High-frequency scalp bots execute rapid trades within milliseconds to capitalize on small price movements, leveraging advanced algorithms and low-latency data feeds for maximum efficiency. News-based trading bots analyze real-time news sentiment and market events to make strategic trades based on anticipated market reactions. Explore the differences in strategy, technology, and performance to understand which bot suits your trading goals.

Why it is important

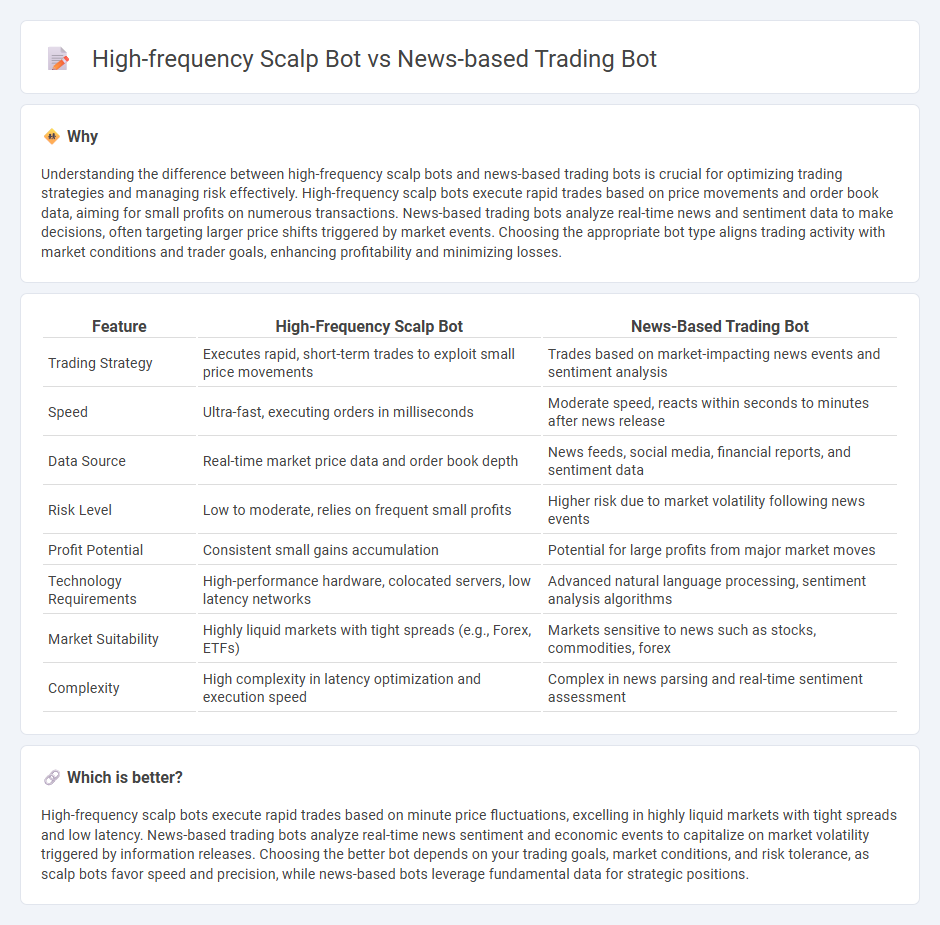

Understanding the difference between high-frequency scalp bots and news-based trading bots is crucial for optimizing trading strategies and managing risk effectively. High-frequency scalp bots execute rapid trades based on price movements and order book data, aiming for small profits on numerous transactions. News-based trading bots analyze real-time news and sentiment data to make decisions, often targeting larger price shifts triggered by market events. Choosing the appropriate bot type aligns trading activity with market conditions and trader goals, enhancing profitability and minimizing losses.

Comparison Table

| Feature | High-Frequency Scalp Bot | News-Based Trading Bot |

|---|---|---|

| Trading Strategy | Executes rapid, short-term trades to exploit small price movements | Trades based on market-impacting news events and sentiment analysis |

| Speed | Ultra-fast, executing orders in milliseconds | Moderate speed, reacts within seconds to minutes after news release |

| Data Source | Real-time market price data and order book depth | News feeds, social media, financial reports, and sentiment data |

| Risk Level | Low to moderate, relies on frequent small profits | Higher risk due to market volatility following news events |

| Profit Potential | Consistent small gains accumulation | Potential for large profits from major market moves |

| Technology Requirements | High-performance hardware, colocated servers, low latency networks | Advanced natural language processing, sentiment analysis algorithms |

| Market Suitability | Highly liquid markets with tight spreads (e.g., Forex, ETFs) | Markets sensitive to news such as stocks, commodities, forex |

| Complexity | High complexity in latency optimization and execution speed | Complex in news parsing and real-time sentiment assessment |

Which is better?

High-frequency scalp bots execute rapid trades based on minute price fluctuations, excelling in highly liquid markets with tight spreads and low latency. News-based trading bots analyze real-time news sentiment and economic events to capitalize on market volatility triggered by information releases. Choosing the better bot depends on your trading goals, market conditions, and risk tolerance, as scalp bots favor speed and precision, while news-based bots leverage fundamental data for strategic positions.

Connection

High-frequency scalp bots and news-based trading bots both leverage real-time data analysis to execute rapid trades, maximizing profit opportunities in volatile markets. High-frequency scalp bots focus on milliseconds-long price fluctuations using complex algorithms, while news-based trading bots analyze breaking news and sentiment to predict market moves before human traders can react. Their synergy enhances market responsiveness by combining instantaneous price action with contextual news-driven insights.

Key Terms

**News-based trading bot:**

News-based trading bots utilize real-time data from financial news sources, social media, and economic reports to identify market-moving events and execute trades accordingly, capitalizing on volatility triggered by breaking news. These bots employ natural language processing (NLP) algorithms to analyze sentiment and relevance, making decisions based on the impact of news on asset prices. Explore more about how news-based trading bots can enhance your trading strategy by integrating AI-driven insights.

Sentiment Analysis

News-based trading bots leverage natural language processing to analyze market sentiment from real-time news feeds, aiming to predict stock movements based on public sentiment shifts. High-frequency scalp bots execute rapid trades exploiting minute price fluctuations, relying primarily on market data and microstructure rather than sentiment analysis. Explore the nuances of sentiment-driven strategies in trading bots to enhance your market approach.

Event-driven Strategy

News-based trading bots leverage real-time market-moving events such as earnings reports, regulatory announcements, or geopolitical developments to capitalize on sudden price shifts, using advanced natural language processing to assess sentiment and market impact. High-frequency scalp bots focus on executing a large volume of quick trades within seconds or milliseconds, exploiting minute price discrepancies and liquidity imbalances primarily in highly liquid markets. Explore the intricacies of event-driven trading strategies and determine which approach aligns best with your trading goals.

Source and External Links

Forex News Trader - An automated news-based trading robot that uses predefined strategies and live news data from multiple Forex news sources to trade automatically at news release times, supporting various advanced trading strategies like pending trap and Martingale.

What I Learned When Building an AI News Trading Bot - A blog explaining how to build a simple AI-driven news trading bot that reads real-time news to generate trading signals, offering flexibility and a foundational template for more complex strategies.

3 News Trading Bots for 2025 - A video overview showcasing three different news trading bots used in 2025, including a free expert advisor called BF News Trader, with detailed backtesting for various currency pairs.

dowidth.com

dowidth.com