Copy trading involves replicating the trades of experienced investors, making it ideal for beginners seeking to leverage expert strategies with minimal effort. Momentum trading focuses on capitalizing on strong price trends, enabling traders to enter positions aligned with prevailing market movements for potential quick gains. Discover more to determine which trading style suits your financial goals.

Why it is important

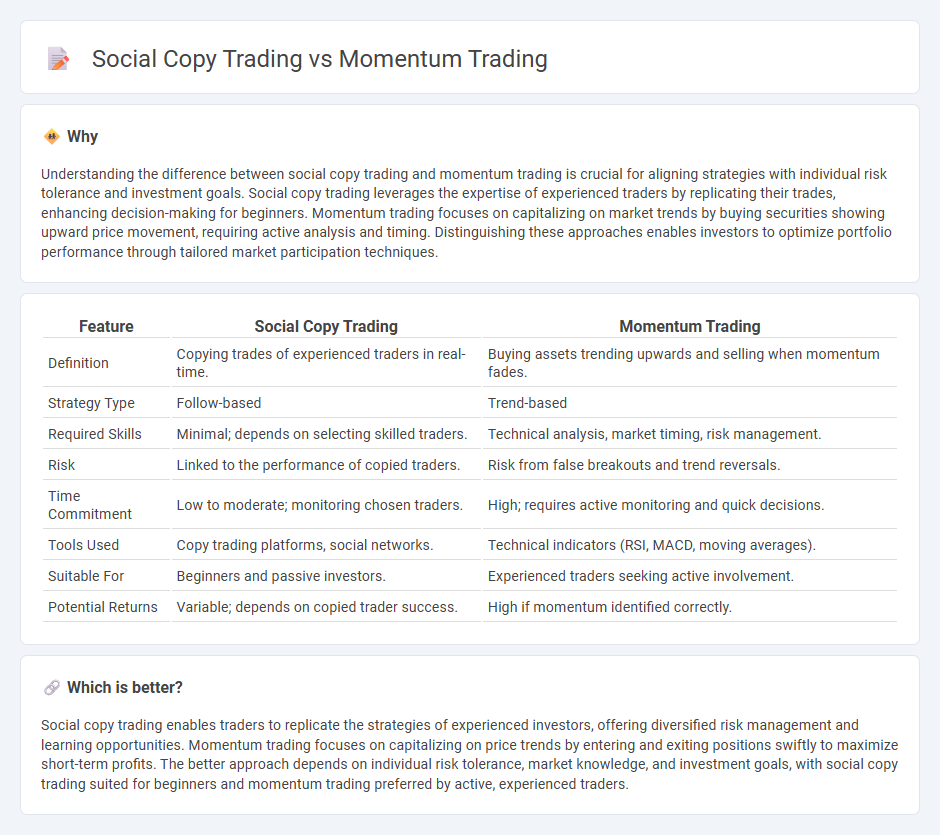

Understanding the difference between social copy trading and momentum trading is crucial for aligning strategies with individual risk tolerance and investment goals. Social copy trading leverages the expertise of experienced traders by replicating their trades, enhancing decision-making for beginners. Momentum trading focuses on capitalizing on market trends by buying securities showing upward price movement, requiring active analysis and timing. Distinguishing these approaches enables investors to optimize portfolio performance through tailored market participation techniques.

Comparison Table

| Feature | Social Copy Trading | Momentum Trading |

|---|---|---|

| Definition | Copying trades of experienced traders in real-time. | Buying assets trending upwards and selling when momentum fades. |

| Strategy Type | Follow-based | Trend-based |

| Required Skills | Minimal; depends on selecting skilled traders. | Technical analysis, market timing, risk management. |

| Risk | Linked to the performance of copied traders. | Risk from false breakouts and trend reversals. |

| Time Commitment | Low to moderate; monitoring chosen traders. | High; requires active monitoring and quick decisions. |

| Tools Used | Copy trading platforms, social networks. | Technical indicators (RSI, MACD, moving averages). |

| Suitable For | Beginners and passive investors. | Experienced traders seeking active involvement. |

| Potential Returns | Variable; depends on copied trader success. | High if momentum identified correctly. |

Which is better?

Social copy trading enables traders to replicate the strategies of experienced investors, offering diversified risk management and learning opportunities. Momentum trading focuses on capitalizing on price trends by entering and exiting positions swiftly to maximize short-term profits. The better approach depends on individual risk tolerance, market knowledge, and investment goals, with social copy trading suited for beginners and momentum trading preferred by active, experienced traders.

Connection

Social copy trading leverages collective market insights by allowing traders to replicate the strategies of experienced investors, enhancing decision-making speed in dynamic markets. Momentum trading focuses on capitalizing on prevailing market trends, relying on the continuation of asset price movements influenced by investor sentiment. Combining social copy trading with momentum strategies amplifies market responsiveness, as traders mimic momentum-driven actions of leading market participants, optimizing trend-following outcomes.

Key Terms

**Momentum trading:**

Momentum trading capitalizes on asset price trends by buying securities showing upward momentum and selling those with downward trends, leveraging market psychology and volume indicators for entry and exit points. Traders analyze technical indicators such as moving averages and Relative Strength Index (RSI) to identify momentum shifts and optimize trade timing. Explore detailed strategies and risk management techniques to enhance momentum trading performance.

Trend

Momentum trading capitalizes on assets showing strong price trends by buying securities that are trending upwards and selling those trending downwards, leveraging market momentum indicators like moving averages and volume analysis. Social copy trading involves replicating trades of expert traders in real-time, allowing investors to follow trend strategies employed by experienced market participants without conducting their own technical analysis. Explore the differences and advantages of these trend-focused strategies to enhance your trading approach.

Volume

Momentum trading leverages real-time trading volume spikes to identify securities with strong price trends, enabling traders to capitalize on rapid market movements. Social copy trading aggregates the buying and selling volumes from experienced traders' portfolios, allowing followers to replicate high-volume, successful strategies seamlessly. Explore detailed comparisons and strategies to optimize your trading by understanding the dynamics of volume in both approaches.

Source and External Links

Momentum Trading: Types, Strategies and More - Part I - Momentum trading involves buying or selling assets based on recent price trends, with two main types: time-series momentum, which looks at an asset's own historical performance, and cross-sectional momentum, which compares asset performance against peers to choose top performers for buying.

Momentum Trading: Types, Strategies, and More - Momentum trading strategies focus on capitalizing on trends by buying assets showing strong recent price gains and selling or avoiding weak performers, using approaches like time-series and cross-sectional momentum to select trades based on past relative or absolute returns.

Momentum Trading for Beginners (What They Don't ...) - Momentum trading is a strategy of riding strong price moves by buying high and selling higher, leveraging technical tools like RSI and MACD, and emphasizing risk management and trend-following techniques for markets like stocks, crypto, and forex.

dowidth.com

dowidth.com