Flash loan arbitrage leverages decentralized finance protocols to execute instant, collateral-free loans for profit by exploiting price discrepancies across multiple platforms, often within seconds. High-frequency trading employs sophisticated algorithms and ultra-low latency systems to capitalize on minute market movements through rapid order execution on centralized exchanges. Explore the intricate dynamics and technological advantages that distinguish flash loan arbitrage from high-frequency trading.

Why it is important

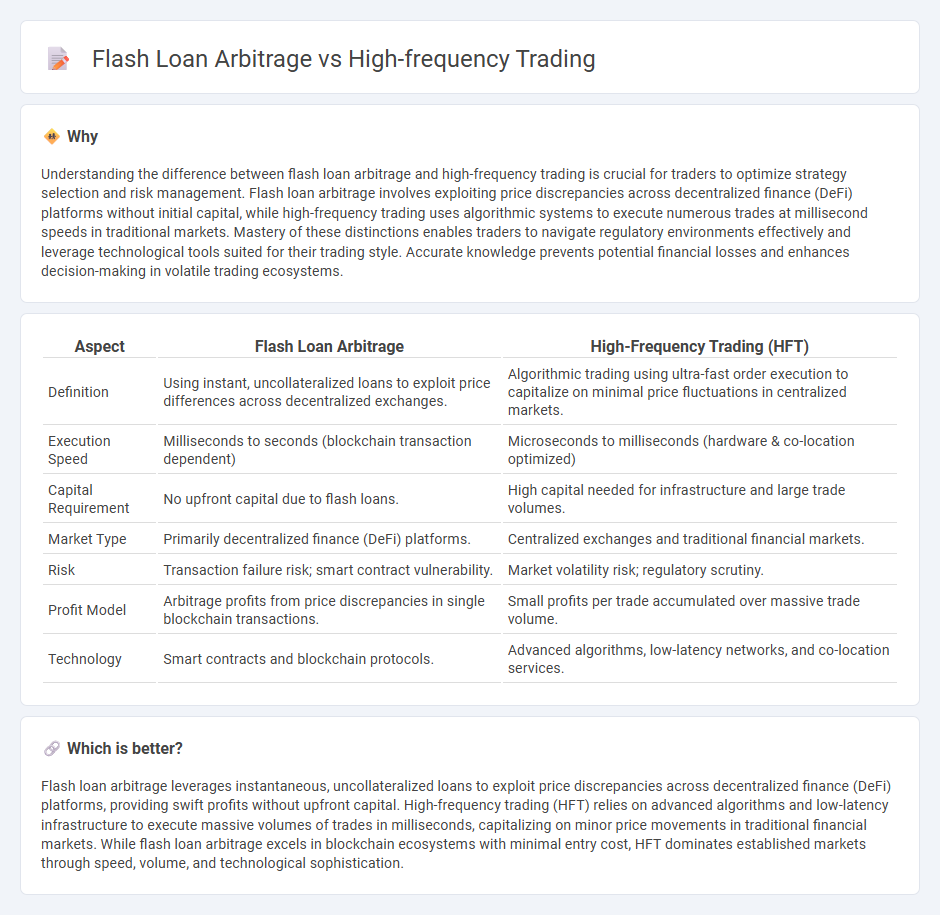

Understanding the difference between flash loan arbitrage and high-frequency trading is crucial for traders to optimize strategy selection and risk management. Flash loan arbitrage involves exploiting price discrepancies across decentralized finance (DeFi) platforms without initial capital, while high-frequency trading uses algorithmic systems to execute numerous trades at millisecond speeds in traditional markets. Mastery of these distinctions enables traders to navigate regulatory environments effectively and leverage technological tools suited for their trading style. Accurate knowledge prevents potential financial losses and enhances decision-making in volatile trading ecosystems.

Comparison Table

| Aspect | Flash Loan Arbitrage | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Using instant, uncollateralized loans to exploit price differences across decentralized exchanges. | Algorithmic trading using ultra-fast order execution to capitalize on minimal price fluctuations in centralized markets. |

| Execution Speed | Milliseconds to seconds (blockchain transaction dependent) | Microseconds to milliseconds (hardware & co-location optimized) |

| Capital Requirement | No upfront capital due to flash loans. | High capital needed for infrastructure and large trade volumes. |

| Market Type | Primarily decentralized finance (DeFi) platforms. | Centralized exchanges and traditional financial markets. |

| Risk | Transaction failure risk; smart contract vulnerability. | Market volatility risk; regulatory scrutiny. |

| Profit Model | Arbitrage profits from price discrepancies in single blockchain transactions. | Small profits per trade accumulated over massive trade volume. |

| Technology | Smart contracts and blockchain protocols. | Advanced algorithms, low-latency networks, and co-location services. |

Which is better?

Flash loan arbitrage leverages instantaneous, uncollateralized loans to exploit price discrepancies across decentralized finance (DeFi) platforms, providing swift profits without upfront capital. High-frequency trading (HFT) relies on advanced algorithms and low-latency infrastructure to execute massive volumes of trades in milliseconds, capitalizing on minor price movements in traditional financial markets. While flash loan arbitrage excels in blockchain ecosystems with minimal entry cost, HFT dominates established markets through speed, volume, and technological sophistication.

Connection

Flash loan arbitrage and high-frequency trading both leverage speed and automation to capitalize on market inefficiencies. Flash loan arbitrage involves borrowing assets instantly without collateral to exploit price differences across decentralized exchanges within a single transaction. High-frequency trading employs sophisticated algorithms and low-latency infrastructures to execute numerous trades rapidly, often targeting arbitrage opportunities in centralized markets.

Key Terms

Latency

High-frequency trading (HFT) exploits minuscule price discrepancies through ultra-low latency systems, using co-location and direct market access to execute thousands of trades per second in traditional financial markets. Flash loan arbitrage, prevalent in decentralized finance (DeFi), leverages instant, uncollateralized loans on blockchain platforms for rapid, atomic transactions but is limited by blockchain network latency and gas fees. Explore the intricacies of latency impacts on these advanced trading strategies to optimize your market approach.

Smart Contracts

High-frequency trading exploits algorithmic speed on centralized exchanges, while flash loan arbitrage leverages decentralized smart contracts to temporarily access large capital for instant, risk-free trades. Smart contracts automate and enforce arbitrage conditions without intermediaries, enabling cost-efficient and transparent execution across DeFi protocols. Discover how these blockchain-driven mechanisms revolutionize market strategies and financial innovation.

Order Book

High-frequency trading exploits ultra-fast order book updates to capitalize on tiny price discrepancies across markets, using sophisticated algorithms and low-latency networks. Flash loan arbitrage leverages instantaneous, uncollateralized loans to execute rapid trades within decentralized finance protocols, exploiting price inefficiencies in on-chain order books. Discover how order book dynamics drive these distinct trading strategies and impact market efficiency.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading is an automated trading method using powerful computers to execute many trades at extremely high speeds, capitalizing on very small price differences across markets in fractions of a second for profit.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT uses complex algorithms to perform thousands of trades per second, exploiting tiny price fluctuations and arbitrage opportunities across markets, primarily used by large institutions like hedge funds and investment banks.

High-frequency trading - Wikipedia - High-frequency trading is algorithmic trading that relies on fast computerized quantitative models to make split-second trading decisions, focusing on strategies such as market-making and arbitrage to profit from temporary price inefficiencies.

dowidth.com

dowidth.com