Flash loans allow traders to borrow instantly and execute complex arbitrage strategies without upfront capital, leveraging blockchain protocols for rapid, collateral-free loans. Liquidity pools, funded by users depositing assets, enable decentralized trading by providing the necessary liquidity and earning fees in return. Discover more about how these DeFi mechanisms transform trading efficiency and risk management.

Why it is important

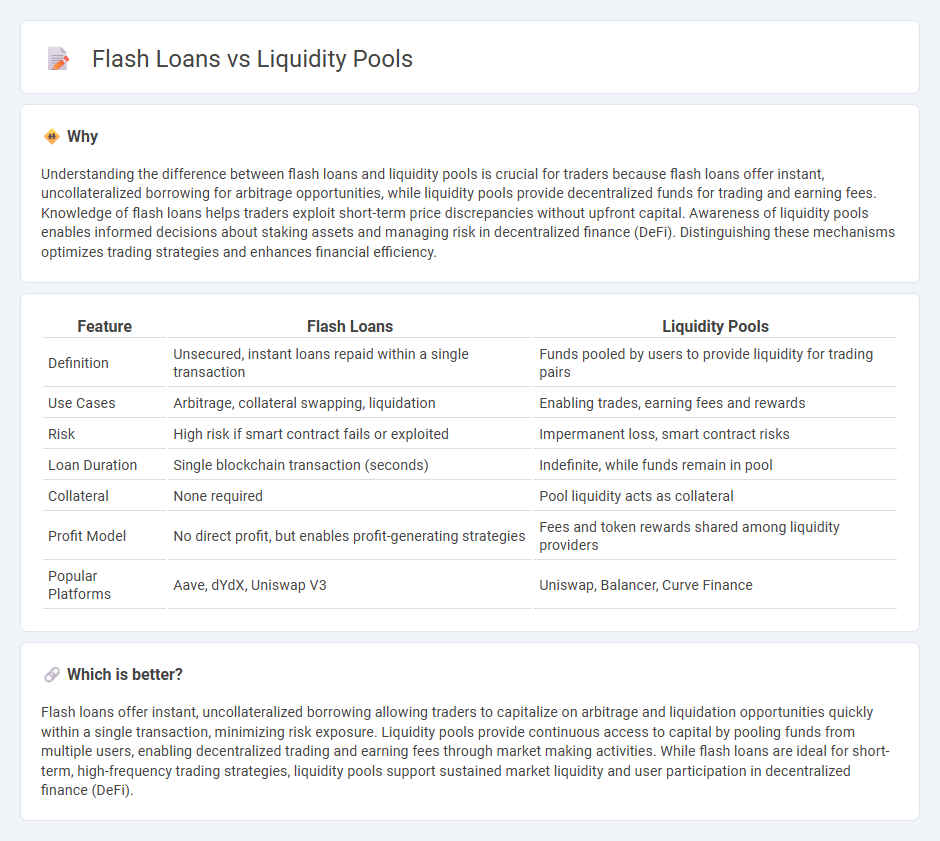

Understanding the difference between flash loans and liquidity pools is crucial for traders because flash loans offer instant, uncollateralized borrowing for arbitrage opportunities, while liquidity pools provide decentralized funds for trading and earning fees. Knowledge of flash loans helps traders exploit short-term price discrepancies without upfront capital. Awareness of liquidity pools enables informed decisions about staking assets and managing risk in decentralized finance (DeFi). Distinguishing these mechanisms optimizes trading strategies and enhances financial efficiency.

Comparison Table

| Feature | Flash Loans | Liquidity Pools |

|---|---|---|

| Definition | Unsecured, instant loans repaid within a single transaction | Funds pooled by users to provide liquidity for trading pairs |

| Use Cases | Arbitrage, collateral swapping, liquidation | Enabling trades, earning fees and rewards |

| Risk | High risk if smart contract fails or exploited | Impermanent loss, smart contract risks |

| Loan Duration | Single blockchain transaction (seconds) | Indefinite, while funds remain in pool |

| Collateral | None required | Pool liquidity acts as collateral |

| Profit Model | No direct profit, but enables profit-generating strategies | Fees and token rewards shared among liquidity providers |

| Popular Platforms | Aave, dYdX, Uniswap V3 | Uniswap, Balancer, Curve Finance |

Which is better?

Flash loans offer instant, uncollateralized borrowing allowing traders to capitalize on arbitrage and liquidation opportunities quickly within a single transaction, minimizing risk exposure. Liquidity pools provide continuous access to capital by pooling funds from multiple users, enabling decentralized trading and earning fees through market making activities. While flash loans are ideal for short-term, high-frequency trading strategies, liquidity pools support sustained market liquidity and user participation in decentralized finance (DeFi).

Connection

Flash loans provide instant, uncollateralized borrowing by leveraging liquidity pools, enabling traders to execute complex arbitrage or refinancing strategies within a single transaction. Liquidity pools, formed by aggregated user funds in decentralized finance (DeFi) protocols, supply the capital necessary for these instantaneous loans without traditional credit checks. The seamless interaction between flash loans and liquidity pools enhances capital efficiency and market fluidity in decentralized trading environments.

Key Terms

Automated Market Maker (AMM)

Liquidity pools in Automated Market Makers (AMMs) provide a decentralized means for trading assets by pooling tokens to enable constant price discovery without order books, ensuring seamless swaps and reduced slippage. Flash loans leverage these liquidity pools, offering instant, uncollateralized loans that must be repaid within one transaction block, facilitating arbitrage and collateral swapping opportunities. Explore how AMM-driven liquidity pools and flash loans revolutionize decentralized finance efficiency and risk management.

Collateral

Liquidity pools serve as aggregated reserves of tokens that users can trade, borrow, or lend with minimal collateral requirements, enabling seamless decentralized finance transactions. Flash loans allow borrowers to access large amounts of capital without upfront collateral, contingent on the loan being repaid within a single Ethereum transaction block. Explore deeper insights into how collateral mechanisms shape liquidity pools and flash loans in decentralized finance.

Arbitrage

Liquidity pools provide decentralized capital from users to facilitate trading, enabling arbitrageurs to exploit price discrepancies across exchanges by swapping assets within these pools. Flash loans offer instant, permissionless borrowing of large sums without collateral, allowing arbitrageurs to execute complex multi-step trades within a single transaction, capturing profits from temporary arbitrage opportunities. Explore detailed strategies and practical examples to master arbitrage using liquidity pools and flash loans.

Source and External Links

Liquidity Pools Explained: How They Work, Key Risks & ... - A liquidity pool is a collection of cryptocurrency tokens locked in a smart contract that enables decentralized trading, offers continuous liquidity, democratizes market-making, and supports methods like yield farming with various pool types such as traditional, stablecoin, multi-asset, single-sided, and concentrated liquidity pools.

Liquidity Pools for Beginners: DeFi 101 - Liquidity pools allow users to deposit assets as liquidity providers and enable decentralized trading by facilitating token swaps in exchange for earning fees, playing a key role in DeFi finance by promoting inclusivity, passive income through fees, and efficient price discovery.

The role of liquidity pools in cryptocurrency markets - Liquidity pools power decentralized exchanges by pooling cryptocurrencies into smart contracts, replacing traditional order books with automated market maker (AMM) protocols that provide instant liquidity and enable trading without intermediaries, while offering benefits like passive income but bearing risks such as impermanent loss and smart contract vulnerabilities.

dowidth.com

dowidth.com