Volatility harvesting exploits fluctuations in asset prices by systematically rebalancing portfolios to capture gains from market volatility, enhancing returns without increasing risk exposure. Risk parity balances portfolio risk equally across asset classes, promoting diversification and reducing dependency on any single market condition. Explore these approaches in-depth to understand how they optimize investment performance and risk management.

Why it is important

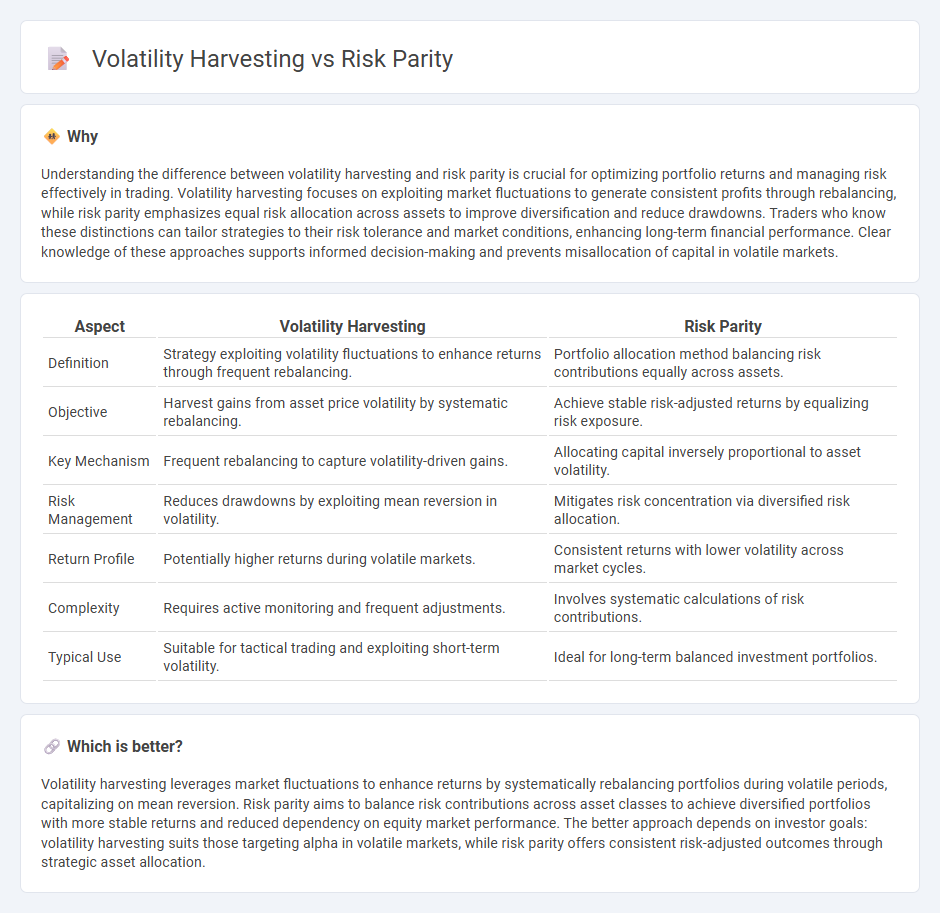

Understanding the difference between volatility harvesting and risk parity is crucial for optimizing portfolio returns and managing risk effectively in trading. Volatility harvesting focuses on exploiting market fluctuations to generate consistent profits through rebalancing, while risk parity emphasizes equal risk allocation across assets to improve diversification and reduce drawdowns. Traders who know these distinctions can tailor strategies to their risk tolerance and market conditions, enhancing long-term financial performance. Clear knowledge of these approaches supports informed decision-making and prevents misallocation of capital in volatile markets.

Comparison Table

| Aspect | Volatility Harvesting | Risk Parity |

|---|---|---|

| Definition | Strategy exploiting volatility fluctuations to enhance returns through frequent rebalancing. | Portfolio allocation method balancing risk contributions equally across assets. |

| Objective | Harvest gains from asset price volatility by systematic rebalancing. | Achieve stable risk-adjusted returns by equalizing risk exposure. |

| Key Mechanism | Frequent rebalancing to capture volatility-driven gains. | Allocating capital inversely proportional to asset volatility. |

| Risk Management | Reduces drawdowns by exploiting mean reversion in volatility. | Mitigates risk concentration via diversified risk allocation. |

| Return Profile | Potentially higher returns during volatile markets. | Consistent returns with lower volatility across market cycles. |

| Complexity | Requires active monitoring and frequent adjustments. | Involves systematic calculations of risk contributions. |

| Typical Use | Suitable for tactical trading and exploiting short-term volatility. | Ideal for long-term balanced investment portfolios. |

Which is better?

Volatility harvesting leverages market fluctuations to enhance returns by systematically rebalancing portfolios during volatile periods, capitalizing on mean reversion. Risk parity aims to balance risk contributions across asset classes to achieve diversified portfolios with more stable returns and reduced dependency on equity market performance. The better approach depends on investor goals: volatility harvesting suits those targeting alpha in volatile markets, while risk parity offers consistent risk-adjusted outcomes through strategic asset allocation.

Connection

Volatility harvesting leverages the rebalancing of assets to capitalize on market fluctuations, which aligns closely with the risk parity approach that allocates portfolio risk evenly across different asset classes. Both strategies aim to enhance risk-adjusted returns by maintaining balanced exposure and adapting to changing market volatility. This connection allows investors to optimize diversification benefits and improve portfolio stability during turbulent market conditions.

Key Terms

Portfolio Allocation

Risk parity allocates capital by balancing asset class risk contributions to achieve diversified volatility exposure across a portfolio. Volatility harvesting exploits mean reversion in asset price volatility through dynamic rebalancing strategies that capture gains from fluctuating market regimes. Explore detailed comparisons on portfolio allocation impacts to optimize risk-adjusted returns effectively.

Risk Contribution

Risk parity focuses on equalizing risk contribution across assets in a portfolio to achieve balanced exposure, typically through leveraging low-volatility assets. Volatility harvesting exploits fluctuations in asset volatility by dynamically rebalancing to capture returns from mean reversion in variance. Explore how these strategies compare in managing risk contribution and enhancing portfolio resilience for deeper insights.

Rebalancing

Risk parity emphasizes equal allocation of risk across diverse asset classes through strategic rebalancing, maintaining target volatility levels. Volatility harvesting leverages frequent rebalancing to capitalize on market volatility, systematically buying low and selling high to enhance returns. Explore the mechanics and benefits of these rebalancing strategies to optimize your investment performance.

Source and External Links

Risk parity - Wikipedia - Risk parity is an investment approach focusing on allocating risk equally across asset classes, aiming to achieve higher risk-adjusted returns and more resilience to market downturns compared to traditional portfolios like 60% stocks and 40% bonds, by balancing volatility contributions rather than capital.

An Introduction to Risk Parity - Risk parity defines a well-diversified portfolio as one where each asset class equally contributes to total portfolio risk (usually measured by volatility), avoiding reliance on expected return forecasts and instead focusing on risk estimates for portfolio construction.

Understanding Risk Parity | CME Group - Risk parity balances risk contributions from each asset to create a truly diversified portfolio, contrasting traditional allocations that concentrate most risk in equities, and is supported by Modern Portfolio Theory principles to offer potentially superior risk-adjusted returns.

dowidth.com

dowidth.com