Paper trading platforms simulate real market conditions, allowing users to practice trading strategies without risking actual capital. Brokerage platforms provide direct access to live markets for buying and selling securities, often with integrated tools for portfolio management and real-time data. Explore the key differences and benefits of both platforms to optimize your trading approach.

Why it is important

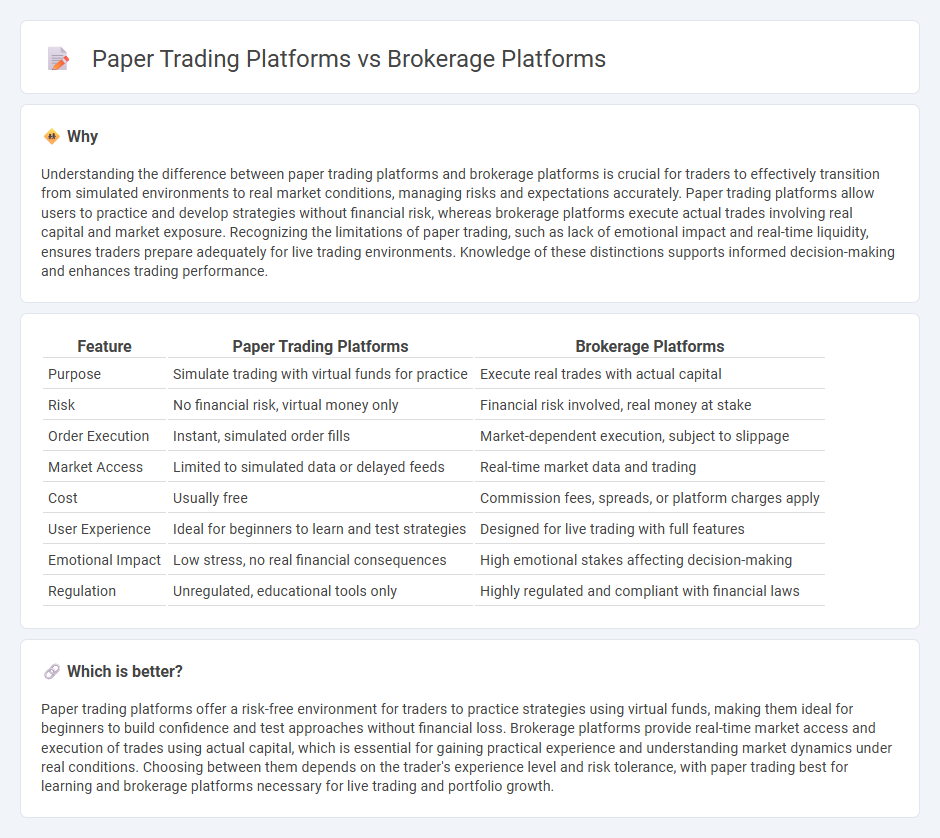

Understanding the difference between paper trading platforms and brokerage platforms is crucial for traders to effectively transition from simulated environments to real market conditions, managing risks and expectations accurately. Paper trading platforms allow users to practice and develop strategies without financial risk, whereas brokerage platforms execute actual trades involving real capital and market exposure. Recognizing the limitations of paper trading, such as lack of emotional impact and real-time liquidity, ensures traders prepare adequately for live trading environments. Knowledge of these distinctions supports informed decision-making and enhances trading performance.

Comparison Table

| Feature | Paper Trading Platforms | Brokerage Platforms |

|---|---|---|

| Purpose | Simulate trading with virtual funds for practice | Execute real trades with actual capital |

| Risk | No financial risk, virtual money only | Financial risk involved, real money at stake |

| Order Execution | Instant, simulated order fills | Market-dependent execution, subject to slippage |

| Market Access | Limited to simulated data or delayed feeds | Real-time market data and trading |

| Cost | Usually free | Commission fees, spreads, or platform charges apply |

| User Experience | Ideal for beginners to learn and test strategies | Designed for live trading with full features |

| Emotional Impact | Low stress, no real financial consequences | High emotional stakes affecting decision-making |

| Regulation | Unregulated, educational tools only | Highly regulated and compliant with financial laws |

Which is better?

Paper trading platforms offer a risk-free environment for traders to practice strategies using virtual funds, making them ideal for beginners to build confidence and test approaches without financial loss. Brokerage platforms provide real-time market access and execution of trades using actual capital, which is essential for gaining practical experience and understanding market dynamics under real conditions. Choosing between them depends on the trader's experience level and risk tolerance, with paper trading best for learning and brokerage platforms necessary for live trading and portfolio growth.

Connection

Paper trading platforms simulate real brokerage platforms by using real-time market data and trading algorithms to mimic live trading conditions without financial risk. These platforms are often linked through API integrations, allowing users to practice trading strategies with virtual funds while experiencing the interfaces and order types of actual brokerages. This connection enhances skill development and strategy testing, providing a seamless transition from simulated to live trading environments.

Key Terms

Execution (brokerage platforms)

Brokerage platforms offer real-time execution with direct market access, providing traders the ability to instantly buy or sell assets at current market prices. These platforms feature advanced order types, algorithmic trading, and seamless integration with financial markets, ensuring optimal trade filling and minimal slippage. Discover how execution capabilities on brokerage platforms can elevate your trading efficiency and outcomes.

Simulation (paper trading platforms)

Simulation platforms, also known as paper trading platforms, offer a risk-free environment for users to practice trading strategies using virtual money without financial consequences. These platforms provide real-time market data and realistic trading conditions that help traders develop skills and test approaches before committing actual capital on brokerage platforms. Explore more about how simulation platforms can enhance your trading proficiency and confidence.

Real Funds (brokerage platforms)

Brokerage platforms enable real funds trading, providing access to live markets with actual capital, while paper trading platforms simulate market conditions without financial risk. Real funds trading involves real-time order execution, market liquidity, and the potential for both profit and loss, which is essential for developing practical investment strategies. Explore the benefits and risks of brokerage platforms to optimize your trading experience.

Source and External Links

Best online brokers of 2025: Choose the right brokerage firm for you - Highlights brokerage platforms like Interactive Brokers, known for low commissions and advanced tools for active traders, and Merrill Edge, noted for strong research and Bank of America integration.

Trading | Charles Schwab - Details Schwab's powerful trading platforms, including thinkorswim, and offers 24/5 trading access with competitive margin rates and award-winning support.

Trading & Brokerage Services - Fidelity Investments - Describes Fidelity's $0 commission trades, advanced trading platforms like Active Trader Pro, and comprehensive research and education resources for all investors.

dowidth.com

dowidth.com