High frequency trading (HFT) uses powerful algorithms and fast data networks to execute thousands of trades per second, capitalizing on minute price discrepancies and market inefficiencies. Statistical arbitrage applies quantitative models to identify and exploit pricing anomalies between related financial instruments over short to medium time frames, relying on historical price patterns and statistical correlations. Explore the mechanics and strategies behind these sophisticated trading techniques to enhance your market understanding.

Why it is important

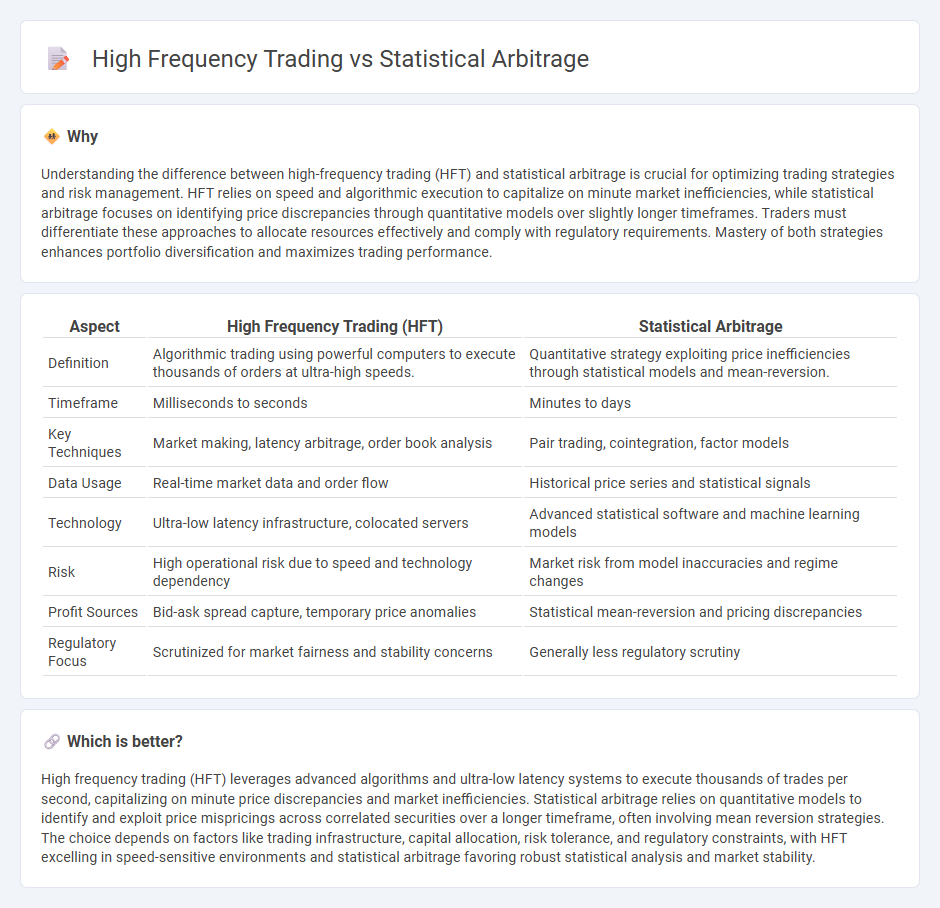

Understanding the difference between high-frequency trading (HFT) and statistical arbitrage is crucial for optimizing trading strategies and risk management. HFT relies on speed and algorithmic execution to capitalize on minute market inefficiencies, while statistical arbitrage focuses on identifying price discrepancies through quantitative models over slightly longer timeframes. Traders must differentiate these approaches to allocate resources effectively and comply with regulatory requirements. Mastery of both strategies enhances portfolio diversification and maximizes trading performance.

