Airdrop farming involves actively seeking and claiming free cryptocurrency tokens distributed by projects to promote adoption and liquidity, often requiring minimal investment but timely participation. Staking requires locking up coins in a blockchain network to support operations like transaction validation, earning rewards based on the amount and duration staked, which provides passive income with potential network benefits. Explore the detailed differences and strategies behind airdrop farming and staking to optimize your trading portfolio.

Why it is important

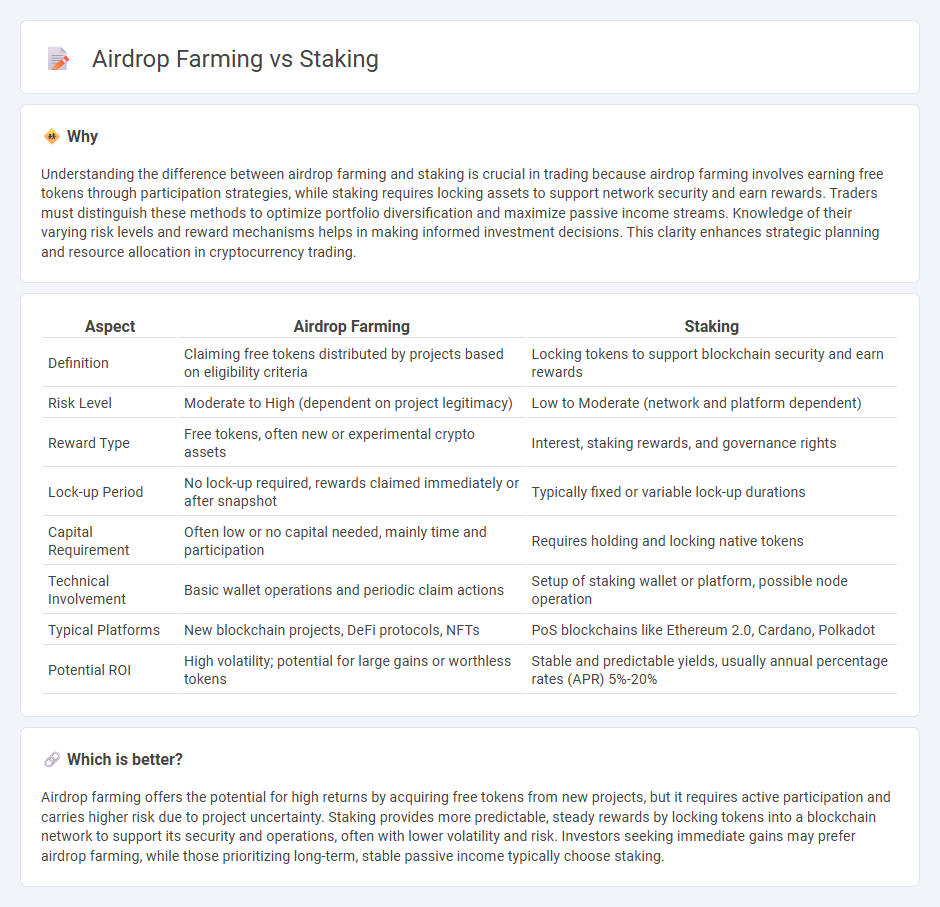

Understanding the difference between airdrop farming and staking is crucial in trading because airdrop farming involves earning free tokens through participation strategies, while staking requires locking assets to support network security and earn rewards. Traders must distinguish these methods to optimize portfolio diversification and maximize passive income streams. Knowledge of their varying risk levels and reward mechanisms helps in making informed investment decisions. This clarity enhances strategic planning and resource allocation in cryptocurrency trading.

Comparison Table

| Aspect | Airdrop Farming | Staking |

|---|---|---|

| Definition | Claiming free tokens distributed by projects based on eligibility criteria | Locking tokens to support blockchain security and earn rewards |

| Risk Level | Moderate to High (dependent on project legitimacy) | Low to Moderate (network and platform dependent) |

| Reward Type | Free tokens, often new or experimental crypto assets | Interest, staking rewards, and governance rights |

| Lock-up Period | No lock-up required, rewards claimed immediately or after snapshot | Typically fixed or variable lock-up durations |

| Capital Requirement | Often low or no capital needed, mainly time and participation | Requires holding and locking native tokens |

| Technical Involvement | Basic wallet operations and periodic claim actions | Setup of staking wallet or platform, possible node operation |

| Typical Platforms | New blockchain projects, DeFi protocols, NFTs | PoS blockchains like Ethereum 2.0, Cardano, Polkadot |

| Potential ROI | High volatility; potential for large gains or worthless tokens | Stable and predictable yields, usually annual percentage rates (APR) 5%-20% |

Which is better?

Airdrop farming offers the potential for high returns by acquiring free tokens from new projects, but it requires active participation and carries higher risk due to project uncertainty. Staking provides more predictable, steady rewards by locking tokens into a blockchain network to support its security and operations, often with lower volatility and risk. Investors seeking immediate gains may prefer airdrop farming, while those prioritizing long-term, stable passive income typically choose staking.

Connection

Airdrop farming and staking are interrelated strategies within the trading ecosystem, where staking tokens often qualifies users for airdrop rewards distributed by blockchain projects. By locking up assets through staking, traders demonstrate network support and increase their eligibility for airdrops, which are free distributions of tokens aimed at incentivizing participation and decentralization. This synergy enhances earning potential and fosters active engagement in decentralized finance (DeFi) protocols.

Key Terms

Yield

Staking involves locking up cryptocurrency to support network operations and earn rewards, typically providing more predictable yields based on the asset and network consensus mechanism. Airdrop farming focuses on performing specific tasks or holding tokens to receive free token distributions, resulting in variable and often speculative yields. Explore the differences in risk and reward structures to optimize your yield strategy.

Eligibility

Staking eligibility typically requires holding a specific cryptocurrency in a compatible wallet or platform, often with a minimum amount or lock-up period to participate and earn rewards. Airdrop farming eligibility involves completing certain tasks such as social media engagement, holding particular tokens, or registering on platforms, aiming to qualify for free token distributions. Explore detailed criteria and strategies to maximize your participation in both staking and airdrop farming opportunities.

Lock-up

Staking involves locking up cryptocurrency for a fixed period to support network operations and earn rewards, often resulting in reduced liquidity during the lock-up. Airdrop farming typically requires minimal lock-up, focusing on tasks or holding specific tokens briefly to qualify for free token distributions. Explore deeper insights on how lock-up periods impact these earning strategies and their respective risk profiles.

Source and External Links

What is crypto staking? | Learn how to earn crypto - Kraken - Staking is a process where token holders lock up their cryptocurrencies to support a proof-of-stake blockchain network and earn rewards, with various types including direct staking, staking pools, delegated staking, exchange staking, and liquid staking.

What is crypto staking and how does it work? - Fidelity Investments - Crypto staking involves locking tokens to participate in validating transactions on proof-of-stake blockchains, where users are selected to propose blocks and earn rewards as validators while others verify their work.

What is staking? - Coinbase - Staking is earning rewards by putting cryptocurrency to work on a blockchain network, helping it run securely and smoothly without lending out your crypto, and is an effective way to grow holdings.

dowidth.com

dowidth.com