Airdrop farming involves strategically collecting cryptocurrency tokens distributed freely by blockchain projects to increase holdings with minimal investment. Arbitrage exploits price differences across various exchanges, enabling traders to buy low on one platform and sell high on another for profit. Explore the key advantages and tactics of airdrop farming versus arbitrage to enhance your trading strategy.

Why it is important

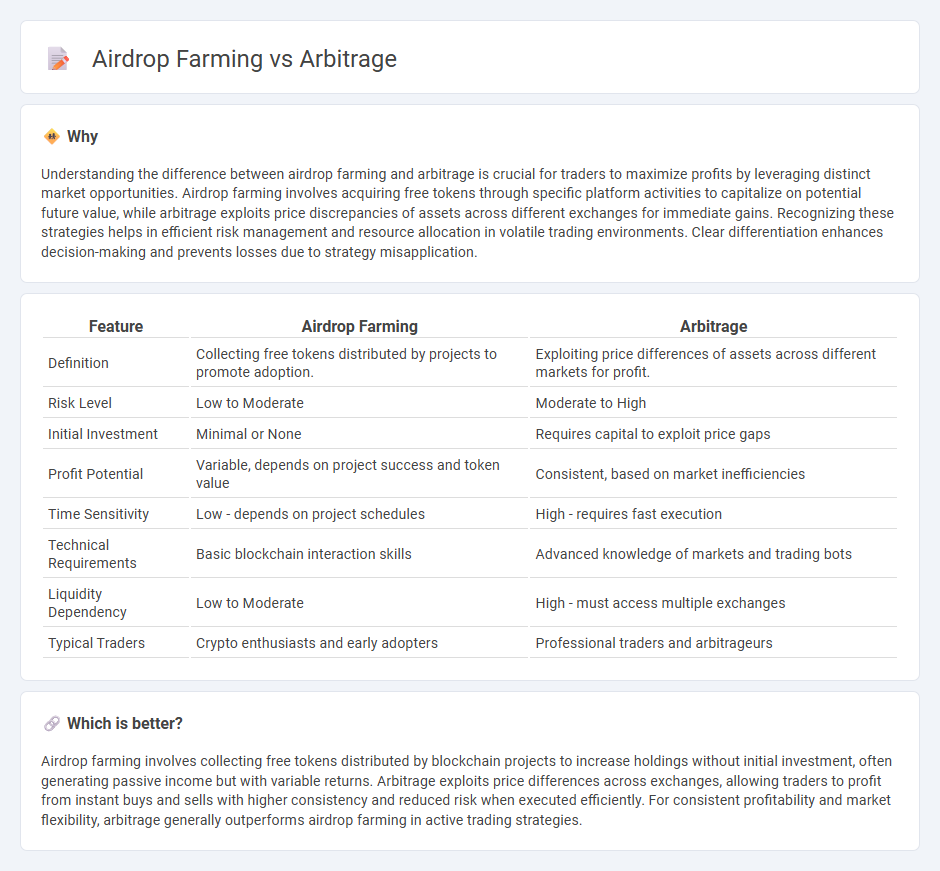

Understanding the difference between airdrop farming and arbitrage is crucial for traders to maximize profits by leveraging distinct market opportunities. Airdrop farming involves acquiring free tokens through specific platform activities to capitalize on potential future value, while arbitrage exploits price discrepancies of assets across different exchanges for immediate gains. Recognizing these strategies helps in efficient risk management and resource allocation in volatile trading environments. Clear differentiation enhances decision-making and prevents losses due to strategy misapplication.

Comparison Table

| Feature | Airdrop Farming | Arbitrage |

|---|---|---|

| Definition | Collecting free tokens distributed by projects to promote adoption. | Exploiting price differences of assets across different markets for profit. |

| Risk Level | Low to Moderate | Moderate to High |

| Initial Investment | Minimal or None | Requires capital to exploit price gaps |

| Profit Potential | Variable, depends on project success and token value | Consistent, based on market inefficiencies |

| Time Sensitivity | Low - depends on project schedules | High - requires fast execution |

| Technical Requirements | Basic blockchain interaction skills | Advanced knowledge of markets and trading bots |

| Liquidity Dependency | Low to Moderate | High - must access multiple exchanges |

| Typical Traders | Crypto enthusiasts and early adopters | Professional traders and arbitrageurs |

Which is better?

Airdrop farming involves collecting free tokens distributed by blockchain projects to increase holdings without initial investment, often generating passive income but with variable returns. Arbitrage exploits price differences across exchanges, allowing traders to profit from instant buys and sells with higher consistency and reduced risk when executed efficiently. For consistent profitability and market flexibility, arbitrage generally outperforms airdrop farming in active trading strategies.

Connection

Airdrop farming and arbitrage intersect in the trading ecosystem where traders capitalize on decentralized finance (DeFi) opportunities by acquiring free tokens during airdrops and exploiting price discrepancies across multiple exchanges. This strategy enhances profit potential by combining the low-cost acquisition of airdrop tokens with real-time arbitrage of these digital assets across platforms. Effective arbitrage requires monitoring liquidity pools and order books, which aligns with active participation in airdrop farming to maximize returns from emerging tokens.

Key Terms

**Arbitrage:**

Arbitrage involves exploiting price differences of the same asset across various markets to generate risk-free profit, often using automated trading bots to capitalize on these inefficiencies in real-time. It requires a deep understanding of market dynamics, transaction fees, and execution speed to ensure profitable trades, contrasting with airdrop farming, which targets free token distributions from blockchain projects. Explore more about arbitrage strategies and tools to maximize your crypto profits effectively.

Price Discrepancy

Arbitrage leverages price discrepancies across different cryptocurrency exchanges to buy low and sell high, capitalizing on market inefficiencies for profit. Airdrop farming involves collecting free tokens distributed by projects, often requiring engagement or holding criteria, with potential gains tied to future token value rather than immediate price differences. Explore detailed strategies and risk factors to maximize returns in both arbitrage and airdrop farming.

Execution Speed

Arbitrage in crypto trading exploits price differences across exchanges, requiring ultra-fast execution speeds to capitalize on fleeting opportunities. Airdrop farming involves claiming free tokens from blockchain projects, where execution speed is less critical but timely participation ensures eligibility. Explore how these strategies differ in speed requirements to optimize your crypto gains.

Source and External Links

Arbitrage - Arbitrage is the practice of taking advantage of price differences in two or more markets by simultaneously buying and selling an asset to earn a risk-free profit, commonly used by financial traders known as arbitrageurs.

What Is Arbitrage? 3 Strategies to Know - Arbitrage is an investment strategy where an investor buys and sells an asset simultaneously in different markets to capitalize on price differences, with common types including pure arbitrage, merger arbitrage, and convertible arbitrage.

Arbitrage (film) - "Arbitrage" is a 2012 American crime drama film starring Richard Gere, centered on a hedge fund manager facing personal and professional crises as he attempts to complete the sale of his trading empire.

dowidth.com

dowidth.com