Alternative data signals leverage unconventional datasets like social media trends, satellite imagery, and web traffic to uncover trading opportunities often missed by traditional methods. Statistical arbitrage signals rely on mathematical models and historical price patterns to identify pricing inefficiencies and execute high-frequency trades. Discover how integrating these distinct approaches can enhance your trading strategy and improve market insights.

Why it is important

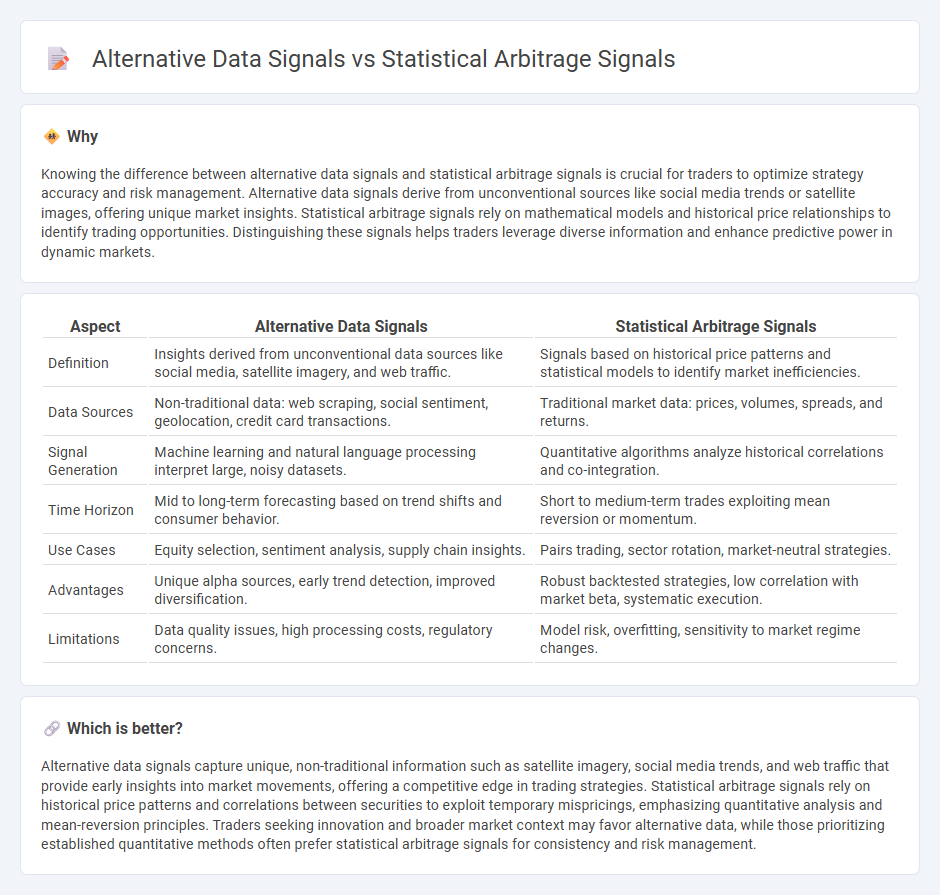

Knowing the difference between alternative data signals and statistical arbitrage signals is crucial for traders to optimize strategy accuracy and risk management. Alternative data signals derive from unconventional sources like social media trends or satellite images, offering unique market insights. Statistical arbitrage signals rely on mathematical models and historical price relationships to identify trading opportunities. Distinguishing these signals helps traders leverage diverse information and enhance predictive power in dynamic markets.

Comparison Table

| Aspect | Alternative Data Signals | Statistical Arbitrage Signals |

|---|---|---|

| Definition | Insights derived from unconventional data sources like social media, satellite imagery, and web traffic. | Signals based on historical price patterns and statistical models to identify market inefficiencies. |

| Data Sources | Non-traditional data: web scraping, social sentiment, geolocation, credit card transactions. | Traditional market data: prices, volumes, spreads, and returns. |

| Signal Generation | Machine learning and natural language processing interpret large, noisy datasets. | Quantitative algorithms analyze historical correlations and co-integration. |

| Time Horizon | Mid to long-term forecasting based on trend shifts and consumer behavior. | Short to medium-term trades exploiting mean reversion or momentum. |

| Use Cases | Equity selection, sentiment analysis, supply chain insights. | Pairs trading, sector rotation, market-neutral strategies. |

| Advantages | Unique alpha sources, early trend detection, improved diversification. | Robust backtested strategies, low correlation with market beta, systematic execution. |

| Limitations | Data quality issues, high processing costs, regulatory concerns. | Model risk, overfitting, sensitivity to market regime changes. |

Which is better?

Alternative data signals capture unique, non-traditional information such as satellite imagery, social media trends, and web traffic that provide early insights into market movements, offering a competitive edge in trading strategies. Statistical arbitrage signals rely on historical price patterns and correlations between securities to exploit temporary mispricings, emphasizing quantitative analysis and mean-reversion principles. Traders seeking innovation and broader market context may favor alternative data, while those prioritizing established quantitative methods often prefer statistical arbitrage signals for consistency and risk management.

Connection

Alternative data signals provide unconventional insights such as social media trends, satellite imagery, and transaction patterns, which enhance the predictive power of statistical arbitrage models by uncovering hidden market inefficiencies. Statistical arbitrage signals leverage these enriched datasets to identify temporary price discrepancies and execute high-frequency trades exploiting mean reversion and co-integration patterns. Integrating alternative data sources improves model robustness, reduces signal noise, and increases alpha generation in quantitative trading strategies.

Key Terms

Mean Reversion

Statistical arbitrage signals rely heavily on historical price data and mean reversion principles, exploiting temporary price deviations from historical averages to generate trading opportunities. Alternative data signals, such as social media sentiment or satellite imagery, complement traditional mean reversion strategies by providing real-time market insights and predictive power beyond price patterns. Explore how integrating alternative data enhances mean reversion models for smarter, data-driven trading decisions.

Big Data Analytics

Statistical arbitrage signals rely on historical price patterns and quantitative models to identify profit opportunities by exploiting market inefficiencies. Alternative data signals leverage Big Data Analytics to incorporate non-traditional datasets such as social media trends, satellite imagery, and transactional data, offering deeper market insights and enhanced predictive power. Explore how integrating these approaches can optimize trading strategies and unlock new alpha sources.

Machine Learning

Statistical arbitrage signals leverage historical price patterns and quantitative models to identify short-term trading opportunities, while alternative data signals utilize non-traditional sources such as social media sentiment, satellite imagery, and web scraping to gain unique market insights. Machine learning enhances both approaches by automating pattern recognition and feature extraction, improving predictive accuracy and adaptability in dynamic market environments. Explore more to understand how machine learning integrates diverse data streams for optimized trading strategies.

Source and External Links

Statistical Arbitrage: Strategies, Risks, and How It Works - Statistical arbitrage signals arise from identifying pairs of assets whose prices diverge temporarily under the assumption they will revert, with entry-exit points specified using advanced time series analysis and statistical tests to capitalize on such mispricings.

Deep Learning Statistical Arbitrage - Modern approaches extract statistical arbitrage signals using deep learning models like convolutional neural networks and Transformers to identify complex time-series patterns of temporary price deviations, optimizing risk-adjusted returns through flexible allocation strategies.

Using a Statistical Arbitrage Strategy for Algo Trading - Statistical arbitrage signals are generated by analyzing spread and z-scores between correlated asset pairs, applying stationarity tests like augmented Dickey-Fuller, and marking trading signals typically based on mean reversion strategies for algorithmic execution.

dowidth.com

dowidth.com