Market microstructure analyzes the processes and mechanisms through which securities prices are formed, focusing on order flow, bid-ask spreads, and information asymmetry. Dealer markets, where dealers hold inventories and set prices, contrast with auction markets by emphasizing liquidity provision and inventory management. Explore how these dynamics impact trading efficiency and market behavior.

Why it is important

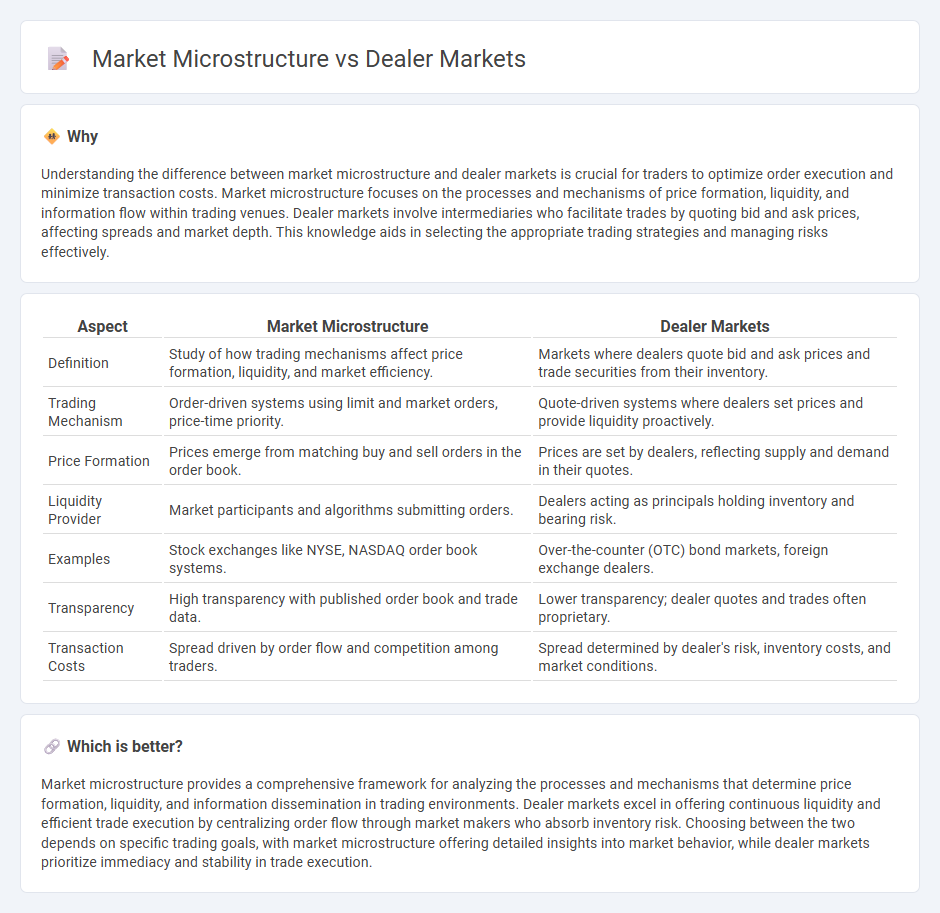

Understanding the difference between market microstructure and dealer markets is crucial for traders to optimize order execution and minimize transaction costs. Market microstructure focuses on the processes and mechanisms of price formation, liquidity, and information flow within trading venues. Dealer markets involve intermediaries who facilitate trades by quoting bid and ask prices, affecting spreads and market depth. This knowledge aids in selecting the appropriate trading strategies and managing risks effectively.

Comparison Table

| Aspect | Market Microstructure | Dealer Markets |

|---|---|---|

| Definition | Study of how trading mechanisms affect price formation, liquidity, and market efficiency. | Markets where dealers quote bid and ask prices and trade securities from their inventory. |

| Trading Mechanism | Order-driven systems using limit and market orders, price-time priority. | Quote-driven systems where dealers set prices and provide liquidity proactively. |

| Price Formation | Prices emerge from matching buy and sell orders in the order book. | Prices are set by dealers, reflecting supply and demand in their quotes. |

| Liquidity Provider | Market participants and algorithms submitting orders. | Dealers acting as principals holding inventory and bearing risk. |

| Examples | Stock exchanges like NYSE, NASDAQ order book systems. | Over-the-counter (OTC) bond markets, foreign exchange dealers. |

| Transparency | High transparency with published order book and trade data. | Lower transparency; dealer quotes and trades often proprietary. |

| Transaction Costs | Spread driven by order flow and competition among traders. | Spread determined by dealer's risk, inventory costs, and market conditions. |

Which is better?

Market microstructure provides a comprehensive framework for analyzing the processes and mechanisms that determine price formation, liquidity, and information dissemination in trading environments. Dealer markets excel in offering continuous liquidity and efficient trade execution by centralizing order flow through market makers who absorb inventory risk. Choosing between the two depends on specific trading goals, with market microstructure offering detailed insights into market behavior, while dealer markets prioritize immediacy and stability in trade execution.

Connection

Market microstructure examines the processes and mechanisms through which securities are traded, focusing on how dealer markets operate by facilitating liquidity and price discovery through dealers who buy and sell inventories. Dealer markets impact market microstructure by influencing bid-ask spreads, order processing costs, and trading volume, which in turn affect market efficiency and transparency. The interaction between traders and dealers in these markets shapes the information flow and execution quality crucial to understanding price formation.

Key Terms

Bid-Ask Spread

Dealer markets feature individual dealers quoting bid-ask spreads, directly impacting transaction costs and liquidity by setting prices at which they are willing to buy and sell securities. Market microstructure examines the mechanisms behind price formation, including the role of bid-ask spreads in reflecting information asymmetry, inventory risk, and order flow dynamics. Explore further how bid-ask spread behavior differs across market types and influences trading strategies.

Order Flow

Dealer markets operate through intermediaries who facilitate trades by holding inventory, influencing order flow by providing liquidity and price stability. Market microstructure examines how order flow impacts price formation, bid-ask spreads, and overall market efficiency within various trading environments. Explore the detailed dynamics of order flow and its critical role in shaping dealer markets and market microstructure for a deeper understanding.

Intermediary

Dealer markets rely on intermediaries who actively buy and sell securities from their own inventory, providing liquidity and facilitating price discovery. Market microstructure studies these intermediaries' roles, examining how trade execution, pricing mechanisms, and order flow impact market efficiency and transaction costs. Explore further to understand the critical influence of intermediaries in shaping market dynamics and trading behavior.

Source and External Links

Understanding Dealer Markets - A dealer market involves multiple dealers acting as market makers who post bid and ask prices, trade securities on their own accounts, provide liquidity, and manage risk via bid-ask spreads, differing from auction and broker markets where buyers and sellers interact more directly.

Types of Markets - Dealers, Brokers, Exchanges - In dealer markets, dealers act as counterparties setting bid-ask prices and trading with investors directly, offering high liquidity especially in bonds, currencies, and derivatives, while assuming counterparty risk through the bid-ask spread.

Dealer markets and how they differ from other markets - Indeed - Dealer markets are electronic over-the-counter markets where dealers trade from their own accounts without third-party involvement, continuously quoting buy and sell prices to provide liquidity and operate as market makers mainly in securities and commodities.

dowidth.com

dowidth.com