High-frequency scalp bots execute rapid trades to capitalize on small price movements, leveraging speed and algorithmic precision for maximum short-term gains. Grid trading bots place buy and sell orders at preset intervals within a price range, aiming to profit from market volatility through systematic order placement. Explore how these trading strategies can optimize your investment portfolio.

Why it is important

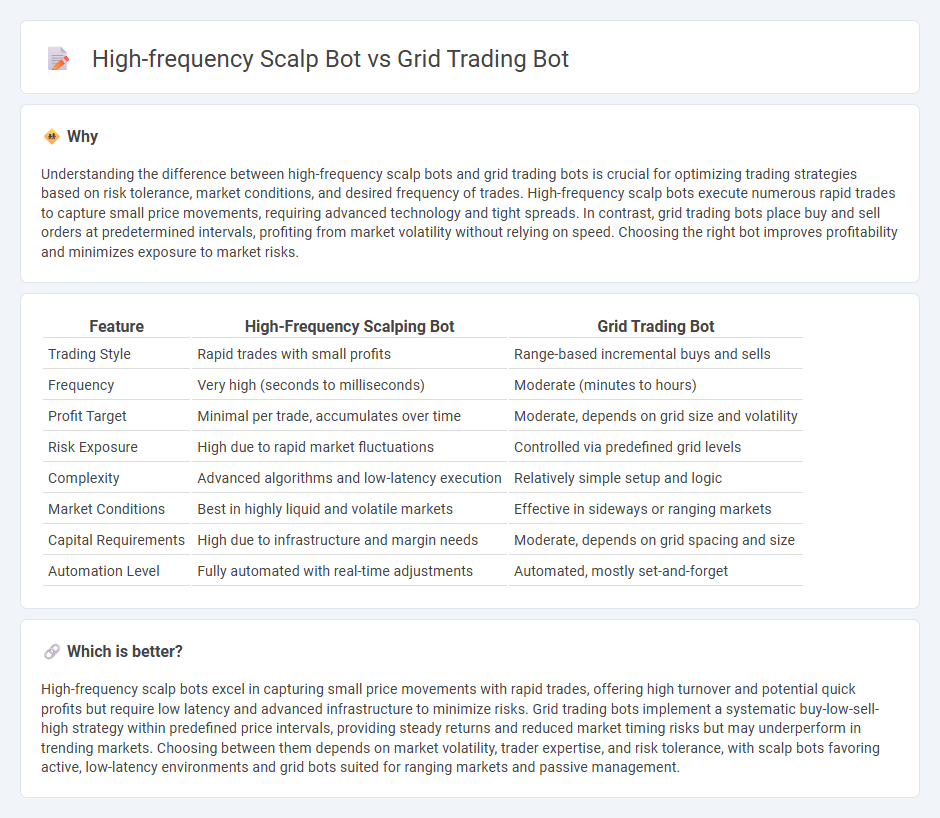

Understanding the difference between high-frequency scalp bots and grid trading bots is crucial for optimizing trading strategies based on risk tolerance, market conditions, and desired frequency of trades. High-frequency scalp bots execute numerous rapid trades to capture small price movements, requiring advanced technology and tight spreads. In contrast, grid trading bots place buy and sell orders at predetermined intervals, profiting from market volatility without relying on speed. Choosing the right bot improves profitability and minimizes exposure to market risks.

Comparison Table

| Feature | High-Frequency Scalping Bot | Grid Trading Bot |

|---|---|---|

| Trading Style | Rapid trades with small profits | Range-based incremental buys and sells |

| Frequency | Very high (seconds to milliseconds) | Moderate (minutes to hours) |

| Profit Target | Minimal per trade, accumulates over time | Moderate, depends on grid size and volatility |

| Risk Exposure | High due to rapid market fluctuations | Controlled via predefined grid levels |

| Complexity | Advanced algorithms and low-latency execution | Relatively simple setup and logic |

| Market Conditions | Best in highly liquid and volatile markets | Effective in sideways or ranging markets |

| Capital Requirements | High due to infrastructure and margin needs | Moderate, depends on grid spacing and size |

| Automation Level | Fully automated with real-time adjustments | Automated, mostly set-and-forget |

Which is better?

High-frequency scalp bots excel in capturing small price movements with rapid trades, offering high turnover and potential quick profits but require low latency and advanced infrastructure to minimize risks. Grid trading bots implement a systematic buy-low-sell-high strategy within predefined price intervals, providing steady returns and reduced market timing risks but may underperform in trending markets. Choosing between them depends on market volatility, trader expertise, and risk tolerance, with scalp bots favoring active, low-latency environments and grid bots suited for ranging markets and passive management.

Connection

High-frequency scalp bots and grid trading bots both optimize automated trading by capitalizing on market fluctuations, but they differ in strategy execution; scalp bots perform rapid trades for small profits within milliseconds, while grid bots place systematic buy and sell orders at preset intervals to exploit price ranges. Integration occurs when scalp bots manage micro-movements within each grid level, enhancing profit capture through precise timing and order execution. This synergy maximizes market exposure and improves overall trading efficiency, leveraging algorithmic speed and structured positioning.

Key Terms

Order Placement Strategy

Grid trading bots execute orders within predefined price intervals, creating a network of buy and sell orders to profit from market fluctuations, optimizing for trendless or sideways markets. High-frequency scalp bots deploy rapid order placements and cancellations to exploit minor price discrepancies, relying on ultra-low latency and high trade volumes for profitability in highly liquid markets. Explore the nuances of these strategies to determine which approach aligns best with your trading goals and market conditions.

Trade Frequency

Grid trading bots execute trades based on predetermined price intervals, resulting in moderate trade frequency with consistent profit capture from market fluctuations. High-frequency scalp bots perform rapid, small-profit trades with extremely high trade frequency, aiming to capitalize on minute price changes often within milliseconds. Explore the operational nuances and advantages of each bot type for optimized trading strategies.

Profit Target Mechanism

Grid trading bots execute orders at predefined price intervals, capturing profits within a set range by placing simultaneous buy and sell orders. High-frequency scalp bots rely on rapid market fluctuations, targeting minimal price changes with frequent trades to accumulate small gains. Explore detailed comparisons on profit target mechanisms to optimize your trading strategy.

Source and External Links

GRID Bot Trading: The Smart Way to Trade Crypto - A Grid Trading Bot automates buy and sell orders within set price levels to capitalize on market volatility by systematically buying low and selling high, operating in continuous closed loops for profit in both base and quote currencies.

What is a grid trading bot and how does it work? - Grid trading bots use automated algorithms to place buy and sell orders at predetermined price intervals in a grid pattern, exploiting price fluctuations to generate returns, and operate 24/7 to remove emotional trading and constant monitoring.

Grid Trading Bots Explained: Choosing the Right Type for Beginners - Advanced AI-powered grid trading bots dynamically adjust grid levels and price ranges using machine learning on market data, optimizing profits in volatile markets while allowing traders a hands-off automated strategy.

dowidth.com

dowidth.com