Microstructure trading focuses on analyzing the detailed mechanics of how orders are processed within financial markets, examining bid-ask spreads, order book dynamics, and liquidity provision. Order Flow Trading emphasizes the real-time interpretation of buy and sell order imbalances to predict short-term price movements and market sentiment. Explore the nuances between these strategies to enhance your trading approach.

Why it is important

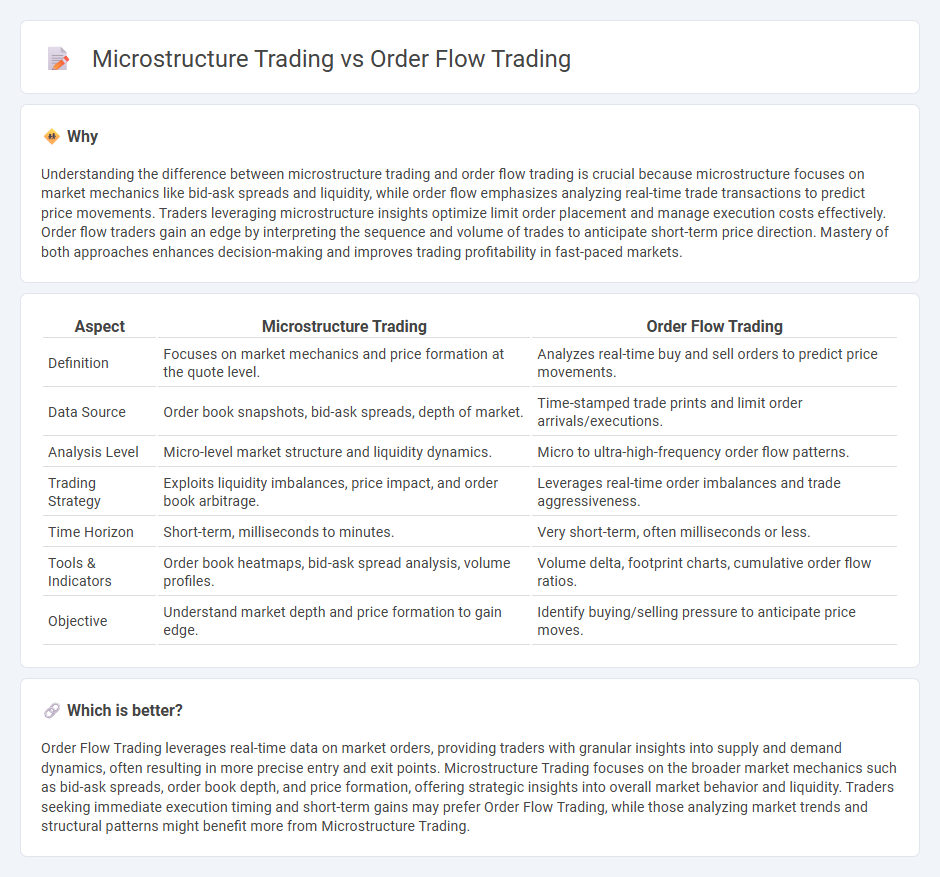

Understanding the difference between microstructure trading and order flow trading is crucial because microstructure focuses on market mechanics like bid-ask spreads and liquidity, while order flow emphasizes analyzing real-time trade transactions to predict price movements. Traders leveraging microstructure insights optimize limit order placement and manage execution costs effectively. Order flow traders gain an edge by interpreting the sequence and volume of trades to anticipate short-term price direction. Mastery of both approaches enhances decision-making and improves trading profitability in fast-paced markets.

Comparison Table

| Aspect | Microstructure Trading | Order Flow Trading |

|---|---|---|

| Definition | Focuses on market mechanics and price formation at the quote level. | Analyzes real-time buy and sell orders to predict price movements. |

| Data Source | Order book snapshots, bid-ask spreads, depth of market. | Time-stamped trade prints and limit order arrivals/executions. |

| Analysis Level | Micro-level market structure and liquidity dynamics. | Micro to ultra-high-frequency order flow patterns. |

| Trading Strategy | Exploits liquidity imbalances, price impact, and order book arbitrage. | Leverages real-time order imbalances and trade aggressiveness. |

| Time Horizon | Short-term, milliseconds to minutes. | Very short-term, often milliseconds or less. |

| Tools & Indicators | Order book heatmaps, bid-ask spread analysis, volume profiles. | Volume delta, footprint charts, cumulative order flow ratios. |

| Objective | Understand market depth and price formation to gain edge. | Identify buying/selling pressure to anticipate price moves. |

Which is better?

Order Flow Trading leverages real-time data on market orders, providing traders with granular insights into supply and demand dynamics, often resulting in more precise entry and exit points. Microstructure Trading focuses on the broader market mechanics such as bid-ask spreads, order book depth, and price formation, offering strategic insights into overall market behavior and liquidity. Traders seeking immediate execution timing and short-term gains may prefer Order Flow Trading, while those analyzing market trends and structural patterns might benefit more from Microstructure Trading.

Connection

Microstructure trading analyzes the detailed processes of how orders are placed, matched, and executed within financial markets, focusing on bid-ask spreads, order book dynamics, and transaction costs. Order flow trading leverages insights from order book data and trade execution patterns to predict short-term price movements and market liquidity. Both approaches rely on understanding the granular mechanics of order placement and execution to optimize trading strategies and enhance market efficiency.

Key Terms

Liquidity

Order Flow Trading analyzes real-time market data to identify supply and demand imbalances, emphasizing how large orders impact price movements and liquidity. Market Microstructure Trading studies the detailed mechanisms of trade execution, bid-ask spreads, and order book dynamics, focusing on the granular behavior of liquidity providers and takers. Explore these strategies to better understand how liquidity influences trading decisions and market efficiency.

Order Book

Order Flow Trading centers on analyzing real-time transactions and liquidity changes directly within the order book to predict short-term price movements. Microstructure trading, by contrast, examines the broader mechanics of the order book, including bid-ask spreads, order arrival rates, and market maker behavior, to understand price formation and market efficiency. Explore this detailed contrast to optimize your trading strategies based on order book dynamics.

Market Participants

Order flow trading emphasizes analyzing real-time buy and sell orders to predict short-term price movements, relying heavily on data from retail traders, institutional investors, and high-frequency trading firms. Market microstructure trading delves deeper into the mechanics of market operations, studying order book dynamics, bid-ask spreads, and the behavior of liquidity providers, market makers, and informed traders. Explore how different market participants influence price discovery and liquidity in both trading strategies to enhance your market insights.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools for Traders - Order flow trading involves analyzing real-time buy and sell orders, including their size and aggressiveness, to better manage risk, adapt strategies for scalping, day trading, or swing trading, and improve performance by spotting volume zones and market momentum.

Lesson 1 - The Basics of Order Flow - Jigsaw Trading - Order flow trading is based on tracking the interaction of market (aggressive) orders hitting limit orders (passive) in the order book to understand buying and selling pressures that cause price movements.

Order Flow Trading & Volumetric Bars | NinjaTrader - This approach uses tools like volumetric bars, volume profiles, VWAP, and cumulative delta to visualize buying and selling pressure, confirm trends, and identify market strength through detailed volume and order data.

dowidth.com

dowidth.com