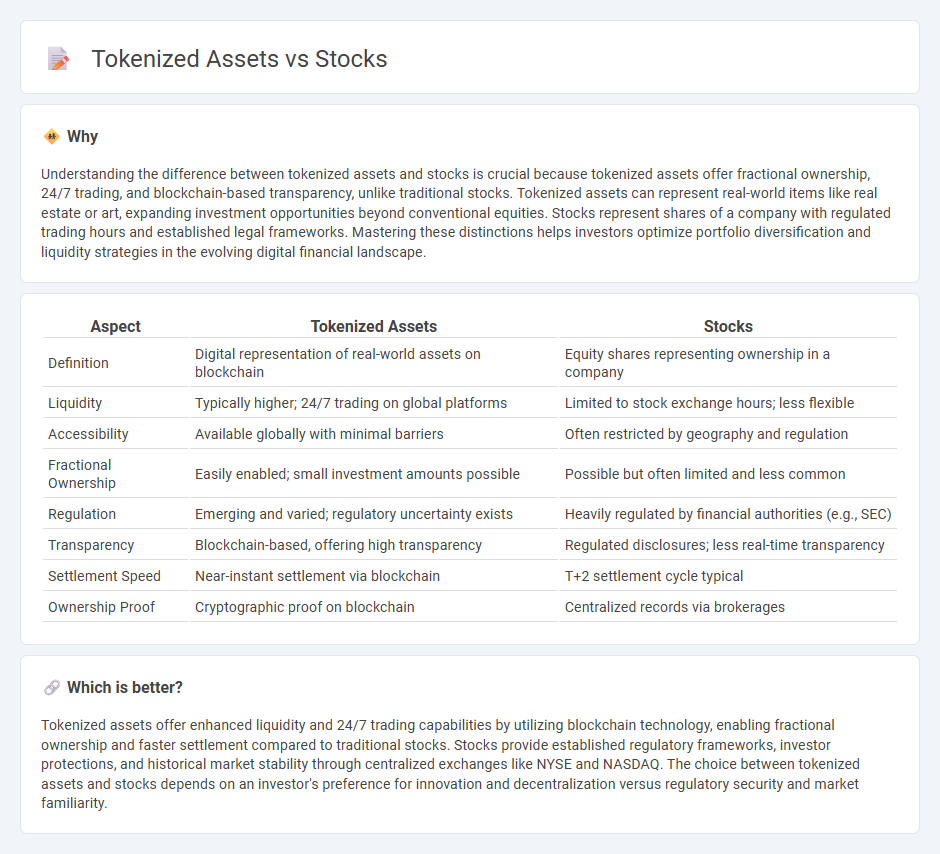

Understanding the difference between tokenized assets and stocks is crucial because tokenized assets offer fractional ownership, 24/7 trading, and blockchain-based transparency, unlike traditional stocks. Tokenized assets can represent real-world items like real estate or art, expanding investment opportunities beyond conventional equities. Stocks represent shares of a company with regulated trading hours and established legal frameworks. Mastering these distinctions helps investors optimize portfolio diversification and liquidity strategies in the evolving digital financial landscape.

Comparison Table

| Aspect | Tokenized Assets | Stocks |

|---|---|---|

| Definition | Digital representation of real-world assets on blockchain | Equity shares representing ownership in a company |

| Liquidity | Typically higher; 24/7 trading on global platforms | Limited to stock exchange hours; less flexible |

| Accessibility | Available globally with minimal barriers | Often restricted by geography and regulation |

| Fractional Ownership | Easily enabled; small investment amounts possible | Possible but often limited and less common |

| Regulation | Emerging and varied; regulatory uncertainty exists | Heavily regulated by financial authorities (e.g., SEC) |

| Transparency | Blockchain-based, offering high transparency | Regulated disclosures; less real-time transparency |

| Settlement Speed | Near-instant settlement via blockchain | T+2 settlement cycle typical |

| Ownership Proof | Cryptographic proof on blockchain | Centralized records via brokerages |

Which is better?

Tokenized assets offer enhanced liquidity and 24/7 trading capabilities by utilizing blockchain technology, enabling fractional ownership and faster settlement compared to traditional stocks. Stocks provide established regulatory frameworks, investor protections, and historical market stability through centralized exchanges like NYSE and NASDAQ. The choice between tokenized assets and stocks depends on an investor's preference for innovation and decentralization versus regulatory security and market familiarity.

Connection

Tokenized assets represent ownership of real-world stocks or assets through blockchain technology, enabling fractional ownership and increased liquidity. This digital representation allows investors to trade stocks on decentralized platforms with enhanced transparency and reduced transaction costs. Integration of tokenized stocks streamlines access to traditional equity markets while leveraging the advantages of blockchain security and automation.

Key Terms

Ownership

Stocks represent direct ownership in a company, granting shareholders voting rights and entitlement to dividends based on company performance. Tokenized assets leverage blockchain technology to offer fractional ownership in various traditional and alternative assets, enhancing liquidity and accessibility. Explore the detailed differences and benefits of stocks versus tokenized assets to make informed investment decisions.

Liquidity

Stocks typically offer high liquidity due to established trading platforms like NYSE and NASDAQ, enabling investors to buy or sell shares quickly. Tokenized assets leverage blockchain technology to provide 24/7 trading and fractional ownership, potentially increasing liquidity for traditionally illiquid assets such as real estate or art. Explore deeper insights into how liquidity dynamics differ between stocks and tokenized assets.

Regulation

Stocks are regulated securities governed by frameworks such as the SEC in the United States and must comply with strict disclosure, reporting, and investor protection rules. Tokenized assets, while increasingly subject to regulatory scrutiny, operate in a more complex landscape involving both securities laws and emerging blockchain-specific regulations that vary internationally. Explore the evolving regulatory developments shaping the future of tokenized assets to better understand their legal landscape.

Source and External Links

Stocks | Investor.gov - Stocks represent ownership in a company and come mainly in two types: common stock (with voting rights and possible dividends) and preferred stock (with priority dividends but usually no voting rights); they are further categorized by growth, income, value, and company size such as large-cap or penny stocks.

What are stocks? | Charles Schwab - Stocks offer partial ownership with common stock providing voting rights and growth potential and preferred stock offering higher fixed dividends with less volatility; ADRs represent foreign stocks traded on U.S. exchanges.

Stocks | FINRA.org - Common stocks fluctuate in price and may pay variable dividends, while preferred stocks tend to have fixed dividends, lower price volatility, and priority in bankruptcy; buying stocks on margin involves borrowing which increases risk and reward potential.

dowidth.com

dowidth.com