Microstructure modeling examines the detailed processes and mechanisms underlying order book dynamics, focusing on market participant behavior and transaction costs. Quote stacking analysis investigates the layering of orders at various price levels to detect potential manipulative patterns and liquidity imbalances. Explore the nuances of these approaches to enhance trading strategy development and market prediction accuracy.

Why it is important

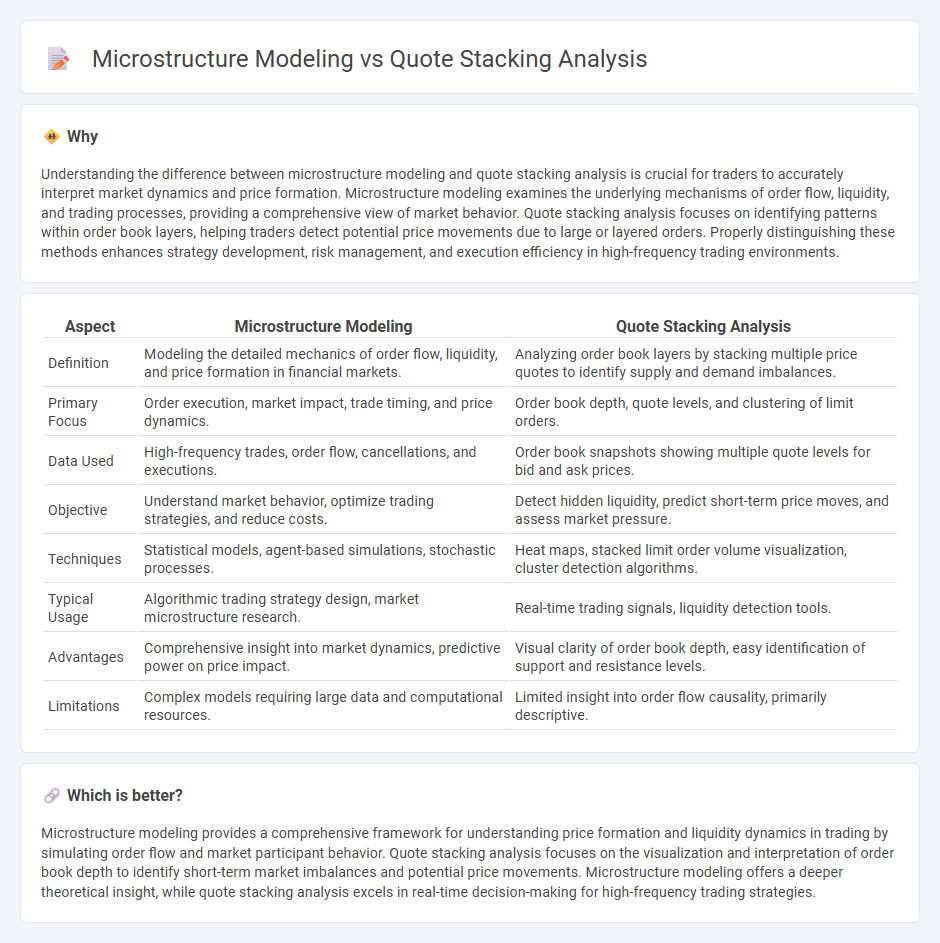

Understanding the difference between microstructure modeling and quote stacking analysis is crucial for traders to accurately interpret market dynamics and price formation. Microstructure modeling examines the underlying mechanisms of order flow, liquidity, and trading processes, providing a comprehensive view of market behavior. Quote stacking analysis focuses on identifying patterns within order book layers, helping traders detect potential price movements due to large or layered orders. Properly distinguishing these methods enhances strategy development, risk management, and execution efficiency in high-frequency trading environments.

Comparison Table

| Aspect | Microstructure Modeling | Quote Stacking Analysis |

|---|---|---|

| Definition | Modeling the detailed mechanics of order flow, liquidity, and price formation in financial markets. | Analyzing order book layers by stacking multiple price quotes to identify supply and demand imbalances. |

| Primary Focus | Order execution, market impact, trade timing, and price dynamics. | Order book depth, quote levels, and clustering of limit orders. |

| Data Used | High-frequency trades, order flow, cancellations, and executions. | Order book snapshots showing multiple quote levels for bid and ask prices. |

| Objective | Understand market behavior, optimize trading strategies, and reduce costs. | Detect hidden liquidity, predict short-term price moves, and assess market pressure. |

| Techniques | Statistical models, agent-based simulations, stochastic processes. | Heat maps, stacked limit order volume visualization, cluster detection algorithms. |

| Typical Usage | Algorithmic trading strategy design, market microstructure research. | Real-time trading signals, liquidity detection tools. |

| Advantages | Comprehensive insight into market dynamics, predictive power on price impact. | Visual clarity of order book depth, easy identification of support and resistance levels. |

| Limitations | Complex models requiring large data and computational resources. | Limited insight into order flow causality, primarily descriptive. |

Which is better?

Microstructure modeling provides a comprehensive framework for understanding price formation and liquidity dynamics in trading by simulating order flow and market participant behavior. Quote stacking analysis focuses on the visualization and interpretation of order book depth to identify short-term market imbalances and potential price movements. Microstructure modeling offers a deeper theoretical insight, while quote stacking analysis excels in real-time decision-making for high-frequency trading strategies.

Connection

Microstructure modeling examines the mechanisms of order flow and price formation in financial markets, providing insights into liquidity and transaction costs. Quote stacking analysis, which studies the accumulation of limit orders at various price levels, enhances the understanding of order book dynamics that microstructure models rely on. Together, these approaches reveal how market participants' behaviors influence price discovery and execution quality.

Key Terms

**Quote Stacking Analysis:**

Quote stacking analysis examines the layering of limit orders at various price levels to identify potential market manipulation or liquidity imbalances. This method captures real-time order book dynamics, highlighting the strategic placement and cancellation of quotes by high-frequency traders. Explore deeper insights into how quote stacking shapes market behavior and trading strategies.

Order Book Depth

Quote stacking analysis examines the accumulation and layering of limit orders in the order book to identify trading intentions and liquidity imbalances. Microstructure modeling uses mathematical frameworks to simulate order book dynamics, capturing price formation and order flow interactions at granular levels. Explore detailed methodologies to understand how these approaches enhance order book depth insights.

Bid-Ask Spread

Quote stacking analysis examines order book depth and frequency to understand short-term liquidity provision and its impact on the bid-ask spread. Microstructure modeling incorporates strategic trader behavior, asymmetric information, and transaction costs to explain spread dynamics over time. Explore detailed comparative insights on how these approaches elucidate bid-ask spread formation and market efficiency.

Source and External Links

How to Embed Quotes into Analysis - Dymocks Tutoring - Explains integrating quotes smoothly into analytical writing by selecting concise quotes and using nominalisation to better connect quotes with interpretation in essays.

Quote Integration and Analysis (PDF) - Details a method for analyzing quotes by stating their meaning, linking them to context, and exploring their broader implications to support an argument effectively.

Sentence Stems to Analyze Quotes - West Seattle High School - Provides sentence stems to help explain the significance of quotes and how they support claims, emphasizing the importance of connecting quotes to the author's intent and argument.

dowidth.com

dowidth.com