Comparison Table

| Aspect | High Frequency Trading (HFT) | Statistical Arbitrage |

|---|---|---|

| Definition | Algorithmic trading using powerful computers to execute thousands of orders at ultra-high speeds. | Quantitative strategy exploiting price inefficiencies through statistical models and mean-reversion. |

| Timeframe | Milliseconds to seconds | Minutes to days |

| Key Techniques | Market making, latency arbitrage, order book analysis | Pair trading, cointegration, factor models |

| Data Usage | Real-time market data and order flow | Historical price series and statistical signals |

| Technology | Ultra-low latency infrastructure, colocated servers | Advanced statistical software and machine learning models |

| Risk | High operational risk due to speed and technology dependency | Market risk from model inaccuracies and regime changes |

| Profit Sources | Bid-ask spread capture, temporary price anomalies | Statistical mean-reversion and pricing discrepancies |

| Regulatory Focus | Scrutinized for market fairness and stability concerns | Generally less regulatory scrutiny |

Which is better?

High frequency trading (HFT) leverages advanced algorithms and ultra-low latency systems to execute thousands of trades per second, capitalizing on minute price discrepancies and market inefficiencies. Statistical arbitrage relies on quantitative models to identify and exploit price mispricings across correlated securities over a longer timeframe, often involving mean reversion strategies. The choice depends on factors like trading infrastructure, capital allocation, risk tolerance, and regulatory constraints, with HFT excelling in speed-sensitive environments and statistical arbitrage favoring robust statistical analysis and market stability.

Connection

High frequency trading (HFT) leverages advanced algorithms and powerful computing to execute thousands of trades per second, capitalizing on minute price discrepancies across markets. Statistical arbitrage relies on quantitative models to identify mispricings between correlated financial instruments, often implemented within HFT strategies to rapidly exploit these opportunities. The integration of statistical arbitrage within HFT enables traders to systematically analyze large datasets and execute trades at speeds necessary to lock in profits before market conditions change.

Key Terms

Statistical Arbitrage:

Statistical arbitrage leverages advanced quantitative models to identify and exploit price inefficiencies across correlated financial instruments, often holding positions from minutes to days. This strategy relies heavily on historical price data, mean reversion principles, and factor-based models to predict temporary deviations, differing from high-frequency trading which emphasizes rapid trade execution and ultra-short holding periods. Explore deeper insights into statistical arbitrage strategies to optimize portfolio performance and risk management.

Mean Reversion

Statistical arbitrage leverages mean reversion by identifying price discrepancies between correlated assets and executing trades when prices revert to their historical relationships, often using pair trading strategies. High frequency trading (HFT) applies advanced algorithms and ultra-low latency technology to exploit fleeting mean reversion opportunities within milliseconds, capitalizing on short-term price inefficiencies. Explore how mean reversion drives strategic decisions in these trading approaches for deeper insights.

Pairs Trading

Statistical arbitrage leverages historical price relationships between paired securities to identify and exploit mean-reverting spreads, while high-frequency trading relies on rapid execution and short-term market inefficiencies for profit. Pairs trading, a common form of statistical arbitrage, involves buying undervalued securities and shorting overvalued counterparts based on statistical correlations and co-integration analysis. Explore how pairs trading strategies optimize returns through advanced quantitative models and automated trade execution.

Source and External Links

Statistical arbitrage - Wikipedia - Statistical arbitrage (Stat Arb) is a quantitative, short-term trading strategy based on mean reversion models, usually involving diversified portfolios held for seconds to days and executed often through automated systems to exploit temporary price inefficiencies between related securities.

The Power of Statistical Arbitrage in Finance - PyQuant News - Statistical arbitrage uses quantitative models to detect temporary price discrepancies between related financial instruments, relying primarily on data analysis, model development, and trade execution to profit from prices reverting to historical averages.

Quantitative Methods of Statistical Arbitrage - Statistical arbitrage exploits the mean reversion property of spreads constructed from pairs or portfolios of assets through quantitative methods to identify and capitalize on pricing inefficiencies.

dowidth.com

dowidth.com