Liquidity sweep involves executing large orders by breaking them into smaller trades to minimize market impact and avoid price slippage. Front-running occurs when a trader exploits advance knowledge of pending large orders to trade ahead and profit from the resulting price movement. Discover how these strategies affect market dynamics and investor outcomes.

Why it is important

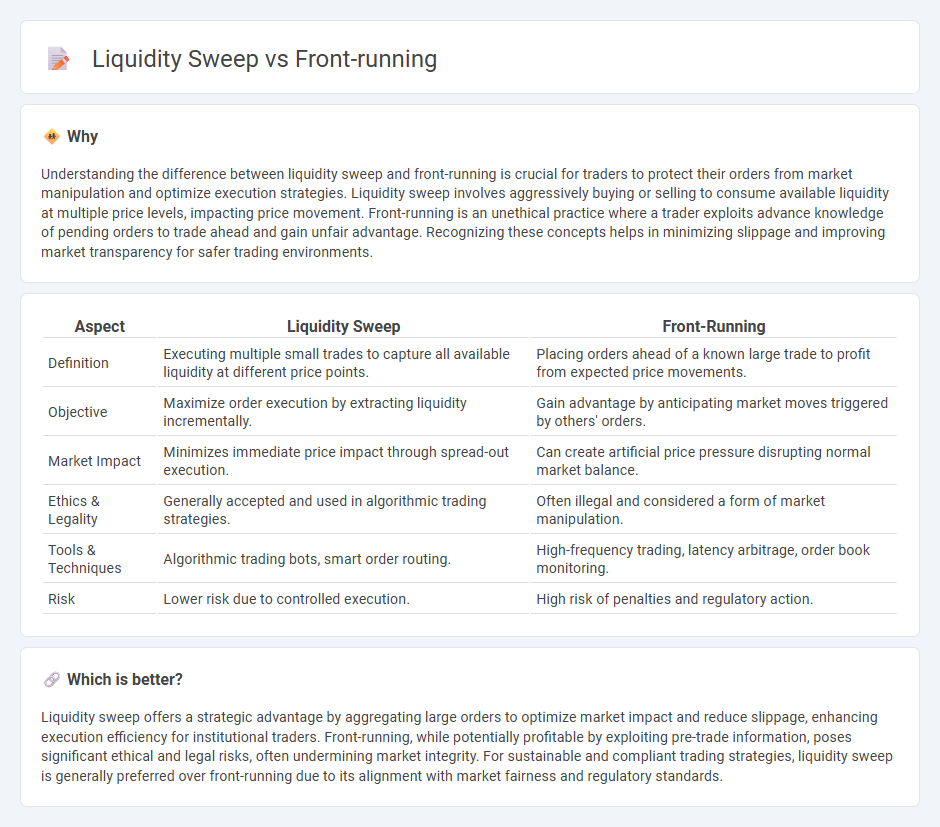

Understanding the difference between liquidity sweep and front-running is crucial for traders to protect their orders from market manipulation and optimize execution strategies. Liquidity sweep involves aggressively buying or selling to consume available liquidity at multiple price levels, impacting price movement. Front-running is an unethical practice where a trader exploits advance knowledge of pending orders to trade ahead and gain unfair advantage. Recognizing these concepts helps in minimizing slippage and improving market transparency for safer trading environments.

Comparison Table

| Aspect | Liquidity Sweep | Front-Running |

|---|---|---|

| Definition | Executing multiple small trades to capture all available liquidity at different price points. | Placing orders ahead of a known large trade to profit from expected price movements. |

| Objective | Maximize order execution by extracting liquidity incrementally. | Gain advantage by anticipating market moves triggered by others' orders. |

| Market Impact | Minimizes immediate price impact through spread-out execution. | Can create artificial price pressure disrupting normal market balance. |

| Ethics & Legality | Generally accepted and used in algorithmic trading strategies. | Often illegal and considered a form of market manipulation. |

| Tools & Techniques | Algorithmic trading bots, smart order routing. | High-frequency trading, latency arbitrage, order book monitoring. |

| Risk | Lower risk due to controlled execution. | High risk of penalties and regulatory action. |

Which is better?

Liquidity sweep offers a strategic advantage by aggregating large orders to optimize market impact and reduce slippage, enhancing execution efficiency for institutional traders. Front-running, while potentially profitable by exploiting pre-trade information, poses significant ethical and legal risks, often undermining market integrity. For sustainable and compliant trading strategies, liquidity sweep is generally preferred over front-running due to its alignment with market fairness and regulatory standards.

Connection

Liquidity sweeps involve rapidly executing large orders to capture available market liquidity across multiple venues, creating opportunities for front-running traders to anticipate and exploit these moves. Front-running leverages advanced algorithms and real-time data to detect liquidity sweeps, allowing traders to buy or sell assets ahead of large orders, profiting from the resulting price impact. This interaction highlights the importance of market transparency and speed in mitigating front-running risks associated with liquidity sweeps.

Key Terms

Order Flow

Front-running exploits prior knowledge of pending orders to execute trades ahead, capturing profit from anticipated price movements. Liquidity sweeps aggressively target multiple price levels to rapidly absorb available liquidity, often triggering stop orders and causing price shifts. Explore deeper insights into order flow strategies and their market impact to enhance trading expertise.

Market Impact

Front-running exploits prior knowledge of large pending orders to trade ahead, causing price distortions and increased market impact by artificially driving prices away from their true value. Liquidity sweeps aggressively consume available liquidity across multiple price levels, leading to swift price movements and elevated market impact due to rapid order book depletion. Explore further to understand how these tactics influence execution strategies and market efficiency.

Execution Speed

Front-running exploits high execution speed to place orders milliseconds before large trades, capturing price advantages ahead of market movement. Liquidity sweeps involve rapid, successive trades designed to consume available liquidity at multiple price levels, relying on swift execution to minimize market impact and slippage. Explore deeper insights on optimizing execution speed for both front-running and liquidity sweep strategies.

Source and External Links

Front Running Explained: What Is It, Examples, Is It Legal? | SoFi - Front running is when a broker trades a financial asset based on non-public information about a forthcoming large trade that will influence the asset's price, allowing the broker to profit before executing the client's order, an act that is illegal and unethical.

Front running - Wikipedia - Front running, also called tailgating, is the practice of entering a trade ahead of a large pending transaction using advance, nonpublic knowledge to profit, and is considered a form of market manipulation involving unethical use of insider information.

Blockchain Front-Running: Risks and Protective Measures - Front-running in blockchain occurs when a trader sees a pending transaction in the mempool and places their own transaction with higher fees to get processed first, profiting from the subsequent market price change caused by the original trade.

dowidth.com

dowidth.com