Degen trading involves high-risk, speculative trades driven by intuition and market hype, often resulting in rapid gains or losses. Algorithmic trading uses computer algorithms to execute trades automatically based on pre-defined criteria, improving speed and consistency. Explore the core differences and benefits of each trading style to determine which suits your strategy best.

Why it is important

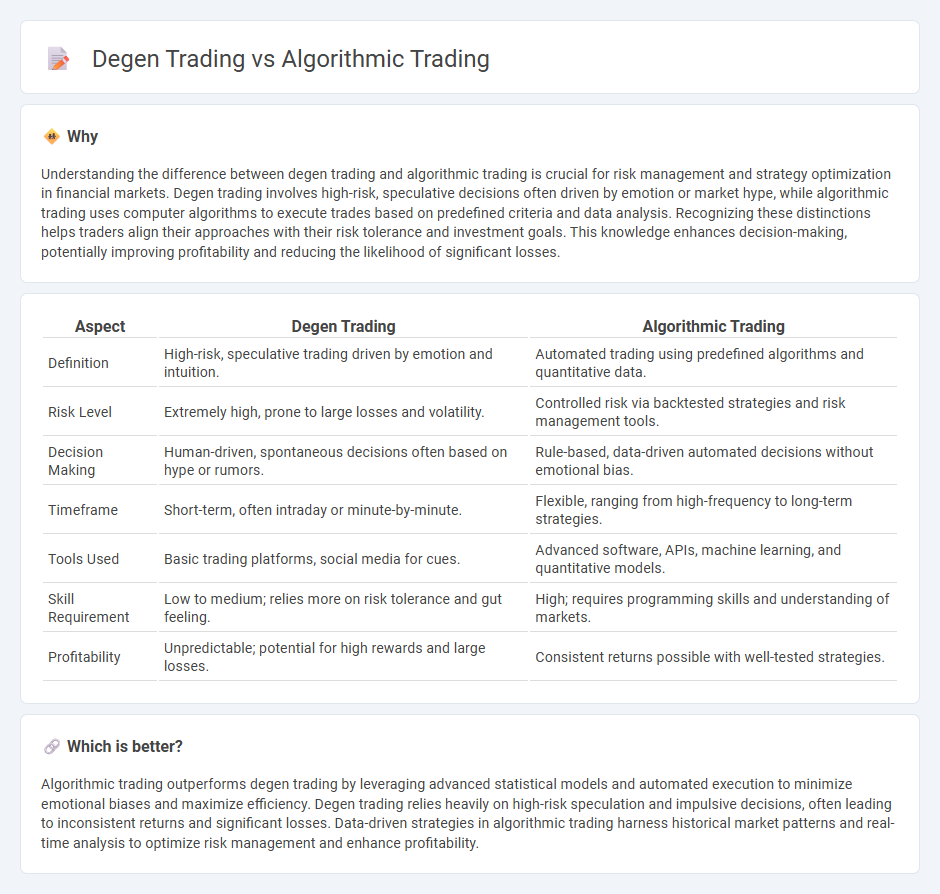

Understanding the difference between degen trading and algorithmic trading is crucial for risk management and strategy optimization in financial markets. Degen trading involves high-risk, speculative decisions often driven by emotion or market hype, while algorithmic trading uses computer algorithms to execute trades based on predefined criteria and data analysis. Recognizing these distinctions helps traders align their approaches with their risk tolerance and investment goals. This knowledge enhances decision-making, potentially improving profitability and reducing the likelihood of significant losses.

Comparison Table

| Aspect | Degen Trading | Algorithmic Trading |

|---|---|---|

| Definition | High-risk, speculative trading driven by emotion and intuition. | Automated trading using predefined algorithms and quantitative data. |

| Risk Level | Extremely high, prone to large losses and volatility. | Controlled risk via backtested strategies and risk management tools. |

| Decision Making | Human-driven, spontaneous decisions often based on hype or rumors. | Rule-based, data-driven automated decisions without emotional bias. |

| Timeframe | Short-term, often intraday or minute-by-minute. | Flexible, ranging from high-frequency to long-term strategies. |

| Tools Used | Basic trading platforms, social media for cues. | Advanced software, APIs, machine learning, and quantitative models. |

| Skill Requirement | Low to medium; relies more on risk tolerance and gut feeling. | High; requires programming skills and understanding of markets. |

| Profitability | Unpredictable; potential for high rewards and large losses. | Consistent returns possible with well-tested strategies. |

Which is better?

Algorithmic trading outperforms degen trading by leveraging advanced statistical models and automated execution to minimize emotional biases and maximize efficiency. Degen trading relies heavily on high-risk speculation and impulsive decisions, often leading to inconsistent returns and significant losses. Data-driven strategies in algorithmic trading harness historical market patterns and real-time analysis to optimize risk management and enhance profitability.

Connection

Degen trading involves high-risk, speculative trades often driven by market momentum and emotional impulses, while algorithmic trading uses programmed instructions to execute trades based on predefined criteria and data analysis. Both approaches rely on rapid decision-making and capitalize on market inefficiencies, but algorithmic trading emphasizes precision and scalability through automation. The fusion of these methods is evident where algorithms execute degen-like strategies, enabling high-frequency speculative trades with reduced human bias.

Key Terms

Algorithmic Trading:

Algorithmic trading leverages sophisticated algorithms and quantitative models to execute trades at high speed and precision, minimizing human error and emotional bias. It relies on historical data analysis, machine learning, and real-time market signals to optimize trade execution and risk management. Explore the mechanisms and advantages of algorithmic trading to enhance your investment strategy.

Backtesting

Algorithmic trading relies on rigorous backtesting using historical market data to develop and validate trading strategies with minimized risk. Degen trading, often characterized by high-risk, impulsive decisions, typically lacks systematic backtesting frameworks, increasing exposure to volatile market swings. Explore detailed methodologies and performance metrics to understand the impact of backtesting in each trading style.

Execution Speed

Algorithmic trading leverages advanced computer algorithms to execute orders at high speeds, often in milliseconds, optimizing market opportunities with precision and reduced human error. In contrast, degen trading relies on rapid, high-risk manual decisions typically driven by market hype or speculation, often sacrificing execution speed accuracy for immediacy. Explore the nuances and key differences in execution speed and strategy by delving deeper into algorithmic and degen trading methodologies.

Source and External Links

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading uses computer codes and software to open and close trades based on preset rules like price movements, with main strategies including price action, technical analysis, and their combination often used for high-frequency trading.

Algorithmic Trading - Definition, Example, Pros, Cons - Algorithmic trading involves programmed rules to execute trades automatically when certain conditions, such as deviations from moving averages, are met, allowing for efficient large order executions while managing market impact.

Algorithmic trading - Wikipedia - Algorithmic trading automates order execution using predefined instructions and has evolved to include machine learning techniques like deep reinforcement learning and directional change algorithms to adapt dynamically to market conditions and improve trade timing.

dowidth.com

dowidth.com