Option selling wheel and credit spread are popular trading strategies used to generate consistent income with defined risk management. The option selling wheel involves sequentially selling puts and covered calls to accumulate premium over time, while credit spreads limit risk by simultaneously selling and buying options at different strikes. Explore the differences and benefits of these strategies to determine which suits your trading goals best.

Why it is important

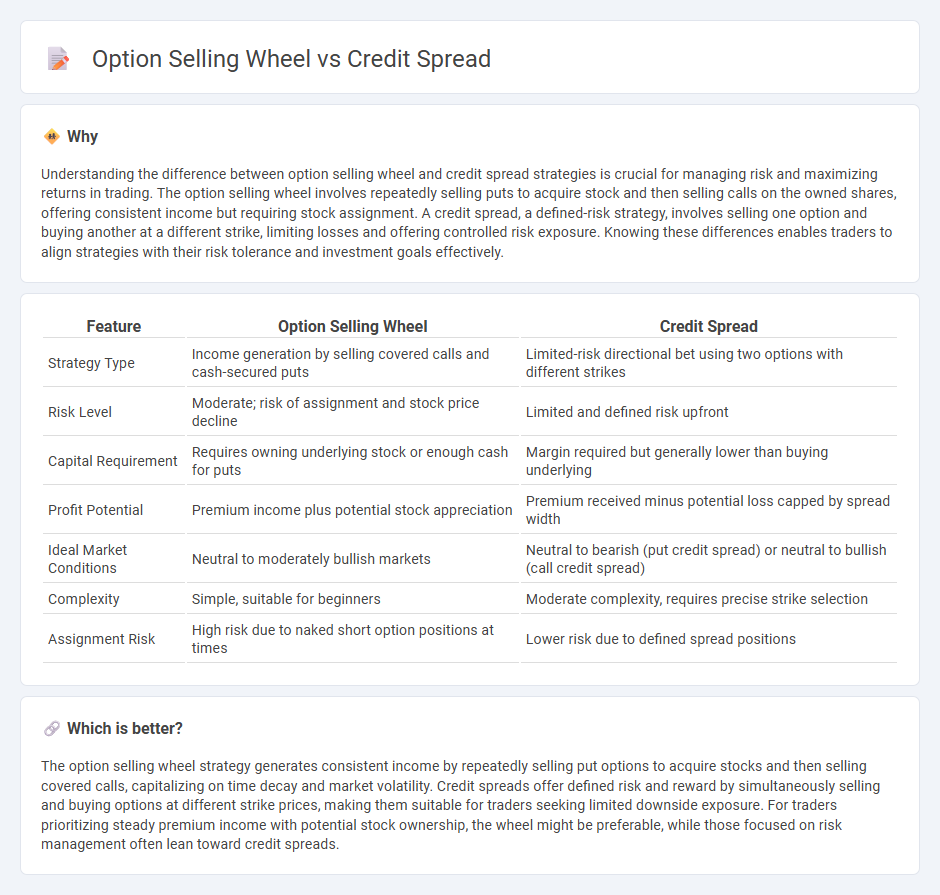

Understanding the difference between option selling wheel and credit spread strategies is crucial for managing risk and maximizing returns in trading. The option selling wheel involves repeatedly selling puts to acquire stock and then selling calls on the owned shares, offering consistent income but requiring stock assignment. A credit spread, a defined-risk strategy, involves selling one option and buying another at a different strike, limiting losses and offering controlled risk exposure. Knowing these differences enables traders to align strategies with their risk tolerance and investment goals effectively.

Comparison Table

| Feature | Option Selling Wheel | Credit Spread |

|---|---|---|

| Strategy Type | Income generation by selling covered calls and cash-secured puts | Limited-risk directional bet using two options with different strikes |

| Risk Level | Moderate; risk of assignment and stock price decline | Limited and defined risk upfront |

| Capital Requirement | Requires owning underlying stock or enough cash for puts | Margin required but generally lower than buying underlying |

| Profit Potential | Premium income plus potential stock appreciation | Premium received minus potential loss capped by spread width |

| Ideal Market Conditions | Neutral to moderately bullish markets | Neutral to bearish (put credit spread) or neutral to bullish (call credit spread) |

| Complexity | Simple, suitable for beginners | Moderate complexity, requires precise strike selection |

| Assignment Risk | High risk due to naked short option positions at times | Lower risk due to defined spread positions |

Which is better?

The option selling wheel strategy generates consistent income by repeatedly selling put options to acquire stocks and then selling covered calls, capitalizing on time decay and market volatility. Credit spreads offer defined risk and reward by simultaneously selling and buying options at different strike prices, making them suitable for traders seeking limited downside exposure. For traders prioritizing steady premium income with potential stock ownership, the wheel might be preferable, while those focused on risk management often lean toward credit spreads.

Connection

Option selling wheel and credit spreads are connected through their use of premium collection strategies in options trading. The wheel strategy involves systematically selling put options to acquire stock and then selling call options against owned shares, while credit spreads involve selling one option and buying another to limit risk and lock in premium. Both approaches aim to generate consistent income by capitalizing on option premiums and volatility decay.

Key Terms

Premiums

Credit spreads and option selling wheel strategies both capitalize on premium collection, but credit spreads limit risk by simultaneously buying and selling options within the same underlying asset. Credit spreads generate income through net credit premiums, while the option selling wheel focuses on repeatedly selling puts and calls to consistently accumulate premiums over time. Explore detailed comparisons to understand which premium-focused strategy aligns with your trading goals.

Assignment

Credit spreads limit potential losses by defining risk upfront through simultaneous buying and selling of options, whereas the option selling wheel involves selling cash-secured puts and covered calls with a higher probability but potential unlimited assignment risk. Assignment risk in credit spreads is controlled via strike selection and position management, while the wheel strategy embraces assignment to acquire or sell stock in a structured income approach. Explore further to understand how each strategy manages assignment and risk for optimal income generation.

Strike Price

Credit spreads involve selling and buying options at different strike prices to limit risk and define potential profit, often choosing strike prices to balance premium income and risk exposure. The option selling wheel strategy focuses on selling out-of-the-money put options with strike prices where the seller is comfortable owning the underlying asset if assigned, maximizing premium collection while managing the likelihood of assignment. Explore these strategies further to understand how strike price selection impacts risk-reward profiles and income generation.

Source and External Links

Credit Spread - Overview, How to Calculate, Example - A credit spread is the difference in yield between two debt instruments of the same maturity but different credit ratings, reflecting the additional yield investors demand for higher credit risk; for example, the spread between a 5-year Treasury note and a 5-year corporate bond shows the risk premium for the corporate bond.

Credit spread | Robeco USA - The credit spread indicates the additional risk lenders take on corporate bonds versus government bonds with similar maturity, is measured in basis points, and fluctuates with market perception of the issuer's creditworthiness or overall market risk aversion.

What Is a Credit Spread? Explained and Defined - SoFi - Credit spreads measure the yield difference between U.S. Treasury bonds and other debt securities of the same maturity to indicate credit quality differences, with higher spreads signaling higher perceived default risk and compensation required by investors.

dowidth.com

dowidth.com