Paper trading competitions provide traders with a competitive environment to practice strategies using virtual funds and real market conditions, emphasizing decision-making speed and accuracy. Simulation trading focuses on replicating market scenarios for skill development and risk management without the pressures of competition or real financial stakes. Explore the distinct advantages of both methods to enhance your trading proficiency.

Why it is important

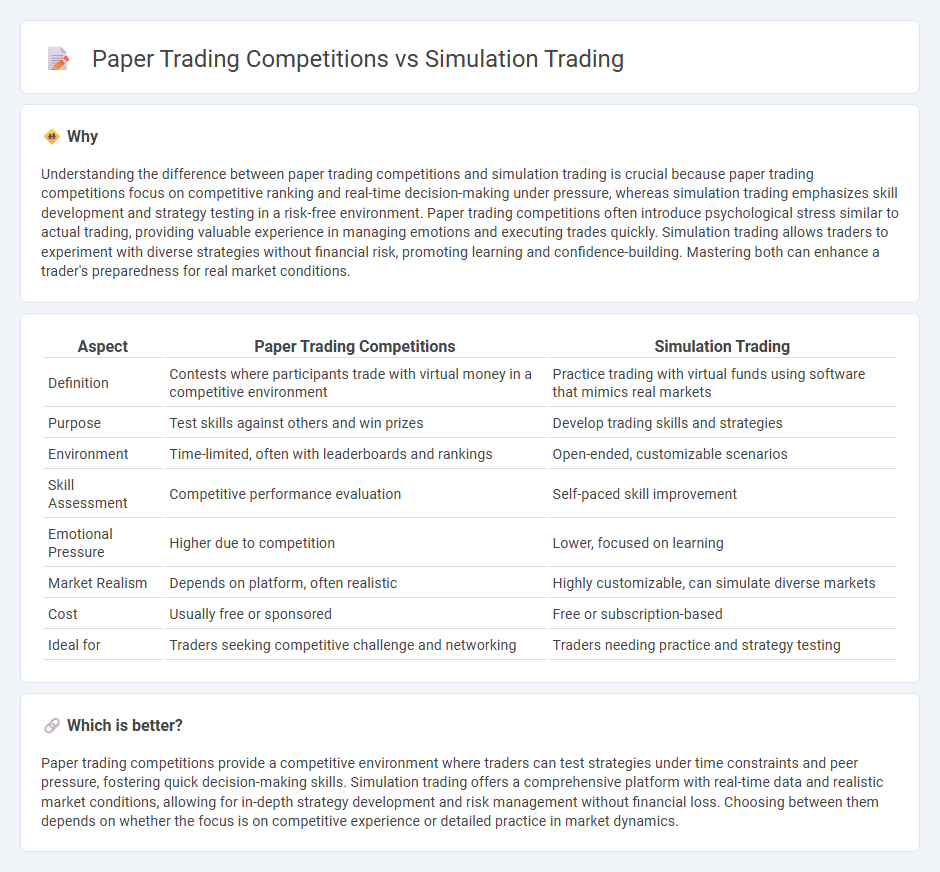

Understanding the difference between paper trading competitions and simulation trading is crucial because paper trading competitions focus on competitive ranking and real-time decision-making under pressure, whereas simulation trading emphasizes skill development and strategy testing in a risk-free environment. Paper trading competitions often introduce psychological stress similar to actual trading, providing valuable experience in managing emotions and executing trades quickly. Simulation trading allows traders to experiment with diverse strategies without financial risk, promoting learning and confidence-building. Mastering both can enhance a trader's preparedness for real market conditions.

Comparison Table

| Aspect | Paper Trading Competitions | Simulation Trading |

|---|---|---|

| Definition | Contests where participants trade with virtual money in a competitive environment | Practice trading with virtual funds using software that mimics real markets |

| Purpose | Test skills against others and win prizes | Develop trading skills and strategies |

| Environment | Time-limited, often with leaderboards and rankings | Open-ended, customizable scenarios |

| Skill Assessment | Competitive performance evaluation | Self-paced skill improvement |

| Emotional Pressure | Higher due to competition | Lower, focused on learning |

| Market Realism | Depends on platform, often realistic | Highly customizable, can simulate diverse markets |

| Cost | Usually free or sponsored | Free or subscription-based |

| Ideal for | Traders seeking competitive challenge and networking | Traders needing practice and strategy testing |

Which is better?

Paper trading competitions provide a competitive environment where traders can test strategies under time constraints and peer pressure, fostering quick decision-making skills. Simulation trading offers a comprehensive platform with real-time data and realistic market conditions, allowing for in-depth strategy development and risk management without financial loss. Choosing between them depends on whether the focus is on competitive experience or detailed practice in market dynamics.

Connection

Paper trading competitions and simulation trading both utilize virtual environments to replicate real market conditions, enabling participants to practice strategies without financial risk. These tools enhance trading skills by providing real-time data feedback and immersive experience, fostering decision-making and risk management expertise. Participation in paper trading contests often involves simulation platforms that track performance metrics, promoting competitive learning and strategy refinement.

Key Terms

Real-time Data

Simulation trading uses real-time market data to replicate live trading conditions, allowing participants to experience actual price movements and market volatility. Paper trading competitions often rely on delayed or static data, which limits the ability to react to rapid market changes and test strategies under true market pressure. Discover more about how real-time data enhances trading accuracy and skill development.

Execution Environment

Simulation trading competitions replicate real market conditions using advanced software platforms, ensuring realistic order execution, latency, and market impact. Paper trading competitions often rely on simplified execution environments with delayed or averaged price feeds, which may not capture live market dynamics accurately. Explore our comprehensive comparison to understand how execution environment affects trading performance.

Performance Metrics

Simulation trading competitions evaluate performance metrics such as accuracy of trade execution, risk-adjusted returns, and consistency in profit generation under real-market conditions without financial risk. Paper trading competitions emphasize strategy testing with metrics like maximum drawdown, Sharpe ratio, and win-loss ratios to simulate decision-making impact. Explore these performance differences to optimize your trading skills effectively.

Source and External Links

Test Your Strategies With Our Trading Simulator - TradeStation - TradeStation offers a simulated trading environment for stocks, options, and futures that uses real-time and historical data for backtesting and forward testing strategies with automation capabilities via EasyLanguage, designed for traders to test without risking capital.

Free Futures Trading Simulator | NinjaTrader - NinjaTrader provides a free, risk-free futures trading simulator with live streaming data, unlimited simulated trading with funded accounts, a backtesting engine, and controls to replay market data for strategy validation and skill sharpening.

Day Trading Simulator - Trade Stocks, Futures & Crypto - Tradingsim features a session-based replay simulator supporting multiple assets like stocks, futures, and crypto with synchronized charts, replay controls, and extensive market data coverage for realistic practice and strategy refinement.

dowidth.com

dowidth.com