On-chain analytics leverage blockchain data to provide real-time insights into transaction flows, wallet activities, and market sentiment, offering precise indicators for trading decisions. Macro analysis examines broader economic factors such as interest rates, geopolitical events, and fiscal policies to understand market trends and potential asset performance. Explore how combining on-chain analytics with macro analysis can enhance your trading strategy and decision-making.

Why it is important

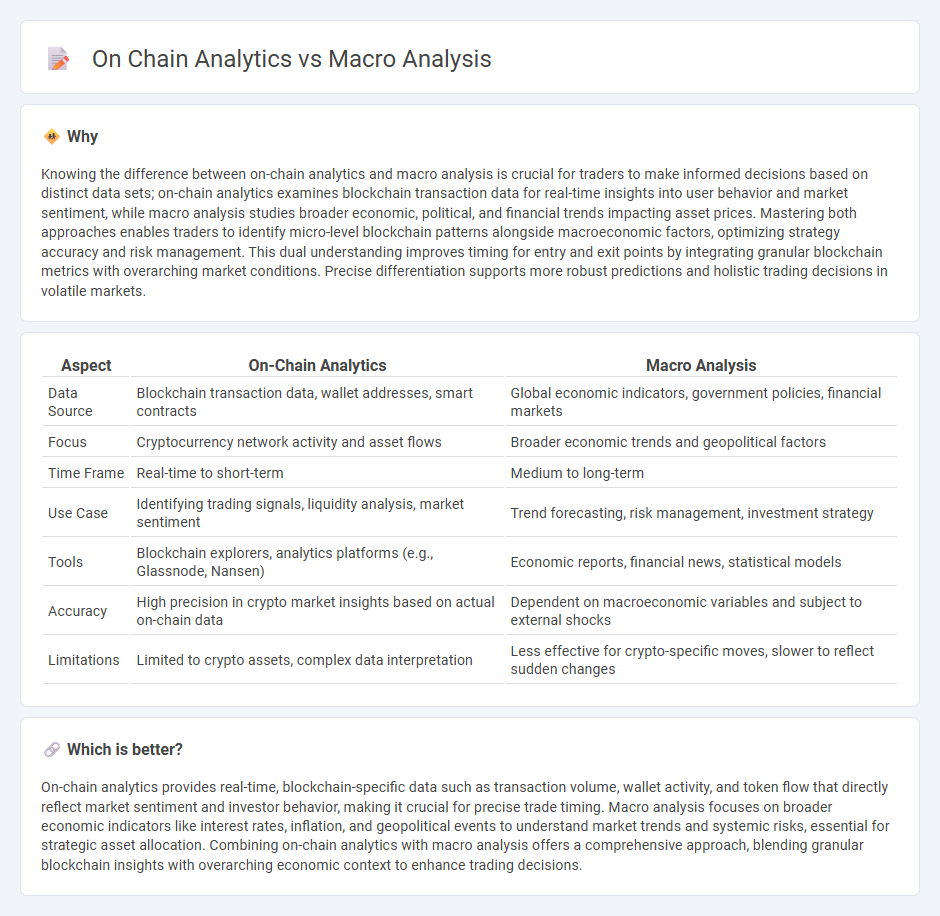

Knowing the difference between on-chain analytics and macro analysis is crucial for traders to make informed decisions based on distinct data sets; on-chain analytics examines blockchain transaction data for real-time insights into user behavior and market sentiment, while macro analysis studies broader economic, political, and financial trends impacting asset prices. Mastering both approaches enables traders to identify micro-level blockchain patterns alongside macroeconomic factors, optimizing strategy accuracy and risk management. This dual understanding improves timing for entry and exit points by integrating granular blockchain metrics with overarching market conditions. Precise differentiation supports more robust predictions and holistic trading decisions in volatile markets.

Comparison Table

| Aspect | On-Chain Analytics | Macro Analysis |

|---|---|---|

| Data Source | Blockchain transaction data, wallet addresses, smart contracts | Global economic indicators, government policies, financial markets |

| Focus | Cryptocurrency network activity and asset flows | Broader economic trends and geopolitical factors |

| Time Frame | Real-time to short-term | Medium to long-term |

| Use Case | Identifying trading signals, liquidity analysis, market sentiment | Trend forecasting, risk management, investment strategy |

| Tools | Blockchain explorers, analytics platforms (e.g., Glassnode, Nansen) | Economic reports, financial news, statistical models |

| Accuracy | High precision in crypto market insights based on actual on-chain data | Dependent on macroeconomic variables and subject to external shocks |

| Limitations | Limited to crypto assets, complex data interpretation | Less effective for crypto-specific moves, slower to reflect sudden changes |

Which is better?

On-chain analytics provides real-time, blockchain-specific data such as transaction volume, wallet activity, and token flow that directly reflect market sentiment and investor behavior, making it crucial for precise trade timing. Macro analysis focuses on broader economic indicators like interest rates, inflation, and geopolitical events to understand market trends and systemic risks, essential for strategic asset allocation. Combining on-chain analytics with macro analysis offers a comprehensive approach, blending granular blockchain insights with overarching economic context to enhance trading decisions.

Connection

On-chain analytics provide real-time blockchain data, such as transaction volume, wallet movements, and liquidity flows, offering granular insights into market participant behavior. Macro analysis incorporates these on-chain metrics alongside traditional economic indicators like interest rates, inflation, and geopolitical events to forecast broader market trends. Integrating both approaches enhances trading strategies by aligning blockchain-specific data with global macroeconomic factors, improving market timing and risk assessment.

Key Terms

Macro analysis:

Macro analysis examines broad economic indicators such as GDP growth, inflation rates, and central bank policies to understand cryptocurrency market trends. It evaluates the impact of global financial events, regulatory changes, and macroeconomic cycles on asset prices, liquidity, and investor sentiment. Explore in-depth insights on how macroeconomic factors shape market dynamics and influence investment strategies.

Interest Rates

Macro analysis examines interest rates by evaluating economic indicators, central bank policies, and global financial trends to understand their broader impact on markets. On-chain analytics offers granular insights by tracking blockchain transactions, lending protocols, and real-time data on decentralized finance platforms affecting interest rates. Explore the synergies and distinctions between these approaches to enhance your understanding of interest rate dynamics.

GDP Growth

Macro analysis examines GDP growth through aggregated economic indicators like national output, employment rates, and inflation trends, providing a broad perspective on economic health. On-chain analytics offers granular insights by tracking blockchain transaction volumes, liquidity flows, and token velocity to gauge digital asset activity linked to GDP growth. Explore how integrating macro and on-chain data can enhance understanding of economic dynamics and investment opportunities.

Source and External Links

The importance of macro environment analysis in building competitive advantage - Macro environment analysis assesses key external factors like political, economic, social, technological, ecological, and legal forces affecting businesses, helping companies adapt strategies and predict future scenarios such as climate regulation impacts.

How to Conduct an Effective Macro Environmental Analysis - This analysis examines uncontrollable external factors impacting a business using tools like PESTLE, SWOT, and Porter's Five Forces to identify trends, opportunities, and threats within political, economic, social, technological, legal, and environmental domains.

Macro Environment - Overview, DEPEST Analysis, Factors - Macro environment refers to broad economic forces influencing industries, analyzed via frameworks such as DEPEST to evaluate demographic, ecological, political, economic, socio-cultural, and technological factors shaping overall business conditions.

dowidth.com

dowidth.com