Penny jump and price ladder are essential tools in trading that enhance order execution and market analysis. Penny jump refers to the minimum price increment traders use to improve their order position, while price ladder displays a real-time order book with bid and ask prices, allowing precise market entry and exit decisions. Explore the differences and benefits of penny jump versus price ladder to optimize your trading strategy.

Why it is important

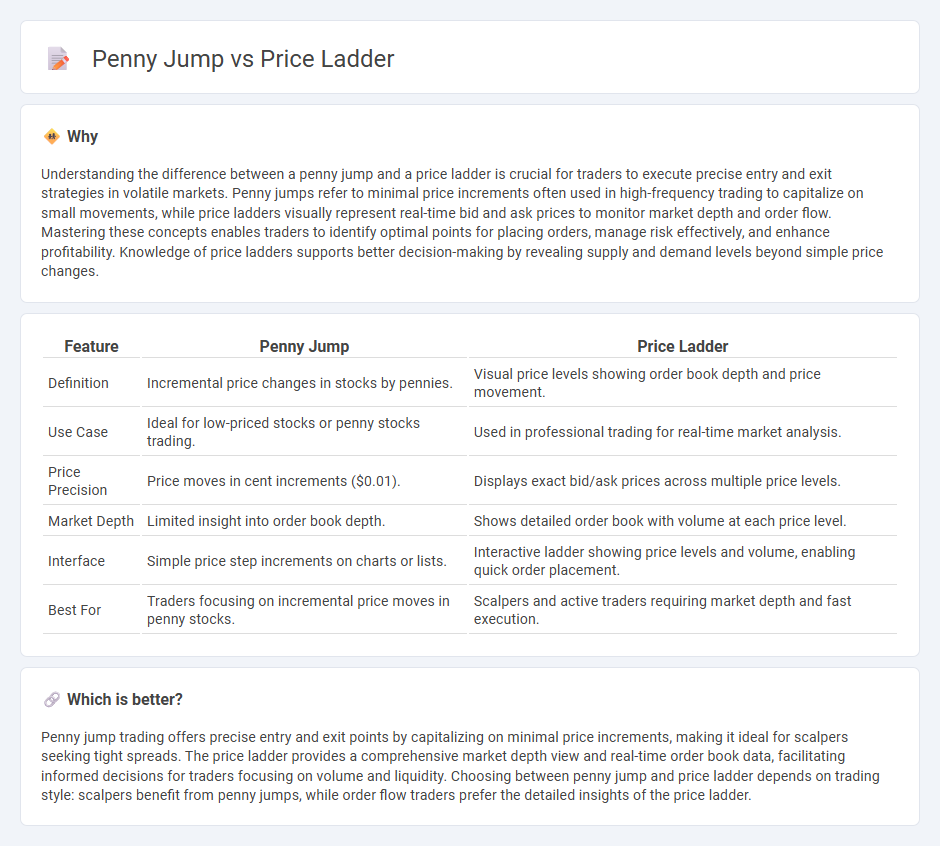

Understanding the difference between a penny jump and a price ladder is crucial for traders to execute precise entry and exit strategies in volatile markets. Penny jumps refer to minimal price increments often used in high-frequency trading to capitalize on small movements, while price ladders visually represent real-time bid and ask prices to monitor market depth and order flow. Mastering these concepts enables traders to identify optimal points for placing orders, manage risk effectively, and enhance profitability. Knowledge of price ladders supports better decision-making by revealing supply and demand levels beyond simple price changes.

Comparison Table

| Feature | Penny Jump | Price Ladder |

|---|---|---|

| Definition | Incremental price changes in stocks by pennies. | Visual price levels showing order book depth and price movement. |

| Use Case | Ideal for low-priced stocks or penny stocks trading. | Used in professional trading for real-time market analysis. |

| Price Precision | Price moves in cent increments ($0.01). | Displays exact bid/ask prices across multiple price levels. |

| Market Depth | Limited insight into order book depth. | Shows detailed order book with volume at each price level. |

| Interface | Simple price step increments on charts or lists. | Interactive ladder showing price levels and volume, enabling quick order placement. |

| Best For | Traders focusing on incremental price moves in penny stocks. | Scalpers and active traders requiring market depth and fast execution. |

Which is better?

Penny jump trading offers precise entry and exit points by capitalizing on minimal price increments, making it ideal for scalpers seeking tight spreads. The price ladder provides a comprehensive market depth view and real-time order book data, facilitating informed decisions for traders focusing on volume and liquidity. Choosing between penny jump and price ladder depends on trading style: scalpers benefit from penny jumps, while order flow traders prefer the detailed insights of the price ladder.

Connection

Penny jump represents the minimal price increment in trading, directly influencing the price ladder's granularity by determining each step's value. The price ladder visually displays price levels, with the penny jump setting the smallest movement traders observe between these levels. This relationship allows traders to gauge market depth and execute precise entries or exits based on incremental price changes.

Key Terms

Order Book

The price ladder displays the order book with detailed price levels and order sizes, helping traders visualize market depth and liquidity. The penny jump tracks minimal price increments, emphasizing price movement precision and microstructure changes within the order book. Explore how these tools enhance trading strategies by analyzing order book dynamics in depth.

Tick Size

Price ladder and penny jump strategies differ primarily in their approach to tick size, with the price ladder utilizing fixed increments based on the market's set tick size to place orders efficiently at multiple price levels. Penny jump strategies exploit the smallest possible price movement, often one tick or even sub-tick increments, to gain priority in order execution. Explore detailed comparisons and practical applications to master the impact of tick size in trading performance.

Liquidity

Price ladder trading offers enhanced liquidity visibility by displaying the full range of buy and sell orders at various price levels, enabling traders to gauge market depth effectively. Penny jump, which involves placing orders just one cent above or below the best available price, can improve execution speed but may reduce overall market liquidity by fragmenting order sizes. Explore detailed comparisons to better understand how each strategy impacts liquidity and trading efficiency.

Source and External Links

Retail Pricing Ladders: How to Maximize Revenue Efficiently - A pricing ladder is a retail strategy offering multiple versions of the same product at escalating price points ("good-better-best"), targeting different customer budgets and value perceptions to maximize sales and revenue.

Pricing Ladders in Retail - 5 Tips for Great Execution - Pricing ladders involve offering distinct versions of a product at various prices to provide choice and steer customers toward desired purchases by leveraging price anchoring psychology.

What is ladder trading? - In trading, a price ladder is a visual tool showing buy and sell orders at various price levels, helping traders place and manage orders efficiently by representing market depth and liquidity dynamically.

dowidth.com

dowidth.com