Microstructure trading focuses on the detailed mechanisms of trade execution, order flow, and price formation within financial markets, leveraging high-frequency data and algorithmic strategies to exploit short-term inefficiencies. Market making involves providing liquidity by continuously quoting buy and sell prices, profiting from the bid-ask spread while managing inventory risk and market volatility. Explore the nuances and techniques behind microstructure trading and market making to enhance your trading strategies and market understanding.

Why it is important

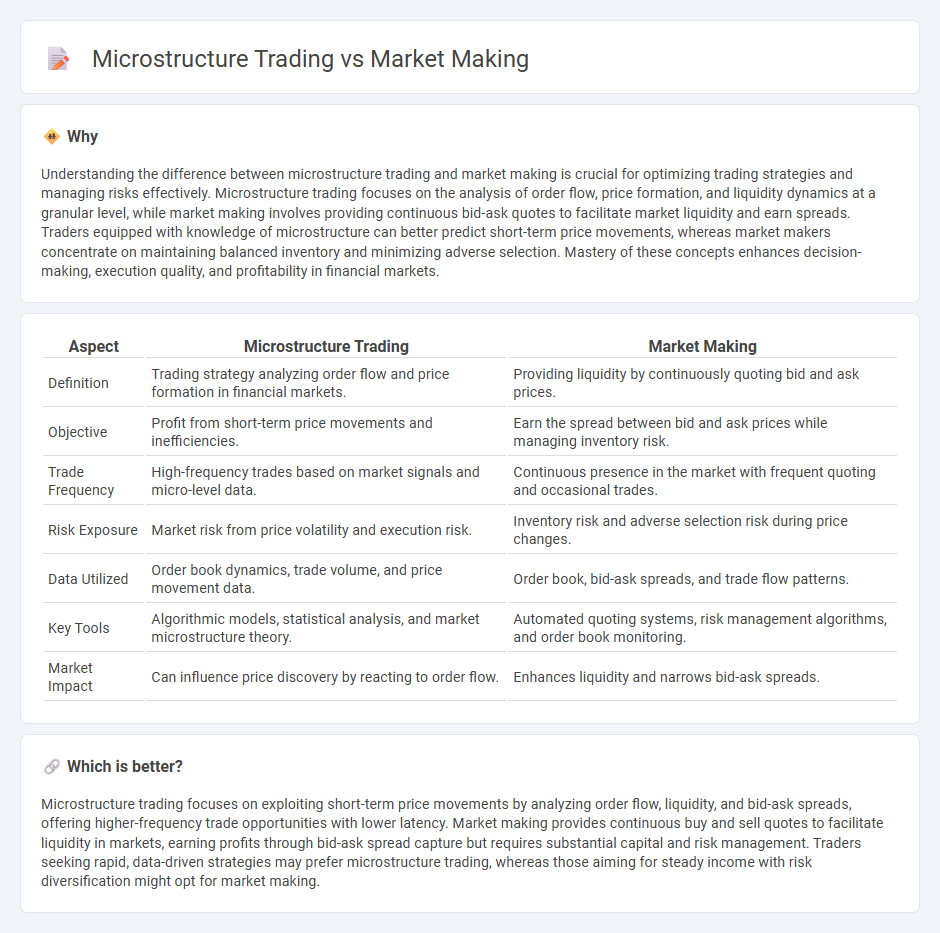

Understanding the difference between microstructure trading and market making is crucial for optimizing trading strategies and managing risks effectively. Microstructure trading focuses on the analysis of order flow, price formation, and liquidity dynamics at a granular level, while market making involves providing continuous bid-ask quotes to facilitate market liquidity and earn spreads. Traders equipped with knowledge of microstructure can better predict short-term price movements, whereas market makers concentrate on maintaining balanced inventory and minimizing adverse selection. Mastery of these concepts enhances decision-making, execution quality, and profitability in financial markets.

Comparison Table

| Aspect | Microstructure Trading | Market Making |

|---|---|---|

| Definition | Trading strategy analyzing order flow and price formation in financial markets. | Providing liquidity by continuously quoting bid and ask prices. |

| Objective | Profit from short-term price movements and inefficiencies. | Earn the spread between bid and ask prices while managing inventory risk. |

| Trade Frequency | High-frequency trades based on market signals and micro-level data. | Continuous presence in the market with frequent quoting and occasional trades. |

| Risk Exposure | Market risk from price volatility and execution risk. | Inventory risk and adverse selection risk during price changes. |

| Data Utilized | Order book dynamics, trade volume, and price movement data. | Order book, bid-ask spreads, and trade flow patterns. |

| Key Tools | Algorithmic models, statistical analysis, and market microstructure theory. | Automated quoting systems, risk management algorithms, and order book monitoring. |

| Market Impact | Can influence price discovery by reacting to order flow. | Enhances liquidity and narrows bid-ask spreads. |

Which is better?

Microstructure trading focuses on exploiting short-term price movements by analyzing order flow, liquidity, and bid-ask spreads, offering higher-frequency trade opportunities with lower latency. Market making provides continuous buy and sell quotes to facilitate liquidity in markets, earning profits through bid-ask spread capture but requires substantial capital and risk management. Traders seeking rapid, data-driven strategies may prefer microstructure trading, whereas those aiming for steady income with risk diversification might opt for market making.

Connection

Microstructure trading relies on detailed analysis of order flow and price formation mechanisms, which are fundamental to market making strategies that provide liquidity and narrow bid-ask spreads. Market makers utilize microstructure insights to optimize quote placements and manage inventory risk effectively, ensuring continuous market participation. These interconnected processes enhance price efficiency and reduce volatility in financial markets.

Key Terms

Bid-Ask Spread

Market making involves continuously providing buy and sell quotes to capture profits from the bid-ask spread, effectively ensuring liquidity in financial markets. Microstructure trading analyzes how the bid-ask spread reflects order flow, information asymmetry, and transaction costs, influencing price discovery mechanisms. Explore deeper insights into bid-ask dynamics and their impact on trading strategies to optimize market participation.

Order Flow

Market making involves providing continuous bid and ask quotes to facilitate liquidity, optimizing revenue through the bid-ask spread, while microstructure trading centers on analyzing order flow to gain predictive insights into price movements and market dynamics. Order flow data, detailing the sequence and volume of trades, offers critical information for adjusting market maker spreads and for microstructure traders to identify informed trading and order imbalances. Explore deeper into how order flow analysis enhances both strategies' effectiveness and profitability.

Liquidity Provision

Market making involves continuously quoting buy and sell prices to provide liquidity, reduce bid-ask spreads, and facilitate smooth trading in financial markets. Microstructure trading focuses on exploiting detailed order book dynamics and price patterns to gain profits, often by analyzing market depth, order flow, and transaction costs. Explore how these approaches impact liquidity provision and market efficiency in greater detail.

Source and External Links

Mastering the Market Maker Trading Strategy - Market makers earn profits mainly through the bid-ask spread by buying securities at the bid price and selling at a slightly higher ask price, while managing inventory and analyzing order flows to anticipate price movements and provide market liquidity under regulation.

Market maker: What it is, importance, benefits & examples - Market makers continuously quote buy and sell prices, hold large inventories, and profit from the bid-ask spread while ensuring liquidity and balancing risks via sophisticated algorithms and strategies.

Market Maker - Definition, Role, How They Work - Market makers can be firms or individuals who post simultaneous bid and ask prices, earning profits from the bid-ask spread and playing a key role in maintaining market liquidity and facilitating trades for investors.

dowidth.com

dowidth.com